Westjet 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84 WestJet 2010 Annual Report

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

For the years ended December 31, 2010 and 2009

(Stated in thousands of Canadian dollars,

except share and per share amounts)

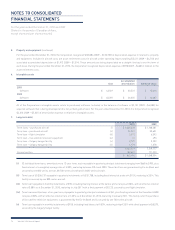

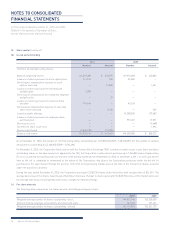

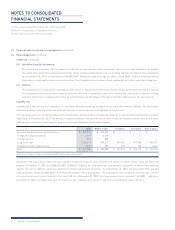

12. Commitments and contingencies (continued)

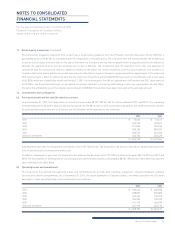

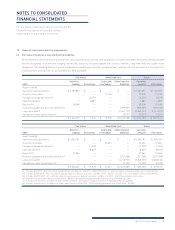

(b) Operating leases and commitments (continued)

As at December 31, 2010, the Corporation is committed to lease an additional three 737-700 aircraft and three 737-800 aircraft for terms ranging

between eight and 10 years in US dollars. These aircraft have been included in the above totals.

The Corporation signed a six-year agreement with Bell ExpressVu to provide satellite programming. The agreement commenced in 2004, expires

in July 2011, and can be renewed for an additional four years. During 2009, the Corporation amended its agreement with LiveTV to install, maintain

and operate live satellite television on all of the Corporation’s aircraft for a term of 10 years. The minimum commitment amounts associated with

these agreements have been included in the totals in the table above.

In 2008, the Corporation signed an agreement with Sabre Airline Solutions (Sabre) to provide the Corporation with a licence to access and use

Sabre’s reservation system, SabreSonic, for a term of eight years. The minimum contract amounts associated with the reservation system have

been included in the totals in the table above.

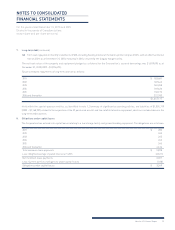

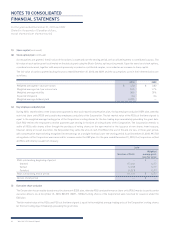

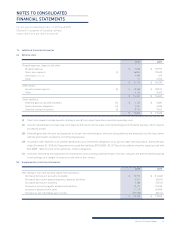

(c) Letters of guarantee

The Corporation has available two revolving loan credit facilities with a Canadian chartered bank totalling $38,000 (2009 – $38,000). One loan

facility is unsecured for $8,000, and the other is a facility for $30,000 that requires funds to be assigned and held in cash security for the full value

of letters of guarantee issued by the Corporation. As at December 31, 2010, $6,691 (2009 – $12,491) of letters of guarantee were issued under

these facilities. These facilities are secured by a general security agreement and $6,691 (2009 – $4,491) of restricted cash.

(d) Operating line of credit

Commencing in the third quarter of 2009, the Corporation has available a three-year revolving operating line of credit with a syndicate of three

Canadian banks. The line of credit is available to a maximum of $80,750 (2009 − $85,000) and is secured by the Corporation’s Campus facility.

The line of credit bears interest at prime plus 0.50% per annum, or a bankers’ acceptance rate at 2.0% annual stamping fee or equivalent, and is

available for general corporate expenditures and working capital purposes. The Corporation is required to pay an annual standby fee of 15 basis

points, based on the average unused portion of the line of credit for the previous quarter, payable quarterly. As at December 31, 2010, no amounts

were drawn (2009 – $nil).

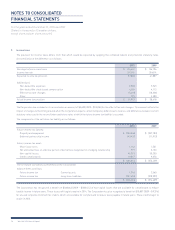

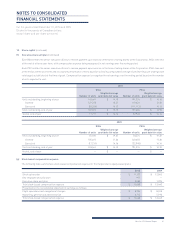

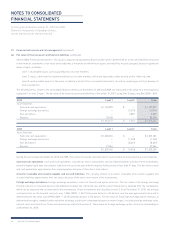

(e) Fuel facility corporations

The Corporation has entered into nine arrangements whereby it participates under contract in fuel facility corporations, along with other airlines, to

procure fuel services at major Canadian airports. The fuel facility corporations operate on a cost-recovery basis. The purpose of these corporations

is to own and fi nance the system that distributes fuel to the contracting airlines, including the leasing of land rights, while providing the contracting

airlines with preferential service and pricing over non-participating entities. The operating costs, including debt service requirements, of the

fuel facility corporations are shared pro rata among the contracting airlines. The nine fuel facility corporations are considered variable interest

entities and have not been consolidated within the Corporation’s accounts. In the remote event that all other contracting airlines withdraw from

the arrangements and the Corporation remained as sole member, it would be responsible for the costs of the fuel facility corporations, including

debt service requirements. As at November 30, 2010, the nine fuel facility corporations had combined total assets of approximately $345,523

(2009 − $341,487) and debt of approximately $312,625 (2009 − $307,825).

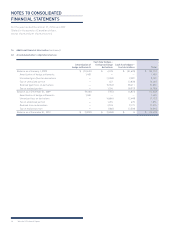

(f) Contingencies

The Corporation is party to legal proceedings and claims that arise during the ordinary course of business. It is the opinion of management that

the ultimate outcome of these and any outstanding matters will not have a material effect upon the Corporation’s fi nancial position, results of

operations or cash fl ows.