Westjet 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2010 Annual Report 83

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

For the years ended December 31, 2010 and 2009

(Stated in thousands of Canadian dollars,

except share and per share amounts)

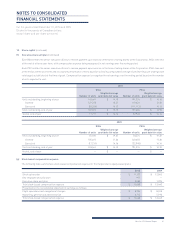

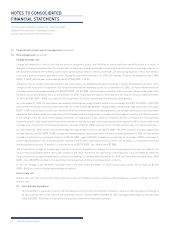

11. Related-party transactions (continued)

The Corporation engaged a relocation fi rm to purchase a single family residence from the President and Chief Executive Offi cer (CEO) for a

guaranteed price of US $1,525 in accordance with the Corporation’s relocation policy. The relocation fi rm will actively market the residence to

locate an outside buyer. If the proceeds on the sale of the home to a third party are less than or greater than the guaranteed price, the difference

between the guaranteed price and the proceeds will accrue to WestJet. The Corporation paid the relocation fi rm’s fees and expenses in

connection with this transaction, and also agreed to reimburse the offi cer for certain related tax and relocation expenses. The residence is

located in the United States and the transaction was a result of the offi cer’s move to Canada in conjunction with his appointment to President and

CEO, effective April 1, 2010. In connection with the relocation, the Corporation granted 38,256 RSUs pursuant to the ESU plan with a total value

of US $500, which are scheduled to wholly vest on April 1, 2011, the anniversary of the offi cer’s appointment to President and CEO. Upon exercise

of the RSUs, the Corporation will remit, on his behalf, an amount suffi cient to satisfy any withholding or other tax requirements of such RSUs,

limited to the withholding tax on the original award amount of US $500. Transactions have been measured at the exchange amount.

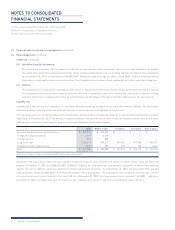

12. Commitments and contingencies

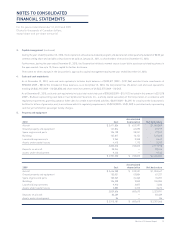

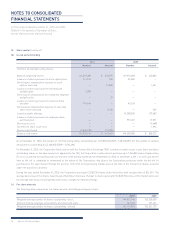

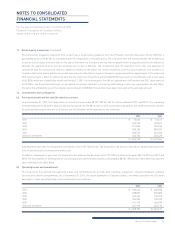

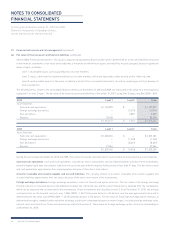

(a) Purchased aircraft and live satellite television systems

As at December 31, 2010, the Corporation is committed to purchase 38 737-700 aircraft for delivery between 2011 and 2017. The remaining

estimated amounts to be paid in deposits and purchase prices for the 38 aircraft, as well as amounts to be paid for live satellite television systems

on purchased and leased aircraft in US dollars and the Canadian-dollar equivalents, are as follows:

USD CAD

2011 $ 72,607 $ 72,217

2012 183,949 182,961

2013 271,896 270,436

2014 289,150 287,597

2015 403,574 401,406

2016 and thereafter 434,764 432,429

$ 1,655,940 $ 1,647,046

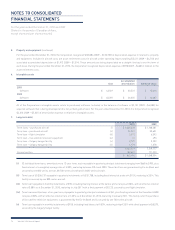

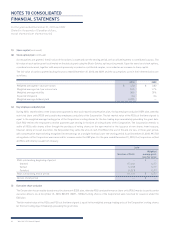

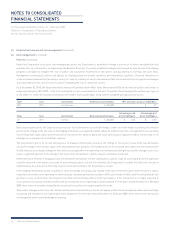

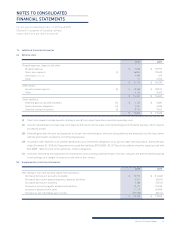

USD CAD

2011 $ 186,454 $ 206,983

2012 188,807 202,085

2013 185,535 195,222

2014 184,359 190,423

2015 161,149 166,189

2016 and thereafter 361,979 405,113

$ 1,268,283 $ 1,366,015

Subsequent to year end, the Corporation took delivery of one 737-700 aircraft. The Corporation did not incur any debt or equity fi nancing for this

aircraft and funded the entire purchase with cash.

In addition, subsequent to year end, the Corporation has deferred the deliveries of six 737-700 aircraft from the years 2012 to 2015 into 2017 and

2018. The total number of the Corporation’s aircraft purchase commitments remains unchanged at 38 737-700 aircraft. These deferrals have not

been refl ected in the table above.

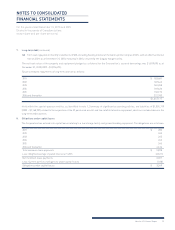

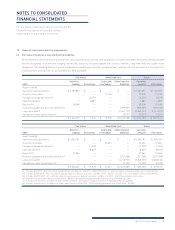

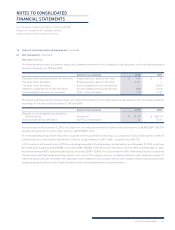

(b) Operating leases and commitments

The Corporation has entered into operating leases and commitments for aircraft, land, buildings, equipment, computer hardware, software

licences and satellite programming. As at December 31, 2010, the future payments in Canadian dollars, and when applicable the US-dollar

equivalents, under operating leases and commitments are as follows: