Qantas 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

QANTAS ANNUAL REPORT 2015

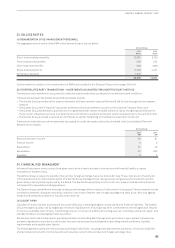

ii. Recognition and Measurement of Non-derivative Financial Liabilities

Non-derivative financial liabilities are recognised initially at fair value less attributable transaction costs. Subsequent to initial

recognition, these liabilities are stated at amortised cost, with any difference between cost and redemption value being recognised

in the Consolidated Income Statement over the period of the borrowings on an effective interest basis. Non-derivative financial

liabilities that are designated as hedged items are subject to measurement under the hedge accounting requirements.

iii. De-recognition of Non-derivative Financial Instruments

A financial asset (or where applicable, a part of a financial asset or part of a group of similar financial assets) is de-recognised

(i.e.removed from the Group’s Consolidated Balance Sheet) when:

–The rights to receive cash flows from the asset have expired; or

–The Group has transferred its rights to receive cash flows from the asset or has assumed an obligation to pay the received cash

flows in full without material delay to a third party under a ‘pass-through’ arrangement; and either (a) the Group has transferred

substantially all the risks and rewards; or (b) the Group has neither transferred nor retained substantially all the risks and rewards

of the asset, but has transferred control of the asset.

The Group de-recognises a financial liability when its contractual obligations are discharged or cancelled or expire.

DERIVATIVE FINANCIAL INSTRUMENTS

The Group is subject to foreign currency, interest rate, fuel price and credit risks. Derivative and non-derivative financial instruments

may be used to hedge these risks. It is the Group’s policy not to enter into, issue or hold derivative financial instruments for

speculative trading purposes.

Derivative financial instruments are recognised at fair value both initially and on an ongoing basis. Transaction costs attributable

to the derivative are recognised in the Consolidated Income Statement when incurred. The method of recognising gains and losses

resulting from movements in market prices depends on whether the derivative is a designated hedging instrument and, if so, the

nature of the risk being hedged. The Group designates certain derivatives as either hedges of the fair value of recognised assets or

liabilities or a firm commitment (fair value hedges), or hedges of highly probable forecast transactions (cash flow hedges).

At the inception of the transactions, the Qantas Group documents the relationship between hedging instruments and hedged

items, including the risk management objective and strategy for undertaking each transaction. The Qantas Group also documents

its assessment, both at hedge inception and on an ongoing basis, of whether the hedging instruments that are used in hedge

transactions have been and will continue to be highly effective.

i. Fair Value Hedges

Changes in the fair value of derivative financial instruments that are designated and qualify as fair value hedges are recorded in

the Consolidated Income Statement, together with any changes in the fair value of the hedged asset or liability or firm commitment

attributable to the hedged risk.

ii. Cash Flow Hedges

The effective portion of changes in the fair value of derivative financial instruments that are designated and qualify as cash flow

hedges are recognised in other comprehensive income and are presented within equity in the hedge reserve. The cumulative gain or

loss in the hedge reserve is recognised in the Consolidated Income Statement in the periods when the hedged item will affect profit

or loss (i.e. when the underlying income or expense is recognised). Where the hedged item is of a capital nature, the cumulative gain

or loss recognised in the hedge reserve is transferred to the carrying amount of the asset when the asset is recognised.

When a hedging instrument expires or is sold, terminated or exercised, or the Qantas Group revokes designation of the hedge

relationship but the hedged forecast transaction is still expected to occur, the cumulative gain or loss at that point remains in

the hedge reserve and is recognised in accordance with the above policy when the transaction occurs. If the underlying hedged

transaction is no longer expected to take place, the cumulative unrealised gain or loss recognised in the hedge reserve with respect

to the hedging instrument is recognised immediately in the Consolidated Income Statement.

iii. Cost of Hedging

The time value of an option, the forward element of a forward contract and any foreign currency basis spread is excluded from the

designation of a financial instrument and accounted for as a cost of hedging. The fair value changes of these elements are recognised

in other comprehensive income and depending on the nature of the hedged item, will either be transferred to the Consolidated

Income Statement in the same period that the underlying transaction affects the Consolidated Income Statement or be capitalised

into the initial carrying value of a hedge and reported as ineffectiveness.