Westjet 2010 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2010 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2010 Annual Report 19

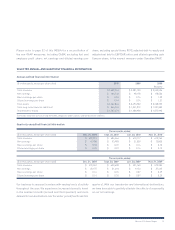

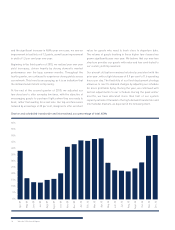

Twelve months ended December 31

(in millions) 2010 2009 Change

ASMs % of total ASMs % of total ASMs

Domestic 12,415.0 63.6% 12,506.9 71.1% (0.7%)

Charter and scheduled transborder and international 7,120.3 36.4% 5,080.7 28.9% 40.1%

Total 19,535.3 100.0% 17,587.6 100.0% 11.1%

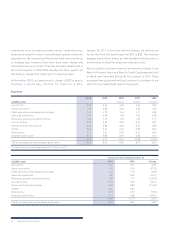

On average, long-haul routes have lower yields; however, even

with the substantial capacity increase in the transborder and

international markets, we experienced overall yield improvement.

This is due to stronger yields and slightly higher load factors in the

domestic market, as compared to the prior year, on a relatively

consistent level of capacity in the domestic market. Our guest

t

raffic remained relatively consistent year over year in our

domestic market, with strong increases in our transborder and

international markets consistent with our ASM growth in those

markets. Our capacity in the transborder and international

markets increased by 40.1 per cent from 2009, with a consistent

load factor and a flat year-over-year yield.

As announced in late 2010, we will be operating a leased

Boeing 757-200 from North American Airlines to provide non-stop

services between Calgary and Honolulu, Calgary and Maui, and

Edmonton and Maui between February 12 and April 30, 2011. This

temporary lease agreement will allow us to provide additional

capacity for non-stop service from Alberta to Hawaii. We will have

a WestJet service ambassador onboard each 757-200 flight to

ensure that the WestJet guest experience is consistently delivered

to our standards and expectations. This initiative once again

demonstrates our WestJet spirit and our ability to meet the

service needs of our guests.

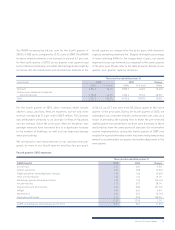

For 2010, other revenues decreased by 4.4 per cent to $204.0 million

from $213.3 million in 2009. We saw significant increases in

WestJet Vacations non-air revenue, offset by decreases in our

charter revenues due to the termination of our charter agreement

with Transat, effective May 10, 2009. Despite the absence of this

agreement in 2010, our strong load factor and traffic growth

indicate that our increased capacity is being profitably absorbed

by the market.

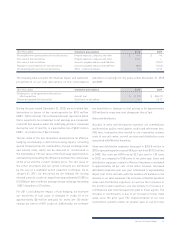

WestJet Vacations experienced significant revenue growth in

2010. Vacation package revenue increased over 70 per cent

from the prior year. Growth was largely to our Southern winter

destinations in Mexico and the Caribbean, in line with WestJet’s

network expansion into these regions. This growth, along with

longer stays in these markets, provided significant year-over-

year growth in our other revenues. WestJet Vacations continues

to be successful in generating an additional revenue stream and

supporting our network expansion to vacation destinations.

Ancillary revenues, which include service fees, onboard sales,

and partner and program revenue, provide an opportunity to

maximize our profits through the sale of higher-margin goods

and services, while enhancing our overall guest experience by

providing guests with additional products and services to meet

their needs. For 2010, ancillary revenues were $91.1 million,

representing a slight decrease from $91.7 million in 2009.

Ancillary fees per guest for the year decreased by 9.5 per cent to

$6.03 per guest from $6.66 per guest in 2009.

After the October 2009 implementation of our Sabre reservation

system, we experienced lower pre-reserved seating, change and

cancellation fees. The variance in pre-reserved seating fees

was experienced throughout the first three quarters of 2010, as

compared to 2009, mainly due to the shift in distribution methods to

more indirect channels, such as the use of travel agents. With our

new reservation system, we had limited ability to sell pre-reserved

seating through these channels. We have implemented plans

to increase the availability of pre-reserved seating through all

booking channels, and have seen these fees per guest continue

to improve throughout 2010. In addition, during the fourth quarter

of 2010, our corporate website redesign helped to improve

our conversion rates on pre-reserved seating fees, as the

booking flow now highlights this option more prominently than

in the past. We are now realizing levels of pre-reserved seating

fees per guest that are higher than those experienced prior to

our reservation system implementation. Lastly, for a period