Qantas 2015 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

QANTAS ANNUAL REPORT 2015

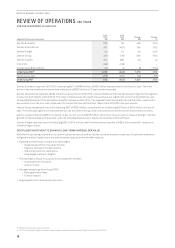

Jetstar-branded airlines continue to focus on a differentiated low fares product offering and service standard with innovation and

investment in new technology and B787 roll out. Greater self-service, including automated bag drops and kiosk check-in, is improving

the customer experience while also delivering cost benefits. Investment in next-generation booking engine and online retailing

capabilities will drive the next wave of ancillary revenue growth.

Jetstar was awarded the best low-cost carrier in Australia/Pacific and was in the top five low-cost carriers worldwide49.

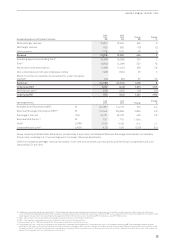

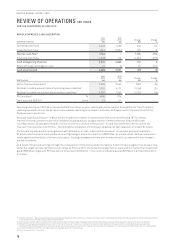

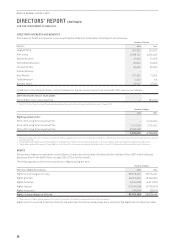

QANTAS LOYALTY

June

2015

June

2014

Change Change

%

Members M10.8 10.1 0.7 7

Billings21 $M 1,369 1,306 63 5

Underlying EBIT $M 315 286 29 10

Qantas Loyalty reported record50 Underlying EBIT of $315 million, up 10 per cent. Billings growth of five per cent reflects strong

underlying system growth, tactical campaigns with existing partners and the addition of new partners to both the Qantas Frequent

Flyer and Aquire programs. Qantas Frequent Flyer direct earn credit cards have continued to show strength, with five per cent

acquisition growth51 outperforming the industry average. Qantas Frequent Flyer reached the milestone of 10.8 million members – a

seven per cent increase.

Qantas Loyalty has continued to innovate and diversify its earnings base during the period, investing in its adjacent businesses52

and reinforcing the core coalition program. These adjacent businesses have accounted for 30 per cent of the overall Underlying EBIT

growth in the year.

Highlights include:

–$1.1 billion currency loaded on Qantas Cash cards, with 410,000 cards activated

–A 57 per cent increase in Qantas epiQure member base driving a 43 per cent growth in wine sales

–Red Planet launch and delivering profits within first year, growing its external client portfolio and delivering top line value to the airline

–Growth of the Aquire loyalty program for small to medium-sized businesses

During 2014/2015 Qantas Loyalty purchased a controlling stake in actuarial and data analytics consulting firm Taylor Fry, an

acquisition that adds to the Group’s customer insights capability and provides a new adjacent revenue stream.

The Qantas Frequent Flyer program maintained a record annual NPS53 and continues to hold a premium over competitor programs.

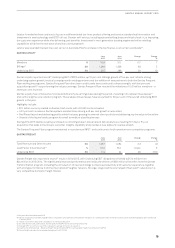

QANTAS FREIGHT

June

2015

June

2014

Change Change

%

Total Revenue and Other Income $M 1,067 1,084 (17) (2)

Load Factor (International)54 %57.0 55.1 1.9 pts 3

Underlying EBIT $M 114 24 90 >100

Qantas Freight also reported a record55 result in 2014/2015, with Underlying EBIT rising almost fivefold to $114 million from

$24million in 2013/2014. The significantly improved performance was led by the delivery of $38 million of benefits from the Qantas

Transformation program, including the introduction of new technology to improve productivity and customer experience, together

with strong performance from the International Freighter network. Stronger cargo load factors helped offset yield22 reductions in a

very competitive domestic freight market.

49 Skytrax World Airline Awards 2015

50 Qantas Loyalty record Underlying EBIT result compared to prior periods normalised for changes in accounting estimates of the fair value of points and breakage expectations effective

1January 2009

51 Growth 12 months to May 2015 compared to 12 months to May 2014

52 Includes Qantas Cash, Qantas Golf, Qantas epiQure, Red Planet, Accumulate and Taylor Fry

53 Average NPS 12 months to July 2015 compared to average 12 months to July 2014

54 Load Factor (International) – Revenue Freight Tonne Kilometre (RFTK) over Available Freight Tonne Kilometre (AFTK)

55 Since Freight was reported as a separate segment in 2007/2008