Qantas 2015 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

QANTAS ANNUAL REPORT 2015

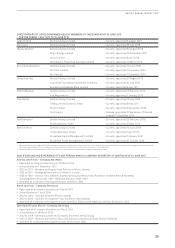

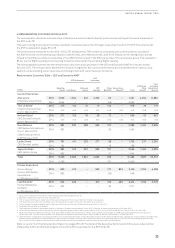

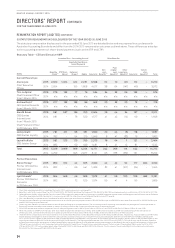

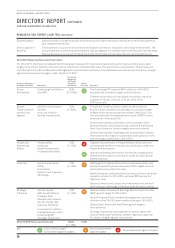

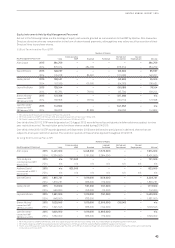

A reconciliation of the CEO’s remuneration outcome to the statutory disclosures is detailed below as an example.

CEO’s Remuneration Outcome to Statutory Remuneration Disclosure for 2014/2015

Reconciliation ($’000) Description

Remuneration outcome for the CEO for 2014/2015

11,88 4

Treatment of STIP

Add: Accounting value for 2012/13 STIP and

2014/15 STIP deferred awards

Less: 2014/15 STIP deferred award

423

(952)

The STIP amount shown in the remuneration outcomes tables is the

full value of the STIP awarded for the corresponding year calculated

as a product of Base Pay, ‘At Target’ Opportunity, STIP Scorecard

Result and Individual Performance Factor (rather than amortising

the accounting values over the relevant performance and service

periods as per the accounting standards).

Treatment of LTIP

Add: Accounting value for LTIP award tested

on relative TSR performance (2013–2015 LTIP)1

850 The LTIP amount shown in the remuneration outcomes tables is

made up of the value of the LTIP driven by vesting based on the

share price at the start of the performance period and value of

the LTIP driven by share price growth (rather than amortising the

accounting values over the relevant performance and service

periods as per the accounting standards).

Add: Accounting value for LTIP award to be

tested in a future year (2014–2016 LTIP)2

670

Add: Accounting value for LTIP award to be

tested in a future year (2015–2017 LTIP)3

741

Less: 2013–2015 LTIP – vesting4(2,353)

Less: 2013–2015 LTIP – share price growth5(4,563)

Statutory remuneration disclosure for the

CEO for 2014/2015 6,700

1 The 2013–2015 LTIP was tested as at 30 June 2015. 85 per cent of Rights vested and the remaining Rights lapsed.

2 The 2014–2016 LTIP is due to be tested as at 30 June 2016. The Qantas share price at the start of the performance period (1 July 2013) was $1.35.

3 The 2015–2017 LTIP is due to be tested as at 30 June 2017. The Qantas share price at the start of the performance period (1 July 2014) was $1.26.

4 The face value of shares awarded based on the Qantas share price at the start of the performance period (1 July 2012).

5 The increase in the value of the share award from the start of the performance period (1 July 2012) to the end of the performance period (30 June 2015).

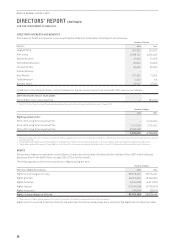

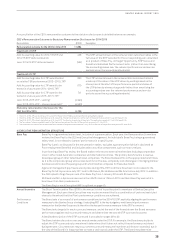

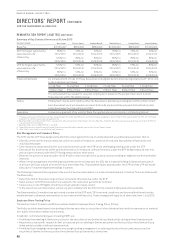

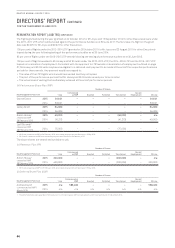

6) EXECUTIVE REMUNERATION STRUCTURE

Base Pay Base Pay is a guaranteed salary level, inclusive of superannuation. Each year, the Remuneration Committee

reviews the Base Pay for the CEO and Executive Management. An individual’s Base Pay, being a guaranteed

salary level, is not related to Qantas’ performance in a specific year.

Base Pay (cash), as disclosed in the remuneration tables, excludes superannuation (which is disclosed as

Post-employment Benefits) and includes salary sacrifice components such as motor vehicles.

In performing a Base Pay review, the Board makes reference to external market data including comparable

roles in other listed Australian companies and international airlines. The primary benchmark is a revenue-

based peer group of other listed Australian companies. The Board believes this is the appropriate benchmark,

as it is the comparator group whose roles best mirror the size, complexity and challenges in managing Qantas’

businesses and is also the peer group with whom Qantas competes for Executive talent.

A general management pay freeze was in place during 2014/2015 and there have been no increases to the

Base Pay for Mr Joyce since July 2011 and for Mr Evans, Ms Hrdlicka and Ms Grant since July 2012. In addition,

the CEO opted to forgo five per cent of his Base Pay from 1 January 2014 until 30 June 2015.

Mr David and Mr La Spina commenced in their KMP roles on 1 March 2015 and their Base Pay was set at a

level lower than their predecessors.

The Base Pay for each Executive KMP is outlined on page 40.

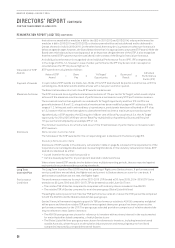

Annual Incentive The Short Term Incentive Plan (STIP) is the annual ‘at risk’ incentive plan for members of Qantas Executive

Management. Each year these Executives may receive an award that is a combination of cash and restricted

shares to the extent that the Plan’s performance conditions are achieved.

Performance

Conditions

The Board sets a ‘scorecard’ of performance conditions for the 2014/15 STIP, explicitly aligning the performance

measures to the Qantas Group strategy. Underlying PBT is the key budgetary and financial performance

measure for the Qantas Group and is therefore the key performance measure in the STIP scorecard.

The Board sets targets for each scorecard measure, and at the end of the financial year the Board assesses

performance against each scorecard measure and determines the overall STIP scorecard outcome.

A detailed description of the STIP scorecard is provided on pages 38 to 39.

The Board retains discretion over any awards made under the STIP. For example, the Board may decide to

adjust the STIP scorecard outcome where it determines that it does not reflect the performance achieved

during the year. Circumstances may occur where scorecard measures have been achieved or exceeded, but in

the view of the Board it is inappropriate to make a cash award under the STIP. The Board may determine