Westjet 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2010 Annual Report 49

that restore the service potential of airframes, engines and

landing gear will be considered components of the aircraft

and will be added to the carrying amount of the asset and

amortized over the period until the next overhaul.

Depreciation

Canadian GAAP – Currently, depreciation of our owned aircraft

is based on aircraft cycles.

IFRS – As a result of componentization as described above,

we have made an election to change the depreciation method

of our aircraft to the straight-line method, which most closely

reflects the expected pattern of consumption of the future

economic benefits embodied in the assets, as we estimate

that the aircraft will be retired after a specified time period

rather than a specified number of cycles flown. Our policy will

be to depreciate our aircraft on a straight-line basis over a

period of 20 years.

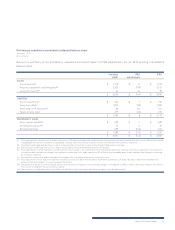

Estimated 2010 impact

Depreciation and amortization expense for the 2010 period

is estimated to increase by approximately $35 to $40 million

due to the increased depreciation expense related to the

componentization of our aircraft, as well as the change in

depreciation method from a units-of-production (cycles) to a

straight-line method.

2. Provisions, contingent liabilities and contingent assets

Maintenance provision for leased aircraft

Canadian GAAP – For our aircraft under operating leases

provisions for future maintenance expenses related to

aircraft lease return conditions are not currently recognized.

Expenses for maintenance are recognized as incurred.

IFRS – A provision will be recognized during the lease term

for the future obligation to return the aircraft to the lessor at

or better than contractually specified maintenance levels.

Maintenance Reserves

Canadian GAAP – A number of aircraft leases also require

WestJet to pay maintenance reserves to the lessor. The purpose

of these payments is to provide the lessor with collateral

should an aircraft be returned in a condition that does not

meet the maintenance requirements of the lease. These

payments are currently expensed when due under contract. If

a maintenance event occurs that qualifies for reimbursement,

a receivable is recognized at the same time the maintenance

costs are recorded.

IFRS – As maintenance reserves are either refunded when

qualifying maintenance is performed, these payments will

be recognized as an asset. As qualifying maintenance is

performed and reimbursed, the asset will be drawn down.

At any time, where the amount of maintenance reserves paid

exceeds the estimated amount recoverable from the lessor,

the non-recoverable amount will be expensed.

Soft dollar credit files

Canadian GAAP – Soft dollar credit files are credits provided to

guests as a sign of goodwill to be used towards future travel.

These are recorded as an expense and as a liability at the

issue date, and measured at incremental cost.

IFRS – The issuance of discretionary credit files does not

require a performance obligation to be fulfilled by WestJet,

nor is the issuance part of a sales transaction and, therefore,

no obligation exists at the time of the issue. As such, soft

dollar credit files will no longer be recognized as a liability

upon issuance but rather recognized as a reduction to revenue

upon redemption.

Estimated 2010 impact

Maintenance expense for the 2010 period is expected to increase

by approximately $15 to $20 million due to the recognition

of maintenance provisions over the term of the aircraft lease,

offset by the maintenance reserves recoverable related to the

maintenance provisions.

Interest expense for 2010 is expected to increase by

approximately $3 to $5 million related to the accretion of the

maintenance provision.