Westjet 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74 WestJet 2010 Annual Report

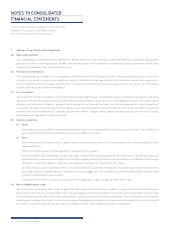

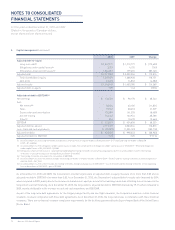

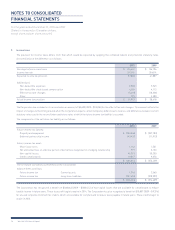

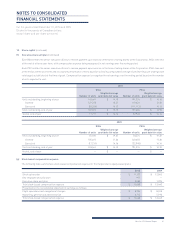

5. Property and equipment (continued)

For the year ended December 31, 2010, the Corporation recognized $128,284 (2009 − $135,702) of depreciation expense in relation to property

and equipment. Included in aircraft costs are asset retirement costs for aircraft under operating leases totalling $5,411 (2009 – $4,710) and

associated accumulated depreciation of $1,912 (2009 – $1,314). These amounts are being depreciated on a straight-line basis over the term of

each lease. During the year ended December 31, 2010, the Corporation recognized depreciation expense of $598 (2009 – $468) in relation to the

asset retirement costs.

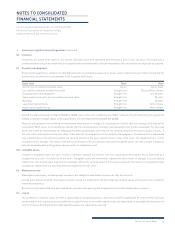

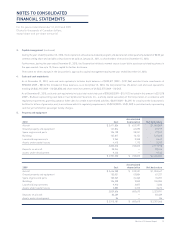

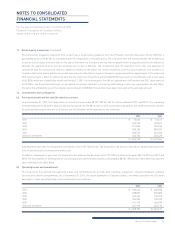

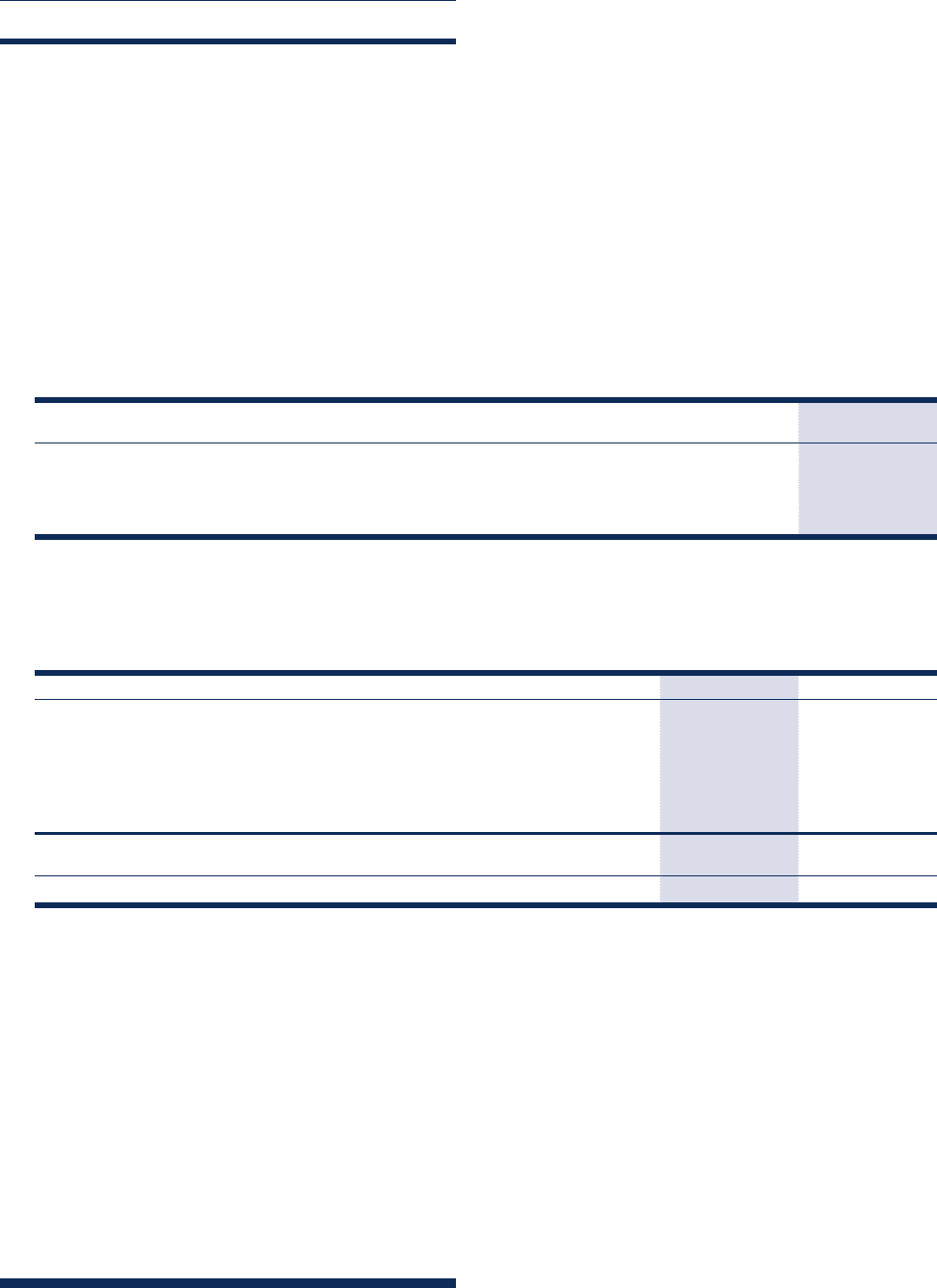

6. Intangible assets

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

For the years ended December 31, 2010 and 2009

(Stated in thousands of Canadian dollars,

except share and per share amounts)

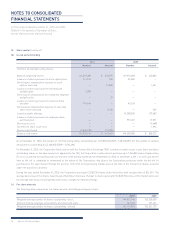

Cost

Accumulated

amortization Net book value

2010

Software $ 43,549 $ 30,531 $ 13,018

2009

Software $ 40,392 $ 26,305 $ 14,087

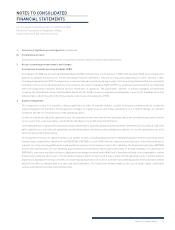

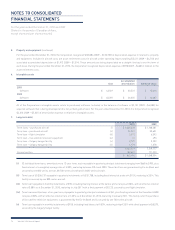

2010 2009

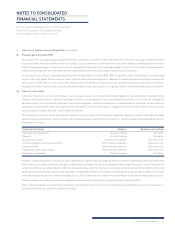

Term loans – purchased aircraft (i) $ 1,005,678 $ 1,168,381

Term loan – purchased aircraft (ii) 25,997 33,631

Term loan – fl ight simulator (iii) 5,575 6,392

Term loan – live satellite television equipment (iv) 41 493

Term loan – Calgary hangar facility (v) 8,707 9,202

Term loan – Calgary hangar facility (vi) 1,179 1,678

1,047,177 1,219,777

Current portion 183,681 171,223

$ 863,496 $ 1,048,554

All of the Corporation’s intangible assets relate to purchased software. Included in the balance of software is $2,151 (2009 − $4,085) for

acquired software that is being developed and is not yet being amortized. For the year ended December 31, 2010, the Corporation recognized

$4,610 (2009 – $5,601) of amortization expense in relation to intangible assets.

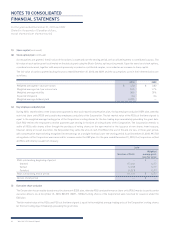

7. Long-term debt

(i) 52 individual term loans, amortized over a 12-year term, each repayable in quarterly principal instalments ranging from $668 to $955, plus

fi xed interest at a weighted average rate of 5.30%, maturing between 2014 and 2020. These facilities are guaranteed by Ex-Im Bank and

secured by one 800-series aircraft, 38 700-series aircraft and 13 600-series aircraft.

(ii) Term loan of US $26,137 repayable in quarterly instalments of US $1,788, including fi xed interest at a rate of 4.315%, maturing in 2014. This

facility is secured by one 800-series aircraft.

(iii) Term loan repayable in monthly instalments of $93, including fl oating interest at the bank’s prime rate plus 0.88%, with an effective interest

rate of 3.88% as at December 31, 2010, maturing in July 2011 with a fi nal payment of $5,123, secured by one fl ight simulator.

(iv) Term loan amortized over a fi ve-year term, repayable in quarterly principal instalments of $41, plus fl oating interest at the Canadian LIBOR

rate plus 0.08%, with an effective interest rate of 1.30% as at December 31, 2010, maturing in January 2011. This facility is for the purchase

of live satellite television equipment, is guaranteed by the Ex-Im Bank and is secured by one 700-series aircraft.

(v) Term loan repayable in monthly instalments of $108, including fi xed interest at 9.03%, maturing in April 2011 with a fi nal payment of $8,575,

secured by the Calgary hangar facility.