Westjet 2010 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2010 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2010 Annual Report 21

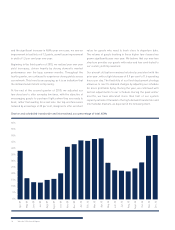

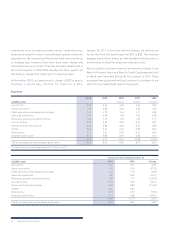

During 2010, our CASM increased by 2.7 per cent due to

increases in aircraft fuel, sales and distribution, as well as

aircraft leasing costs. These increases were largely offset by

decreases in marketing, general and administration, as well as

depreciation and amortization expense. Our CASM, excluding

fuel and employee profit share, grew slightly to 8.52 cents,

representing an increase of 0.8 per cent over 2009.

We remain diligent in our efforts to control expenses in order

to maintain our low-cost advantage. As part of our ongoing

focus to achieve sustainable cost savings, we constantly evaluate

alternatives to improve the effectiveness and efficiency of

our airline.

Aircraft fuel

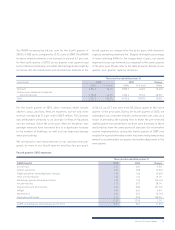

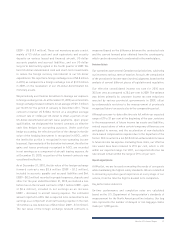

Aircraft fuel expense for 2010 was $674.6 million, representing

an increase of 18.2 per cent from the prior year. The average

market price for jet fuel rose to US $91 per barrel in 2010 versus

US $71 per barrel in 2009, representing an increase of 28.2 per cent.

With the Canadian dollar strengthening versus the US dollar in

2010, the average market price for jet fuel in Canadian dollars

was $94 per barrel versus $81 per barrel in 2009, an increase

of 16.0 per cent.

The increase in fuel costs was primarily due to increases in

US-dollar West Texas Intermediate (WTI) crude oil prices and

refining costs, partially offset by a higher Canadian dollar and

lower fuel hedging charges in 2010. Fuel remains our most

significant cost, representing approximately 29 per cent of total

operating costs for the year, as compared to approximately

28 per cent in 2009.

Under our fuel price risk management policy, we are permitted

to hedge a portion of our future anticipated jet fuel purchases for

up to 36 months, as approved by our Board of Directors. The policy

establishes hedging limits based on time horizon. Management

continually reviews and adjusts its strategy based on market

conditions and competitors’ positions. Our hedging program is

designed to mitigate the risk of sudden and substantial movements

in fuel prices causing volatility in our earnings and cash flows.

We do not hold or use any derivative instruments for speculative

purposes. Financial derivatives in crude-oil-based commodities

(including a variety of crude oil, heating oil and jet benchmarks)

that are traded directly on organized exchanges or are available

over the counter, can be useful in mitigating the risk of volatile

fuel prices. During the year ended December 31, 2010, we

purchased Canadian-dollar WTI call options and Canadian-dollar

jet fuel swaps, call options and collars. The cash premium paid

during the year related to option-style contracts was $6.2 million

(2009 – $nil).

As at December 31, 2010, we had a mixture of Canadian-dollar

WTI and jet fuel call options and collars to hedge approximately

20 per cent (2009 – 14 per cent) of our anticipated jet fuel

requirements for the next 12 months. The following tables outline,

per type, as at December 31, 2010, the notional volumes per

barrel (bbl.) or per gallon (gal.), along with the weighted average

contract prices.

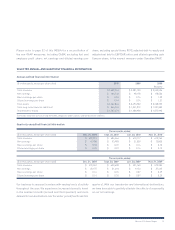

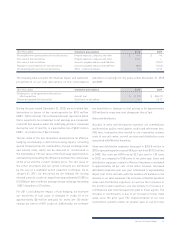

Type Year Instrument Notional volumes (bbl.) WTI average call price (CAD/bbl.)

WTI 2011 Call options 1,230,000 $ 97

Type Year Instrument Notional volumes (gal.)

Jet average call

price (CAD/gal.)

Jet average put

price (CAD/gal.)

Jet 2011 Collars 1,260,000 $ 2.50 $ 2.00