Westjet 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2010 Annual Report 41

As at December 31, 2010, fuel derivatives of $5.7 million

(2009 – $0.1 million) and foreign exchange derivatives of $nil

(2009 – $0.2 million) outstanding with our counterparties were

in an asset position. We do not expect these counterparties to fail

to meet their obligations.

We are not exposed to counterparty credit risk on our deposits

that relate to purchased aircraft, as the funds are held in a security

trust separate from the assets of the financial institution. While

we are exposed to counterparty credit risk on our deposits

relating to airport operations, we consider this risk as remote

because of the nature of the deposit and the credit risk rating of

the counterparty.

Liquidity risk

Liquidity risk is the risk that we will encounter difficulty in meeting

obligations associated with financial liabilities. We maintain

a strong liquidity position and sufficient financial resources to

meet our obligations as they fall due.

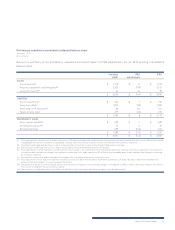

The table below presents a maturity analysis of our undiscounted

contractual cash flow for our non-derivative and derivative

financial liabilities as at December 31, 2010. The analysis, based

on foreign exchange and interest rates in effect at the balance

sheet date, includes both principal and interest cash flows for

long-term debt and obligations under capital leases.

A portion of our cash and cash equivalents balance relates to

cash collected on advance ticket sales, for which the balance at

December 31, 2010, was $308.0 million (2009 – $286.4 million).

Typically, we have cash and cash equivalents on hand to have

sufficient liquidity to meet our liabilities when due, under both

normal and stressed conditions. As at December 31, 2010,

we had cash on hand of 3.86 (2009 – 3.51) times the advance

ticket sales balance. We aim to maintain a current ratio of at

least 1.00. As at December 31, 2010, our current ratio was

1.52 (2009 – 1.48). As at December 31, 2010, we have not been

required to post collateral with respect to any of our outstanding

derivative contracts.

Fair value of financial instruments

Fair value represents a point-in-time estimate. The carrying

amount of cash and cash equivalents, accounts receivable, and

accounts payable and accrued liabilities included in the balance

sheet approximate their fair values because of the short-term

nature of the instruments. The fair value of deposits, which relate

to purchased aircraft and airport operations, approximates their

carrying amounts as they are at a floating market rate of interest.

At December 31, 2010, the fair value of our fixed-rate long-term

debt was approximately $1,142.0 million (2009 – $1,323.1 million).

($ in thousands)

Carrying

Amount Within 1 year 1–3 years 4–5 years Over 5 years

Accounts payable and accrued liabilities (i) $ 299,204 $ 299,204 $ — $ — $ —

Foreign exchange derivatives 3,579 3,579 — — —

Fuel derivatives 800 800 — — —

Long-term debt 1,232,319 235,215 414,455 341,920 240,729

Obligations under capital leases 5,878 282 490 490 4,616

Total $ 1,541,780 $ 539,080 $ 414,945 $ 342,410 $ 245,345

(i) Excludes foreign exchange derivatives of $3,579 and fuel derivatives of $800.