Qantas 2015 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

QANTAS ANNUAL REPORT 2015

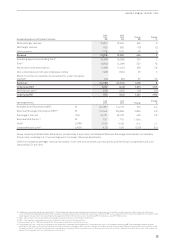

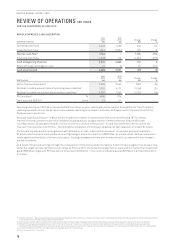

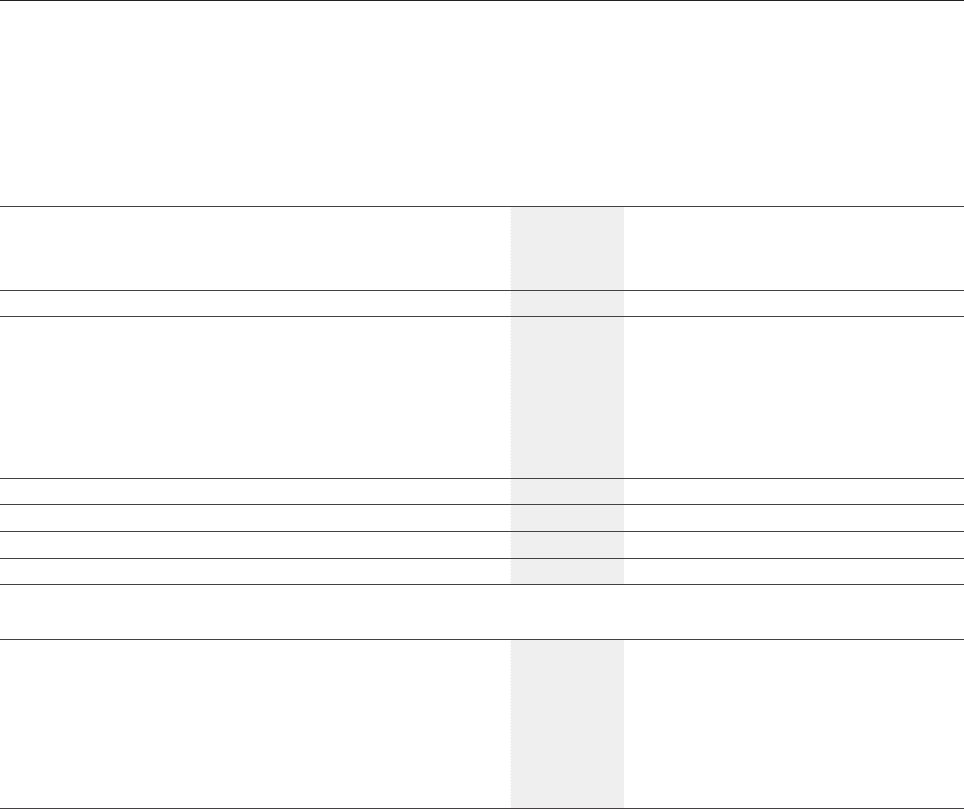

Group Underlying Income Statement Summary

June

2015

$M

June

2014

$M

Change

$M

Change

%

Net passenger revenue 13,667 13,242 425 3

Net freight revenue 936 955 (19) (2)

Other revenue 1,213 1,155 58 5

Revenue 15,816 15,352 464 3

Operating expenses (excluding fuel)16 (9,064) (9,288) 224 2

Fuel16 (3,899) (4,496) 597 13

Depreciation and amortisation (1,096) (1,422) 326 23

Non-cancellable aircraft operating lease rentals (495) (520) 25 5

Share of net loss of investments accounted for under the equity

method16 (29) (66) 37 56

Expenses (14,583) (15,792) 1,209 8

Underlying EBIT 1,233 (440) 1,673 >100

Net finance costs16 (258) (206) (52) (25)

Underlying PBT 975 (646) 1,621 >100

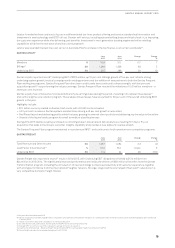

Operating Statistics

June

2015

June

2014 Change

Change

%

Available Seat Kilometres (ASK)17 M 142,287 141,715 572 0.4

Revenue Passenger Kilometres (RPK)18 M 112,5 4 3 109,659 2,884 2.6

Passengers Carried ‘000 49,181 48,776 405 0.8

Revenue Seat Factor 19 %79.1 77.4 1.7pts

Yield15 c/RPK 10.40 10.29 0.11 1.1

Comparable unit cost20 c/ASK 4.79 5.05 (0.26) (5.1)

Group capacity (Available Seat Kilometres) increased by 0.4 per cent, and demand (Revenue Passenger Kilometres) increased by

2.6 per cent, resulting in a 1.7 percentage point increase in Revenue Seat Factor.

Yield from ticketed passenger revenue increased 1.1 per cent on a constant currency basis, and the Group’s comparable unit cost

improved by 5.1 per cent.

16 Underlying operating expenses (excluding fuel) – total Underlying expenses excluding share of net loss of investments accounted for under the equity method, fuel and net finance

costs. These Underlying expenses differ from equivalent statutory expenses due to items excluded from Underlying PBT, such as adjustments for impacts of AASB 9 which relate to other

reporting periods and other items identified by Management. Refer to the reconciliation of Underlying PBT to Statutory (Loss)/Profit Before Tax

17 ASK – total number of seats available for passengers, multiplied by the number of kilometres flown

18 RPK – total number of passengers carried, multiplied by the number of kilometres flown

19 Revenue Seat Factor – RPKs divided by ASKs. Also known as seat factor, load factor or load

20 Comparable unit cost – unit cost is adjusted to aid comparability between reporting periods. Comparable unit cost is calculated as Underlying PBT less passenger revenue and fuel,

adjusted for the impact of the Qantas International fleet write-down, changes in discount rates, changes in foreign exchange rates, share of net loss of investments accounted for under

the equity method. If adjusted for movements in average sector length per ASK comparable unit cost improvement is 4.2 per cent and if adjusted further for the impact of the carbon tax

repeal, the comparable unit cost improvement is 2.6 per cent.