Westjet 2010 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2010 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2010 Annual Report 39

Our operations are affected by a number of external factors that

are beyond our control such as weather conditions and special

circumstances or events occurring in the locations we serve.

Delays or cancellations due to weather conditions and work

stoppages or strikes by airport workers, baggage handlers, air

traffic controllers and other workers not employed by us could

have a material adverse impact on our financial condition and

operating results. Delays contribute to increased costs and

decreased aircraft utilization, which negatively affect profitability.

Our business is dependent on its ability to operate without

interruption at a number of key airports, including Toronto

Pearson International Airport and Calgary International Airport.

An interruption or stoppage in service at a key airport could have a

material adverse impact on our business, results from operations

and financial condition.

A localized epidemic or a global pandemic may adversely affect

our business.

A widespread outbreak of influenza, SARS, the H1N1 influenza

virus or any other widespread illness (whether domestic or

international) or any governmental or World Health Organization

travel advisories (whether relating to Canadian or international

cities or regions) could affect our ability to continue full operations

and could materially adversely affect demand for air travel. We

cannot predict the likelihood of such a public health emergency

or the effect that it may have on our business or the market price

of our securities. However, any significant reduction in guest

traffic on our network could have a material adverse effect on

our business, results from operations and financial condition.

Governmental fee increases discourage air travel.

All commercial service airports in Canada are regulated by the

federal government. Airport authorities continue to implement

or increase various user fees that impact travel costs for guests,

including landing fees for airlines and airport improvement fees.

Airport authorities generally have the unilateral discretion to

implement and adjust such fees. The combined increased fees,

and increases in rents under various lease agreements between

airport authorities and the Government of Canada, which in many

instances are passed through to air carriers and air travellers,

may negatively impact travel, in particular, discretionary travel.

Increases in air navigation fees in Canada could have a negative

impact on our business and our financial results.

Please refer to Accounting – Financial instruments and risk

management below for a further discussion on risks.

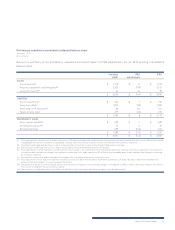

ACCOUNTING

Financial instruments and risk management

Our financial assets and liabilities consist primarily of cash and

cash equivalents, accounts receivable, derivatives both designated

and not designated in an effective hedging relationship, deposits,

accounts payable and accrued liabilities, long-term debt, and

capital lease obligations.

We are exposed to market, credit and liquidity risks associated

with our financial assets and liabilities. From time to time, we

use various financial derivatives to reduce market risk exposures

from changes in foreign exchange rates, interest rates and jet

fuel prices. We do not hold or use any derivative instruments for

trading or speculative purposes.

Overall, our Board of Directors has responsibility for the

establishment and approval of our risk management policies.

Management continually performs risk assessments to ensure

t

hat all significant risks related to us and our operations have been

reviewed and assessed to reflect changes in market conditions

and our operating activities.

Fuel risk

The airline industry is inherently dependent upon jet fuel to

operate and, therefore, we are exposed to the risk of volatile fuel

prices. Fuel prices are affected by a host of factors outside our

control, such as significant weather events, geopolitical tensions,

refinery capacity, and global demand and supply. To provide

management with reasonable foresight and predictability into

operations and future cash flows, we periodically use short-term

and long-term financial derivatives. Upon proper qualification, we

designate our fuel derivatives as cash flow hedges for accounting

purposes. For a discussion of the nature and extent of our use of