Qantas 2015 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

QANTAS ANNUAL REPORT 2015

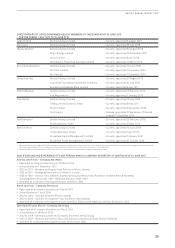

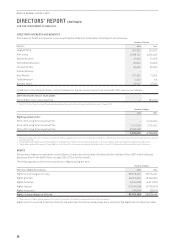

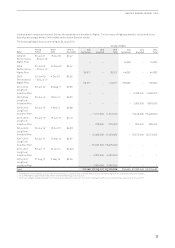

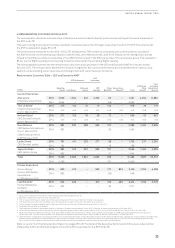

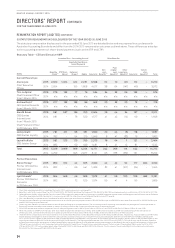

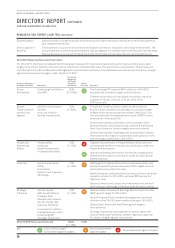

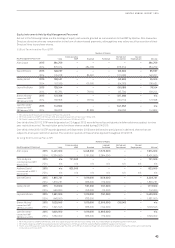

4) REMUNERATION OUTCOMES FOR 2014/2015

The remuneration decisions and outcomes at Qantas are clearly linked to Qantas’ performance via the performance measures in

theSTIP and LTIP.

This year’s strong financial performance resulted in outcomes above the ‘At Target’ level under the 2014/15 STIP. The result under

theSTIP is detailed on pages 35 to 36.

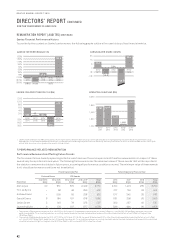

The performance measures for the 2013–2015 LTIP, being Qantas’ TSR relative to companies with ordinary shares included in

the ASX100 and an airline peer group (Global Listed Airlines), were tested as at 30 June 2015. Based on the vesting scale, Qantas

ranked in the 93rd percentile of companies in the ASX100 and ranked in the 60th percentile of the airline peer group. This resulted in

85percent of Rights vesting and converting to Qantas shares with the remaining Rights lapsing.

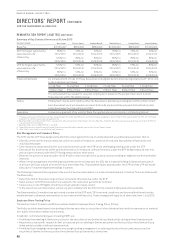

The following table summarises the remuneration decisions and outcomes for the CEO and Executive KMP for the year ended

30June2015. The remuneration detailed in this table is aligned to the current performance period and therefore is particularly

useful in understanding current year pay and its alignment with current year performance.

Remuneration Outcomes Table – CEO and Executive KMP1

STIP Outcomes3

LTIP

Outcomes4

$’000s

Base Pay

(Cash)2Cash Bonus

Deferred

Award

LTIP

Vesting5

Other

Benefits6

Termination

Benefit10 Total

LTIP Share

Price

Growth7

Total

Including

Share Price

Growth

Current Executives

Alan Joyce

Chief Executive Officer

2015

2014

2,000

2,054

1,904

–

952

–

2,353

–

112

(45)

–

–

7,321

2,009

4,563

–

11,88 4

–

Tino La Spina8

Chief Financial Officer

from 1 March 2015

2015

2014

279

n/a

152

n/a

76

n/a

19

n/a

152

n/a

–

n/a

678

n/a

36

n/a

714

n/a

Andrew David8

CEO Qantas Domestic

from 1 March 2015

2015

2014

277

n/a

152

n/a

76

n/a

29

n/a

72

n/a

–

n/a

606

n/a

57

n/a

663

n/a

Gareth Evans

CEO Qantas International

from 1 March 2015

Chief Financial Officer

to 28 February 2015

2015

2014

981

981

537

–

268

–

692

–

107

69

–

–

2,585

1,050

1,341

–

3,926

–

Lesley Grant

CEO Qantas Loyalty

2015

2014

781

782

411

–

205

–

277

–

58

16

–

–

1,732

798

537

–

2,269

–

Jayne Hrdlicka

CEO Jetstar Group

2015

2014

981

982

513

–

257

–

692

–

121

61

–

–

2,564

1,043

1,341

–

3,905

–

Total 2015

2014

5,299

4,799

3,669

–

1,834

–

4,062

–

622

101

–

–

15,486

4,900

7,875

–

23,361

–

Former Executives

Simon Hickey9

Former

CEO Qantas

International

to 28 February 2015

2015

2014

860

982

612

–

–

–

663

–

177

(34)

833

–

3,145

948

1,253

–

4,398

–

Lyell Strambi9

Former CEO Qantas

Domestic

to 28 February 2015

2015

2014

654

982

466

–

–

–

615

–

196

95

483

–

2,414

1,077

1,162

–

3,576

–

1 Detail of non-statutory remuneration methodology is explained on pages 36 and 37.

2 Base Pay (cash) paid to each Executive during the year.

3 The full value of STIP awards made to each Executive during each of the 2014/2015 and 2013/2014 financial years.

4 LTIP awards vested in 2014/2015 at 85 per cent. LTIP awards did not vest in 2013/2014, therefore nil value shown.

5 The face value of shares awarded based on the Qantas share price at the start of the performance period (1 July 2012).

6 Other Benefits are detailed on page 34.

7 The increase in the value of the share award from the start of the performance period (1 July 2012) to the end of the performance period (30 June 2015).

8 2014/2015 remuneration reflects the period of time in a key management role for Mr La Spina (1 March 2015 to 30 June 2015) and Mr David (1 March 2015 to 30 June 2015).

9 Mr Hickey ceased as a KMP on 28 February 2015 and ceased employment with Qantas on 15 May 2015 and Mr Strambi ceased as a KMP and ceased employment with Qantas on

28 February 2015. 2014/2015 remuneration is included up until the termination date of Mr Hickey of 15 May 2015 and for Mr Strambi of 28 February 2015.

10 Under the terms of separation, termination benefits of 10 months’ Base Pay and 6 months’ Base Pay were paid to Mr Hickey and Mr Strambi, respectively. As good leavers, both Mr Hickey

and Mr Strambi were eligible to receive deferred cash payments prorated for the portion of the performance period employed under the 2014/15 STIP and the Rights granted under

2013–2015 LTIP which lapsed on the termination date and were replaced by the deferred cash payments as disclosed in the table above.

Refer to section 6 of the Remuneration Report on pages 35 to 37 for detail of the Executive Remuneration Structure, a description

of Base Pay, STIP and LTIP and analysis of the 2014/2015 outcomes for the STIP and LTIP.