Qantas 2015 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

QANTAS ANNUAL REPORT 2015

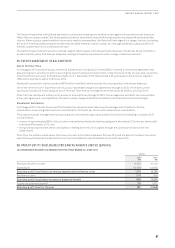

ii. Subsequent Expenditure

Subsequent expenditure is capitalised only when it increases the future economic benefits embodied in the specific asset to which

it relates. All other expenditure, including expenditure on internally generated goodwill and brands, is recognised in the Consolidated

Income Statement as incurred.

iii. Amortisation

Amortisation is calculated to write off the cost of intangible assets less their estimated residual values using the straight-line

method over their estimated useful lives and is recognised in the Consolidated Income Statement. Goodwill, Brand Names and

Trademarks and Airport Landing Slots are indefinite lived intangible assets and are allocated to the relevant CGU. These indefinite

lived intangible assets are not amortised but tested annually for impairment. Contract intangible assets is not amortised until such

time the intangible asset is ready for use, but tested annually for impairment.

Years

Software 3 – 10

Customer Contracts/Relationships 5 – 10

(L) EMPLOYEE BENEFITS

Wages, Salaries, Annual

Leave and Sick Leave

Liabilities for wages, salaries, annual leave (including leave loading) and sick leave vesting to

employees are recognised in respect of employees’ services up to the end of the reporting period.

These liabilities are measured at the amounts expected to be paid when they are settled and include

related on-costs, such as workers compensation insurance, superannuation and payroll tax. The

annual leave provision is discounted using Corporate Bond rates which most closely match the terms

to maturity of the provision. The unwinding of the discount is treated as a finance charge.

Employee Share Plans The grant date fair value of equity-settled share-based payment awards granted to employees is

generally recognised as an expense, with a corresponding increase in equity, over the vesting period

of the awards. The amount recognised as an expense is adjusted to reflect the number of awards for

which related service and non-market performance conditions are expected to be met, such that the

amount ultimately recognised is based on the number of awards that meet the related service and

non-market performance conditions at the vesting date. For share-based payment awards with non-

vesting conditions (such as market performance conditions), the grant date fair value of the share-

based payment is measured to reflect such conditions and that there is no true-up for differences

between expected and actual outcomes.

The fair value of equity-based entitlements settled in cash is recognised as an employee expense

with a corresponding increase in liability over the period during which employees unconditionally

become entitled to payment. The liability is remeasured at each reporting date and at settlement

date based on the fair value. Any changes in the fair value of the liability are recognised as an

employee expense in the Consolidated Income Statement.

Long Service Leave

The liability for long service leave is recognised as a provision for employee benefits and measured

at the present value of estimated future payments to be made in respect of services provided by

employees up to the end of the reporting period. The provision is calculated using expected future

increases in wage and salary rates including related on-costs and expected settlement dates based on

staff turnover history. The provision is discounted using Corporate Bond rates which most closely match

the terms to maturity of the provision. The unwinding of the discount is treated as a finance charge.

Defined Contribution

Superannuation Plans

The Qantas Group contributes to employee defined contribution superannuation plans. Contributions

to these plans are recognised as an expense in the Consolidated Income Statement as incurred.

Defined Benefit

Superannuation Plans

The Qantas Group’s net obligation with respect to defined benefit superannuation plans is calculated

separately for each plan. The Qantas Superannuation Plan has been split based on the divisions which

relate to accumulation members and defined benefit members. Only defined benefit members are

included in the Qantas Group’s net obligation calculations. The calculation estimates the amount of

future benefit that employees have earned in return for their service in the current and prior periods,

which is discounted to determine its present value, and the fair value of any plan assets is deducted.

The calculation of defined benefit obligations is performed annually by a qualified actuary using

theprojected unit credit method. When the calculation results in a potential asset for the Group, the

recognised asset is limited to the present value of economic benefits available in the form of any future

refunds from the plan or reductions in future contributions to the plan. To calculate the present value

of economic benefits, consideration is given to any applicable minimum funding requirements.