Westjet 2010 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2010 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16 WestJet 2010 Annual Report

For the fourth quarter of 2010, our CASM increased by 1.1 per cent

to 12.23 cents compared to 12.10 cents in the same quarter

of 2009. Our CASM, excluding fuel and employee profit share,

decreased by 1.8 per cent to 8.51 cents from 8.67 cents in the

same quarter of 2009.

Aircraft fuel

In the fourth quarter of 2010, aircraft fuel expenses increased

by 20.4 per cent from the prior year to $179.3 million. We saw

a significant increase in jet fuel prices, with the average market

price for jet fuel being US $100 per barrel in the fourth quarter

of 2010, versus US $84 per barrel in the fourth quarter of 2009,

an increase of 19.0 per cent. Our fuel costs per ASM increased by

5.9 per cent to 3.57 cents in the fourth quarter of 2010, up from

3.37 cents in the same period in 2009. Our fourth quarter unhedged

fuel costs were $0.73 per litre, an increase of 9.0 per cent

from last year. Including costs related to fuel hedging, our

fourth quarter fuel costs were $0.74 per litre, up 7.2 per cent

from $0.69 per litre in the same quarter of 2009. The increase

in our fuel costs were partially offset by favourable foreign

exchange rates this quarter, as compared to the same quarter

in the prior year.

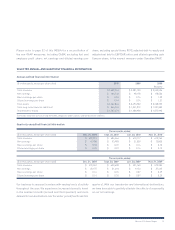

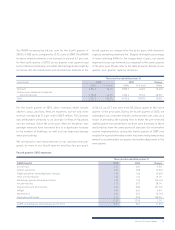

The following table displays our fuel costs per litre, including

and excluding fuel hedging, for the three months ended

December 31, 2010 and 2009. Please refer to page 52 of this

MD&A for a discussion of the use of non-GAAP measures,

including aircraft fuel expense, excluding hedging, which is

reconciled to GAAP in the following table.

Three months ended December 31

($ in thousands, except per litre data) 2010 2009 Change

Aircraft fuel expense – GAAP $ 179,276 $ 148,853 20.4%

Realized loss on designated fuel derivatives – effective portion (1,512) (3,707) (59.2%)

Aircraft fuel expense, excluding hedging – Non-GAAP $ 177,764 $ 145,146 22.5%

Fuel consumption (thousands of litres) 242,621 216,872 11.9%

Fuel costs per litre (dollars) – including fuel hedging 0.74 0.69 7.2%

Fuel costs per litre (dollars) – excluding fuel hedging 0.73 0.67 9.0%

Sales and distribution

Our fourth quarter sales and distribution expense per ASM was

1.33 cents, an increase of 16.7 per cent from 1.14 cents in the

same quarter of the prior year. Sales and distribution expenses

increased to $67.0 million from $50.4 million in the same period

of 2009, representing an increase of 33.1 per cent. The growth

of WestJet Vacations represented approximately 40 per cent

of this increase. The increase in WestJet Vacations costs were

due to the significant increases in the number of tour package

bookings made compared to the same quarter of the prior year.

This resulted in increased commissions and incentive payments,

as the majority of WVI bookings were made indirectly through the

travel agency community. As well, sales expenses increased from

the fourth quarter of 2009, which related primarily to increased

WestJet travel agency commission and incentive payments.

The percentage of our airline’s bookings made through the

travel trade has increased, which drives higher commission and

incentive expenses, but also contributes higher average fares.

The remainder of the variance was due to increased distribution

costs, resulting primarily from increased global distribution

system (GDS) fees and credit card fees, which are in line with

the rate of increase of our bookings, as well as costs associated

with the redesign of our corporate website. These increases are

offset by the $2.4 million bad debt provision recorded in the

fourth quarter of 2009 related to accounts receivable from our

previous cargo service provider. Since January 2010, we have

had a new cargo partner in place.

Marketing, general and administration

During the fourth quarter of 2010, our marketing, general and

administration expense decreased by $2.4 million from the same

quarter of 2009 to $52.3 million. The marketing, general and