Qantas 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

QANTAS ANNUAL REPORT 2015

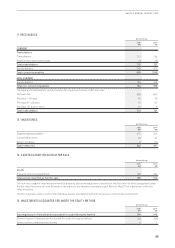

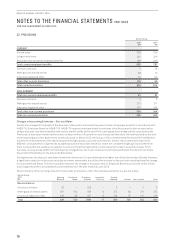

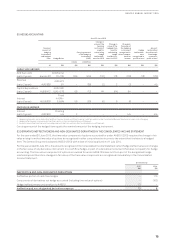

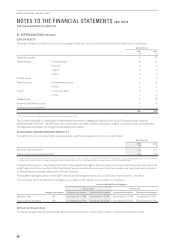

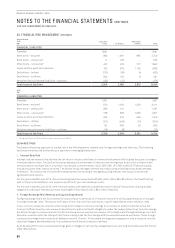

(D) HEDGE ACCOUNTING

As at 30 June 2015

Nominal

amount of

hedging

instrument

and hedged

item Hedge Rates

Carrying amount

of the hedging

instrument

(AUD)1

Change in

value of the

hedging

instrument

used for

calculating

hedge

ineffective-

ness for 2015

Change in

value of the

hedged item

used for

calculating

hedge

ineffective-

ness for 2015

Change in

the value of

the hedging

instrument

recognised in

other compre-

hensive

income

Hedge

ineffective-

ness

recognised in

profit or loss2

Amount

reclassified

from the cash

flow hedge

reserve to

profit or loss3

Assets Liabilities

M$M $M $M $M $M $M $M $M

CASH FLOW HEDGES

AUD fuel costs

(up to 2 years) barrels 33

AUD/barrel

70–135 539 (419) (131) 118 (118) (13) (170)

Revenue

(up to 2 years) AUD $38

AUD/JPY

81 –(38) (2) 2(2) –40

Capital Expenditure

(up to 2 years) AUD $472

AUD/USD

0.90–0.78 66 (12) 64 (64) 64 – –

Interest

(up to 6 years) AUD $828

Fixed

4.40%–

5.99% 56 (53) (6) 6(6) – –

FAIR VALUE HEDGES

Interest

(up to 5 years) AUD $20

Floating

n/a 2–––n/a –n/a

1 Hedging instruments are located within the Other Financial Assets and Other Financial Liabilities caption on the Consolidated Balance Sheet and includes costs of hedging.

2 Hedge ineffectiveness is recognised in the Other caption in the Consolidated Income Statement.

3 Amounts reclassified from the cash flow hedge reserve to the Fuel caption in the Consolidated Income Statement.

Carrying amount of the hedged item equals the nominal amount of the hedging instrument.

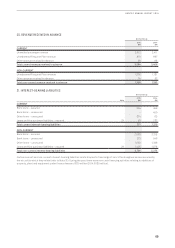

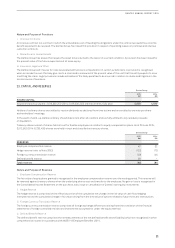

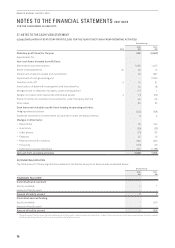

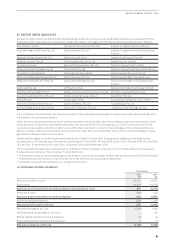

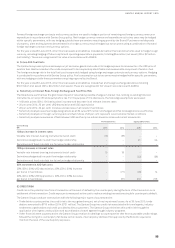

(E) DERIVATIVE INEFFECTIVENESS AND NON-DESIGNATED DERIVATIVES IN THE CONSOLIDATED INCOME STATEMENT

For the year ended 30 June 2015, the time value component of options accounted for under AASB 9 (2013) requires the change in fair

value arising from the time value of options be recognised in other comprehensive income to the extent that it relates to a hedged

item. The Qantas Group early adopted AASB 9 (2013) with a date of initial application of 1 July 2014.

For the year ended 30 June 2014, the amounts recognised in the Consolidated Income Statement reflect hedge ineffectiveness on changes

i

n the fair value of any derivative instrument in a cash flow hedge, or part of a derivative instrument that does not qualify for hedge

accounting. The time value component of options accounted for under AASB 139 does not form part of the designated hedge

relationship and therefore changes in fair value of the time value component are recognised immediately in the Consolidated

Income Statement.

Qantas Group

2015

$M

2014

$M

INEFFECTIVE AND NON-DESIGNATED DERIVATIVES

Ineffective portion of cash flow hedges –110

Components of derivatives not hedge accounted (including time value of options) –(102)

Hedge ineffectiveness on transition to AASB 9 13 –

Ineffective and non-designated derivatives expense 13 8