Westjet 2010 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2010 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 WestJet 2010 Annual Report

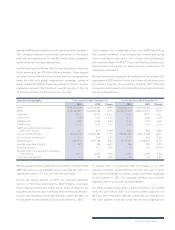

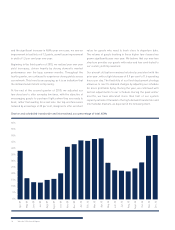

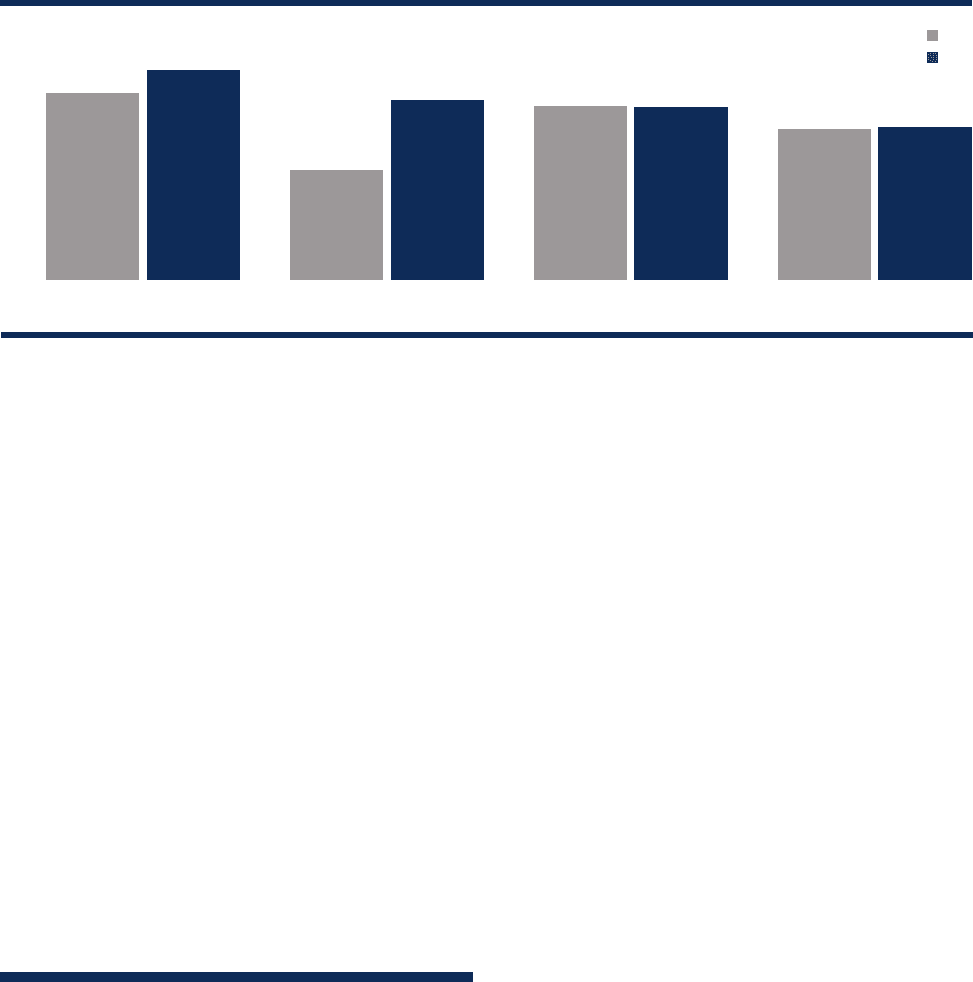

strong oad factor, particularly with the significant quarter-

over-quarter capacity increase of 13.8 per cent. This reflects

the improvement in the demand environment during the fourth

quarter. Our quarterly load factors over the 2009 and 2010 years

are depicted on the following chart.

During the fourth quarter of 2010, we broke our record for number

of guests flown in one day. On December 23, 2010, we flew over

50,000 guests on 434 flights. In addition, our on-time performance

statistic of 75.4 per cent during the fourth quarter of 2010 was our

best recorded performance since the fourth quarter of 2007.

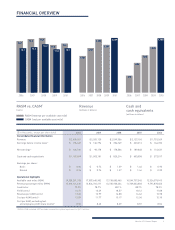

Cost control remains a key priority for us, and we have continued

with our disciplined approach to cost management. For the year

ended December 31, 2010, our realized CASM was 12.09 cents,

an increase of 2.7 per cent from a CASM of 11.77 cents in the

prior year. Excluding fuel and employee profit share, our CASM

increased slightly to 8.52 cents, up 0.8 per cent from 2009.

We maintained one of the strongest balance sheets in the North

American airline industry during 2010, as evidenced by our

significant cash and cash equivalents balance of $1,187.9 million

as at December 31, 2010, an increase of 18.2 per cent from

December 31, 2009. The increase in our cash position was a result

of our positive cash flow from operations. Our current ratio,

defined as current assets over current liabilities, improved

to 1.52 compared to 1.48 as at December 31, 2009, and our

adjusted debt-to-equity ratio improved by 2.8 per cent to 1.39

from 1.43 as at December 31, 2009. Similarly, our adjusted net

debt to earnings before interest, taxes, depreciation, aircraft rent

and other items (EBITDAR) ratio improved by 19.1 per cent to

1.78 compared to 2.20 as at December 31, 2009.

Our ROIC calculation is used to assess our efficiency at allocating

our capital to generate profitable returns. As at December 31,

2010, our trailing 12-month ROIC improved to 9.2 per cent from

7.8 per cent at December 31, 2009. This increase is primarily

attributable to improved earnings in 2010 versus 2009, and is

moving towards our target of a 12 per cent ROIC.

Operating cash flow for the year ended December 31, 2010, was

$443.3 million, an increase of 39.1 per cent from $318.7 million

in 2009. This increase is related primarily to improved earnings

from operations, as well as a positive year-over-year change in

non-cash working capital. Similarly, our diluted operating cash

flow per share increased to $3.05, as compared to $2.41 in 2009,

representing an increase of 26.6 per cent year over year.

During 2010, we increased our fleet size by five, ending the year

with 91 aircraft. With an average age of 5.2 years, we continue to

operate one of the youngest fleets of any large North American

commercial airline.

Quarterly load factor

84%

82%

80%

78%

76%

74%

72%

70%

Q1 Q2 Q3 Q4

2009

2010