Westjet 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

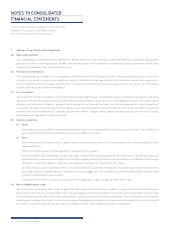

72 WestJet 2010 Annual Report

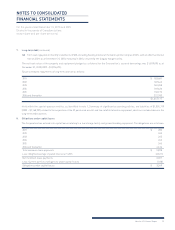

3. Capital management (continued)

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

For the years ended December 31, 2010 and 2009

(Stated in thousands of Canadian dollars,

except share and per share amounts)

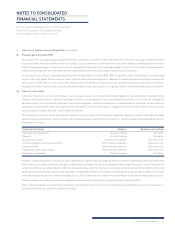

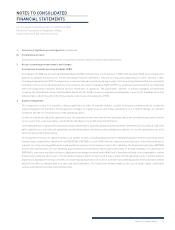

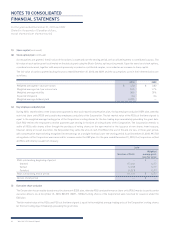

2010 2009 Change

Adjusted debt-to-equity

Long-term debt(i) $ 1,047,177 $ 1,219,777 $ (172,600)

Obligations under capital leases(ii) 3,357 4,102 (745)

Off-balance-sheet aircraft leases(iii) 1,066,815 779,655 287,160

Adjusted debt $ 2,117,349 $ 2,003,534 $ 113,815

Total shareholders’ equity 1,507,679 1,388,928 118,751

Add: AOCL 10,470 14,852 (4,382)

Adjusted equity $ 1,518,149 $ 1,403,780 $ 114,369

Adjusted debt-to-equity 1.39 1.43 (2.8%)

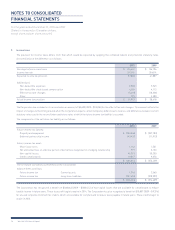

Adjusted net debt to EBITDAR(iv)

Net earnings $ 136,720 $ 98,178 $ 38,542

Add:

Net interest(v) 50,254 62,105 (11,851)

Taxes 59,947 38,618 21,329

Depreciation and amortization 132,894 141,303 (8,409)

Aircraft leasing 142,242 103,954 38,288

Other(vi) 814 10,478 (9,664)

EBITDAR $ 522,871 $ 454,636 $ 68,235

Adjusted debt (as above) 2,117,349 2,003,534 113,815

Less: Cash and cash equivalents (1,187,899) (1,005,181) (182,718)

Adjusted net debt $ 929,450 $ 998,353 $ (68,903)

Adjusted net debt to EBITDAR 1.78 2.20 (19.1%)

(i) As at December 31, 2010, long-term debt includes the current portion of long-term debt of $183,681 (2009 – $171,223) and long-term debt of $863,496

(2009 – $1,048,554).

(ii) As at December 31, 2010, obligations under capital leases includes the current portion of obligations under capital leases of $108 (2009 – $744) and obligations

under capital leases of $3,249 (2009 – $3,358).

(iii) Off-balance-sheet aircraft leases is calculated by multiplying the trailing 12 months of aircraft leasing expense by 7.5. As at December 31, 2010, the trailing

12 months of aircraft leasing costs totalled $142,242 (2009 – $103,954).

(iv) The trailing 12 months are used in the calculation of EBITDAR.

(v) As at December 31, 2010, net interest includes the trailing 12 months of interest income of $9,910 (2009 – $5,601) and the trailing 12 months of interest expense of

$60,164 (2009 – $67,706).

(vi) As at December 31, 2010, other includes the trailing 12 months foreign exchange loss of $780 (2009 – loss of $12,306) and the trailing 12 months of non-operating

loss on derivatives of $34 (2009 – gain of $1,828).

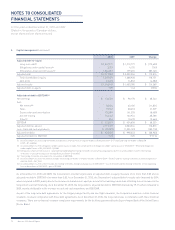

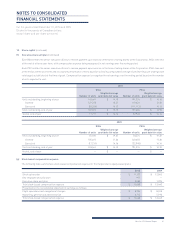

As at December 31, 2010 and 2009, the Corporation’s internal targets were an adjusted debt-to-equity measure of no more than 3.00 and an

adjusted net debt to EBITDAR of no more than 3.00. As at December 31, 2010, the Corporation’s adjusted debt-to-equity ratio improved by 2.8%

when compared to 2009, mainly due to the increase in shareholders’ equity as a result of net earnings more than offsetting the net increase in the

Corporation’s aircraft fi nancing. As at December 31, 2010, the Corporation’s adjusted net debt to EBITDAR improved by 19.1% when compared to

2009, mainly attributable to the increase in cash and cash equivalents and EBITDAR.

As part of the long-term debt agreements for the Calgary hangar facility and one fl ight simulator, the Corporation monitors certain fi nancial

covenants to ensure compliance with these debt agreements. As at December 31, 2010, the Corporation was in compliance with these fi nancial

covenants. There are no fi nancial covenant compliance requirements for the facilities guaranteed by the Export-Import Bank of the United States

(Ex-Im Bank).