Westjet 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 WestJet 2010 Annual Report

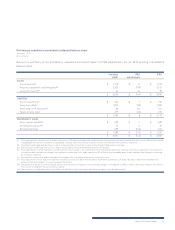

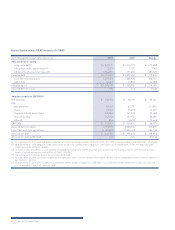

Preliminary unaudited impact to certain line items on the 2010

statement of earnings

($ in millions)

The following illustrates our preliminary unaudited estimated

pre-tax impact to specific items on our 2010 statement of earnings.

This table does not present all of our 2010 IFRS adjustments,

rather, only the most significantly affected expenses are included.

The remaining adjustments are not expected to have a material

net impact on our 2010 IFRS earnings before tax.

As noted in the table below, our estimated 2010 IFRS depreciation

and maintenance charges are expected to be higher than those

recorded under Canadian GAAP. This increase is due strictly to

timing of expense recognition, and overall expenses related to

the maintenance of our fleet will ultimately be the same under

IFRS and Canadian GAAP.

The increases in 2010 are related to the timing and recognition

of major engine maintenance costs for both our owned and

leased aircraft. Under Canadian GAAP, the costs of major engine

maintenance are recognized as incurred. Because of the young

age of our fleet, we have not performed significant levels of engine

overhauls prior to 2011. Under our current maintenance plan,

we anticipate that increasing levels of major maintenance will

be performed beginning in 2013. For leased aircraft, under IFRS,

these costs are recognized over the term of the lease based

on usage of the aircraft, rather than being based on the actual

maintenance event occurring. As a result, there will be timing

differences in expense recognition between IFRS and Canadian

GAAP, where in years when significant major maintenance

events occur, IFRS maintenance costs would be otherwise lower,

assuming a consistent fleet size and composition, than those

recognized under Canadian GAAP.

Depreciation expense under IFRS is also increased as compared

to that recognized under Canadian GAAP in 2010, due to the fact

that major maintenance events are recognized as a separate

component of the overall aircraft cost, and depreciated

over a shorter useful life until the next scheduled overhaul.

Under Canadian GAAP, these overhaul expenses would not have

been capitalized, rather, they would have been recognized as

maintenance expense when incurred.

These differences are related to the accounting recognition of

expenditures; therefore, we do not expect any changes in cash

flows as a result of adopting IFRS.

We expect that income tax expense for 2010 will decrease as a

result of lower expected 2010 earnings before income tax under

IFRS, as compared to under Canadian GAAP.

Significant accounting policy differences

We have identified the following significant differences between

our current accounting policies and those required or expected

to apply in preparing IFRS financial statements. The estimated

impact for 2010 is discussed for certain of these differences.

1. Property, plant and equipment

Componentization

Canadian GAAP – Maintenance and repair costs for owned

aircraft, including major overhauls, are currently charged to

expense at the time maintenance is performed.

IFRS – Each item of property and equipment with a significant

cost in relation to the total cost and/or a different useful life is

required to be depreciated separately. The costs of activities

($ in millions) Note

Canadian

GAAP

IFRS

adjustments IFRS

Depreciation and amortization 1 $ 133 $ 35–40 $ 168–173

Maintenance expense 2 100 15–20 115–120

Interest expense 2, 4 60 8–12 68–72

$ 58–72