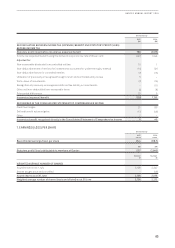

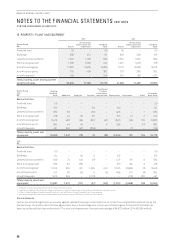

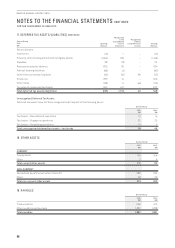

Qantas 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

FOR THE YEAR ENDED 30 JUNE 2015

70

QANTAS ANNUAL REPORT 2015

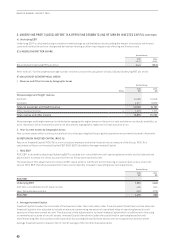

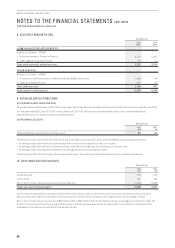

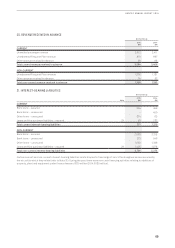

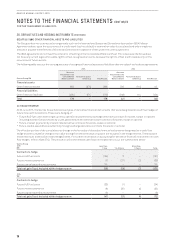

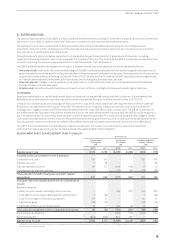

22. PROVISIONS

Qantas Group

2015

$M

2014

$M

CURRENT

Annual leave 253 259

Long service leave 291 316

Redundancies and other employee benefits 138 206

Total current employee benefits 682 781

Onerous contracts 123

Make good on leased assets 63 10

Insurance, legal and other 72 62

Total other current provisions 136 95

Total current provisions 818 876

NON-CURRENT

Total non-current employee benefits 41 61

Onerous contracts 2 3

Make good on leased assets 211 177

Insurance, legal and other 141 164

Total other non-current provisions 354 344

Total non-current provisions 395 405

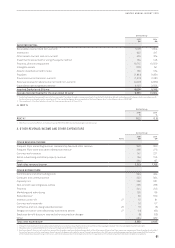

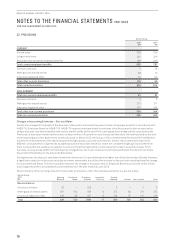

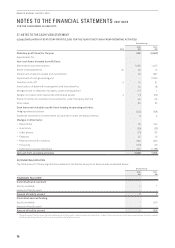

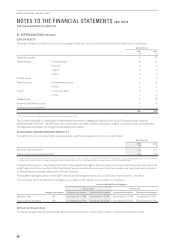

Changes in Accounting Estimates – Discount Rates

Qantas has changed its estimate of the discount rates used to calculate the present value of employee benefits in accordance with

AASB 119: Employee Benefits (AASB 119). AASB 119 requires employee benefit provisions to be discounted to their present value

using a discount rate determined by reference to market yields at the end of the reporting period on high quality corporate bonds.

Previously, it was determined that there was no deep market in Australia for such bonds and therefore, the market yields at the end

of the reporting period for government bonds was used. In March 2015, the Group of 100 commissioned the actuarial firm Milliman

toperform an assessment of the depth of Australia’s high quality corporate bond market. In their report released in April 2015,

Milliman concluded that it is generally accepted practice that bonds rated AA or above are considered high quality and therefore

there is now sufficient evidence to support a conclusion that the high quality corporate bond market in Australia is deep. From

this date, as required by AASB 119 the Group has changed the rate it uses to discount its Employee Benefit Provisions from State

Government Bond Rates to the Corporate Bond Rate.

During the year, the discount rate determined with reference to Corporate Bonds was higher than State Government Bonds. However,

a significant reduction in discount rates due to market movements has offset the increase in discount rate resulting from the change

to Corporate Bond Rates. The net favourable impact of the change in discount rates on Employee Benefits provisions of $14 million

was recognised in the Consolidated Income Statement for the year ended 30 June 2015.

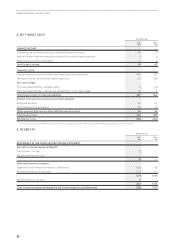

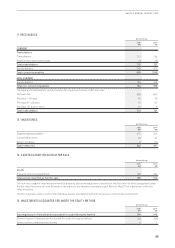

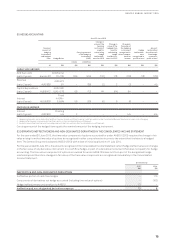

Reconciliations of the carrying amounts of each class of provision, other than employee benefits, are set out below:

Qantas Group

2015

$M

Opening

Balance

Provisions

Made

Provisions

Utilised

Unwind of

Discount

Closing

Balance Current Non-current Total

Reconciliations

Onerous contracts 26 –(23) – 3 1 2 3

Make good on leased assets 187 104 (26) 9274 63 211 274

Insurance, legal and other 226 36 (57) 8213 72 141 213

Total 439 140 (106) 17 490 136 354 490