Westjet 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2010 Annual Report 71

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

For the years ended December 31, 2010 and 2009

(Stated in thousands of Canadian dollars,

except share and per share amounts)

1. Summary of signifi cant accounting policies (continued)

(t) Comparative amounts

Certain prior-period balances have been reclassifi ed to conform to the current period’s presentation.

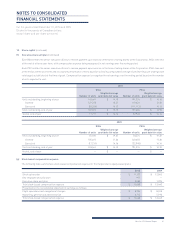

2. Recent accounting pronouncements and changes

International fi nancial reporting standards (IFRS)

On February 13, 2008, the Accounting Standards Board (AcSB) confi rmed that the changeover to IFRS from Canadian GAAP will be required for

publicly accountable enterprises for interim and annual fi nancial statements, effective for fi scal years beginning on or after January 1, 2011,

including comparatives for 2010. The objective is to improve fi nancial reporting by having a single set of accounting standards that are comparable

with other entities on an international basis. The transition from current Canadian GAAP to IFRS is a signifi cant undertaking that will materially

affect the Corporation’s reported fi nancial position and results of operations. The Corporation continues to monitor standards developments

issued by the International Accounting Standards Board and the AcSB, as well as regulatory developments issued by the Canadian Securities

Administrators, which may affect the timing, nature or disclosure of its adoption of IFRS.

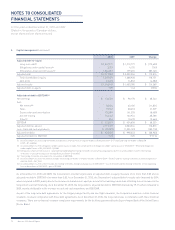

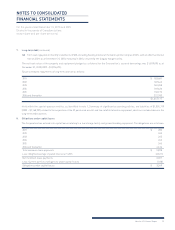

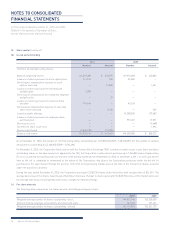

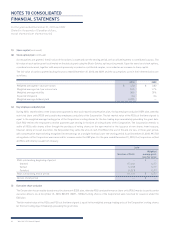

3. Capital management

The Corporation’s policy is to maintain a strong capital base in order to maintain investor, creditor and market confi dence and to sustain the

future development of the airline. The Corporation manages its capital structure and makes adjustments to it in light of changes in economic

conditions and the risk characteristics of the underlying assets.

In order to maintain or adjust the capital structure, the Corporation may, from time to time, purchase shares for cancellation pursuant to normal

course issuer bids, issue new shares, pay dividends and adjust current and projected debt levels.

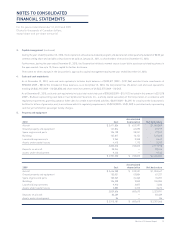

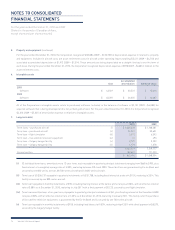

In the management of capital, the Corporation includes shareholders’ equity (excluding accumulated other comprehensive loss (AOCL)), long-term

debt, capital leases, cash and cash equivalents and the Corporation’s off-balance-sheet obligations related to its aircraft operating leases, all of

which are presented in detail below.

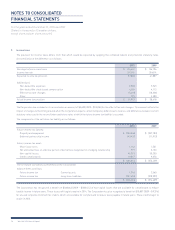

The Corporation monitors its capital structure on a number of bases, including adjusted debt-to-equity and adjusted net debt to earnings before

interest, taxes, depreciation and aircraft rent (EBITDAR). EBITDAR is a non-GAAP fi nancial measure commonly used in the airline industry to

evaluate results by excluding differences in the method by which an airline fi nances its aircraft. In addition, the Corporation will adjust EBITDAR

for one-time special items, for non-operating gains and losses on derivatives and for gains and losses on foreign exchange. The calculation of

EBITDAR is a measure that does not have a standardized meaning prescribed under GAAP and is therefore not likely to be comparable to similar

measures presented by other issuers. The Corporation adjusts debt to include its off-balance-sheet aircraft operating leases. Common industry

practice is to multiply the trailing 12 months of aircraft leasing expense by 7.5 to derive a present-value debt equivalent. The Corporation defi nes

adjusted net debt as adjusted debt less cash and cash equivalents. The Corporation defi nes equity as the sum of share capital, contributed

surplus and retained earnings, and excludes AOCL.