Westjet 2010 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2010 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 WestJet 2010 Annual Report

sole member, we would be responsible for the costs of the fuel

facility corporations, including debt service requirements. As

at November 30, 2010, the nine fuel facility corporations have

combined total assets of approximately $345.5 million and debt

of approximately $312.6 million.

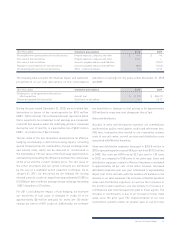

Investing cash flow

Cash used in investing activities for 2010 totalled $48.6 million,

as compared to $166.7 million in 2009. In 2009, cash was used for

aircraft additions of $118.7 million for the purchase of one leased

aircraft during the year as well as deposits paid to Boeing on

future owned aircraft deliveries. In 2010, we incurred $29.9 million

in aircraft addition costs related to deposits paid, as no additional

aircraft were purchased during the year. Furthermore, in 2010,

we incurred $18.7 million in other property and equipment

additions as compared to $48.0 million in the prior year.

Free cash flow

Free cash flow is a measure that represents the cash that a

company is able to generate after meeting its requirements to

maintain or expand its asset base. It is a calculation of operating

cash flow, less the amount of cash used in investing activities

related to property and equipment. Our free cash flow for the

year ended December 31, 2010, was $394.7 million, as compared

to $152.0 million in the prior year, representing an increase of

159.7 per cent. This increase was due to higher operating cash

flow relative to the prior year, as well as lower investments in

property and equipment as compared to 2009. Our 2010 free

cash flow per share was $2.72, as compared to $1.15 in 2009, a

year-over-year increase of 136.5 per cent.

Please refer to page 52 of this MD&A for a reconciliation of

the non-GAAP measures listed above, including free cash flow

and free cash flow per share, to the nearest measure under

Canadian GAAP.

Contractual obligations and commitments

Our contractual obligations for each of the next five years, which

do not include commitments for goods and services required in the

ordinary course of business, are indicated in the following table:

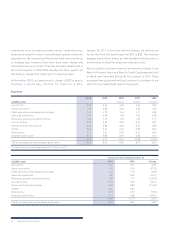

($ in thousands) Total 2011 2012 2013 2014 2015 Thereafter

Long-term debt repayments $ 1,047,177 $ 183,681 $ 169,642 $ 169,358 $ 169,626 $ 132,170 $ 222,700

Capital lease obligations(i) 5,878 282 245 245 245 245 4,616

Operating leases and commitments(ii) 1,366,015 206,983 202,085 195,222 190,423 166,189 405,113

Purchase obligations(iii) 1,647,046 72,217 182,961 270,436 287,597 401,406 432,429

Total contractual obligations $ 4,066,116 $ 463,163 $ 554,933 $ 635,261 $ 647,891 $ 700,010 $ 1,064,858

(i) Includes weighted average imputed interest at 5.28 per cent totalling $2,521.

(ii) Relates to operating leases and commitments for aircraft, land, buildings, equipment, computer hardware, software licences and satellite programming. The obligations of

these operating leases, where applicable, in US dollars are: 2011 – $186,454; 2012 – $188,807; 2013 – $185,535; 2014 – $184,359; 2015 – $161,149; and thereafter $361,979.

(iii) Relates to purchases of aircraft, as well as amounts to be paid for live satellite television systems on purchased and leased aircraft. These purchase obligations in

US dollars are: 2011 – $72,607; 2012 – $183,949; 2013 – $271,896; 2014 – $289,150; 2015 – $403,574; and thereafter $434,764.

We currently have 38 aircraft under operating leases. We have

entered into agreements with independent third parties to lease

three additional 737-700 aircraft and three additional 737-800

aircraft for terms ranging between eight and 10 years, to be

delivered throughout 2011 and 2012. Although the current

obligations related to our aircraft operating lease agreements

are not recognized on our balance sheet, we include these

commitments in assessing our overall leverage through our

adjusted debt-to-equity and adjusted net debt to EBITDAR ratios.

We signed an agreement with Bell ExpressVu to provide satellite

programming. The agreement commenced in 2004, expires

in July

2011

, and can be renewed for an additional four years.

During 2009, we amended our agreement with LiveTV to install,

maintain and operate live satellite television for all of our aircraft

f

or a term of 10 years. The minimum commitment amounts

associated with these agreements have been included in the

operating leases and commitments caption in the table above.