Qantas 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

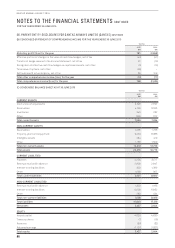

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

FOR THE YEAR ENDED 30 JUNE 2015

86

QANTAS ANNUAL REPORT 2015

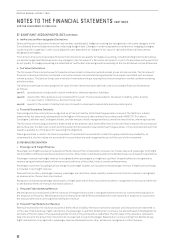

34. FINANCIAL RISK MANAGEMENT CONTINUED

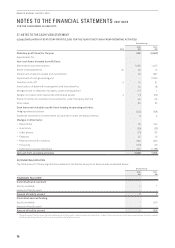

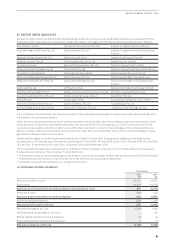

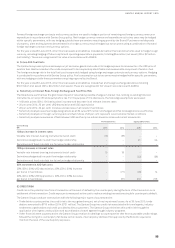

The table below sets out the maximum exposure to credit risk as at 30 June 2015:

Qantas Group

Notes

2015

$M

2014

$M

On Consolidated Balance Sheet

Cash and cash equivalents 10 2,908 3,001

Receivables 11 1,093 1,354

Other financial assets 26 662 206

The Qantas Group minimises the concentration of credit risk by undertaking transactions with a large number of customers and

counterparties in various countries in accordance with Board-approved policy. As at 30 June 2015, the credit risk of the Qantas

Group to counterparties in relation to other financial assets, cash and cash equivalents, and other financial liabilities amounted to

$2,963million (2014: $3,057 million). Refer to Note 26(B) for offsetting disclosures of contractual arrangements. The Qantas Group’s

credit exposure in relation to these assets is with counterparties that have a minimum credit rating of A-/A3, unless individually

approved by the Board.

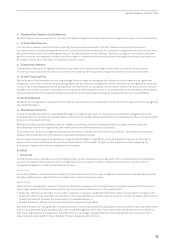

(D) FAIR VALUE

The fair value of cash, cash equivalents and non-interest-bearing financial assets and liabilities approximates their carrying value

due to their short maturity. The fair value of financial assets and liabilities is determined by valuing them at the present value of

future contracted cash flows. Cash flows are discounted using standard valuation techniques at the applicable market yield, having

regard to the timing of the cash flows.

The fair value of forward foreign exchange and fuel contracts is determined as the unrealised gain/loss at balance date by reference

to market exchange rates and fuel prices. The fair value of interest rate swaps is determined as the present value of future contracted

cash flows. Cash flows are discounted using standard valuation techniques at the applicable market yield, having regard to the timing

of the cash flows. The fair value of options is determined using standard valuation techniques.

Other financial assets and liabilities represent the fair value of derivative financial instruments recognised on the Consolidated

Balance Sheet in accordance with AASB 9. Refer to Note 37 for a definition of the fair value hierarchy.

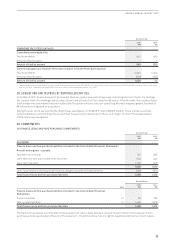

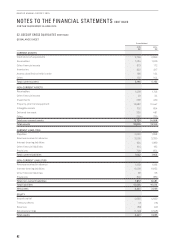

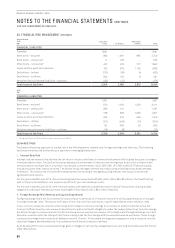

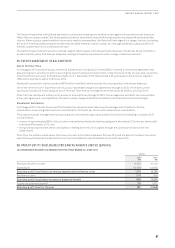

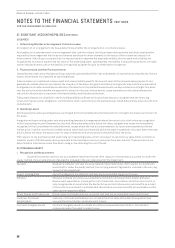

2015 2014

Carrying Amount held at Carrying Amount held at

Notes

Fair Value through

profit and loss Amortised Cost Fair Value

Fair Value through

profit and loss Amortised Cost Fair Value

Financial assets

Cash and cash

equivalents 10 –2,908 2,917 –3,001 3,011

Receivables 11 –1,093 1,093 –1,354 1,354

Other financial assets126 662 –662 206 –206

Financial liabilities

Payables 19 –1,881 1,881 –1,851 1,851

Interest-bearing liabilities

21 –5,562 5,575 –6,483 6,392

Other financial liabilities126 484 –484 248 –248

1 Other financial assets and liabilities represent the fair value of derivative financial instruments recognised on the Consolidated Balance Sheet in accordance with AASB 9. These

derivative financial instruments have been measured at fair value using Level 2 inputs in estimating their fair values.

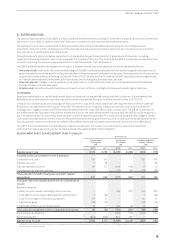

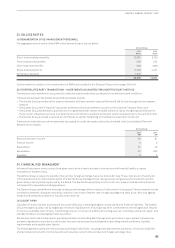

(E) CAPITAL MANAGEMENT

The Qantas Group’s capital management framework is designed to maximise shareholder value by targeting top quartile Total

Shareholder Return relative to the ASX100 and global airline peers. The framework’s key elements are to:

–Maintain an optimal capital structure commensurate with credit rating metrics1 between BBB and BBB-, which minimises cost of

capital, through holding an appropriate mix of debt (net debt including off balance sheet for aircraft operating leases) and equity

–Achieve Return on Invested Capital (ROIC) performance that exceeds cost of capital over the cycle. ROIC performance for the year

ended 30 June 2015 was 16.2 per cent (2014: (1.5) per cent)

–Grow Invested Capital over time via disciplined ROIC accretive investment, with flexibility to increase or decrease annual

investment levels as required. The Qantas Group’s average Invested Capital during the year ended 30 June 2015 was $9.1 billion

(2014: $13 billion)

1 Primary credit rating metrics are ‘Funds From Operations (FFO) to Debt’ and ‘Debt to EBITDA’ under Standard & Poor’s rating methodology and the equivalent ratios under Moody’s rating

methodology