Westjet 2010 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2010 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52 WestJet 2010 Annual Report

the first quarter of 2010. As at December 31, 2010, we have

hedged approximately 20 per cent of our anticipated jet fuel

requirements for the next 12 months.

For the first quarter of 2011, we anticipate that CASM, excluding

fuel and profit share, will be flat to down year-over-year on

an IFRS-comparable basis. From our inception, maintaining a

low-cost structure has been one of the keys to success at WestJet

and is ingrained in the way we do business. Throughout 2011,

we will roll out more self-tagging baggage functionality at nine

additional domestic airports and also exploit some cost-saving

opportunities we have identified in the procurement process.

We expect year-over-year capacity to increase between 9 and

10 per cent for the first quarter of 2011, and full-year capacity

to increase between 6 and 8 percent as compared to 2010. We

will take delivery of three aircraft during the first three months

of 2011 and three more throughout the remainder of the year,

ending 2011 with a fleet of 97. The additional capacity in the first

quarter will continue to be directed into the transborder and

international markets with domestic capacity slightly down.

Our full-year domestic capacity is expected to grow modestly

(1 to 2 per cent) in 2011, with increased frequencies within the

eastern triangle, which includes Toronto, Montreal and Ottawa,

and core transcontinental routes, including Vancouver-Toronto

and Calgary-Toronto. We have also introduced year-round

service on the Ottawa-Halifax and Ottawa-Vancouver routes.

These capacity extensions align with our code-share and business

traveller strategies.

For 2011, we anticipate total capital expenditures of $95 to

$105 million, with the majority of the spending related to aircraft

deposits and rotables. We purchased an aircraft in the first

quarter of 2011, which is the key reason for the increase in capital

expenditures, when compared to 2010 when we added only

leased aircraft.

As we move forward into 2011, we are encouraged by the

strengthening yield trend that emerged in the second half of 2010

and the growing optimism surrounding an economic recovery.

We expect that first quarter year-over-year RASM improvements

will be roughly in line with the positive change seen in the fourth

quarter of 2010. We realize fuel costs may be a headwind in 2011,

but we firmly believe that our fundamental low-cost structure

and strong balance sheet positions us well to weather fuel price

uncertainty. We will continue to capitalize on the recent investment

in our new reservations systems. Momentum is building and

our WestJet brand is stronger than ever. For 2011, we are

confident in our ability to continue to achieve profitable growth,

driven by the commitment of each and every one of our over

8,000 WestJetters.

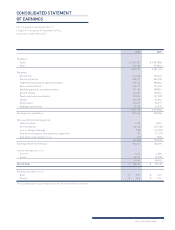

NON-GAAP MEASURES

To supplement our consolidated financial statements presented

in accordance with Canadian GAAP, we use various non-GAAP

performance measures as discussed below. These measures

are provided to enhance the reader’s overall understanding of

our current financial performance; they are included to provide

investors and management with an alternative method for

assessing our operating results in a manner that is focused

on the performance of our ongoing operations and to provide a

more consistent basis for comparison between quarters. These

measures are not in accordance with, or an alternative to, Canadian

GAAP and do not have standardized meanings. Therefore, they

are not likely to be comparable to similar measures presented

by other entities.

The following non-GAAP measures are used to monitor our

financial performance:

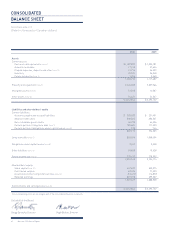

Adjusted debt: The sum of long-term debt, obligations under

capital leases and off-balance-sheet aircraft operating leases.

Our practice, consistent with common industry practice, is to

multiply the trailing 12 months of aircraft leasing expense by 7.5

to derive a present value debt equivalent. This measure is used

in the calculation of adjusted debt-to-equity and adjusted net

debt to EBITDAR, as defined below.

Adjusted equity: The sum of share capital, contributed surplus

and retained earnings, excluding AOCL. This measure is used in

the calculation of adjusted debt-to-equity.