Qantas 2015 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

QANTAS ANNUAL REPORT 2015

THE BOARD SAFEGUARDS THE INTEGRITY OF CORPORATE

FINANCIAL REPORTING

The Board and Audit Committee closely monitor the

independence of the external auditor. Regular reviews occur

of the independence safeguards put in place by the external

auditor. Qantas rotates the lead external audit partner every five

years and imposes restrictions on the employment of personnel

previously employed by the external auditor.

Policies are in place to restrict the type of non-audit services

which can be provided by the external auditor and a detailed

review of non-audit fees paid to the external auditor is

undertaken on a half-yearly basis.

At each meeting, the Audit Committee meets privately

with Executive Management without the external auditor,

and with the internal and external auditors without

ExecutiveManagement.

THE BOARD MAKES TIMELY AND BALANCED DISCLOSURE

Qantas is committed to ensuring that trading in its shares takes

place in an orderly and informed market, with transparent

and consistent communication with all shareholders. Qantas

has an established process to ensure that it complies with its

continuous disclosure obligations at all times, including a bi-

annual confirmation by all Executive Management that the areas

for which they are responsible have complied with the Group’s

Continuous Disclosure Policy.

Qantas proactively communicates with its shareholders via the

ASX and its web-based Newsroom, with all materials released

by the Group made available to all shareholders at the same

time. Additionally, Qantas actively conveys its publicly-disclosed

information and seeks the views of its shareholders, large and

small, in a number of forums, including at the Annual General

Meeting, the Qantas Investor Day and, as is common practice

among its major listed peers, through periodic meetings with

current and potential institutional shareholders.

THE BOARD RESPECTS THE RIGHTS OF SHAREHOLDERS

Qantas has a Shareholder Communications Policy which

promotes effective two-way communication with shareholders

and the wider investment community, and encourages

participation at general meetings.

Shareholders also have the option to receive communications

from, and send communications to, Qantas and its Share

Registry electronically, including email notification of significant

market announcements.

The external auditor attends the Annual General Meeting (AGM)

and is available to answer shareholder questions that are

relevant to the audit.

THE BOARD RECOGNISES AND MANAGES RISK

Qantas is committed to embedding risk management practices

to support the achievement of business objectives and fulfil

corporate governance obligations. The Board is responsible

for reviewing and overseeing the risk management strategy for

the Qantas Group and for ensuring the Qantas Group has an

appropriate corporate governance structure. Within that overall

strategy, Management has designed and implemented a risk

management and internal control system to manage Qantas’

material business risks.

During 2014/2015, the two Board committees responsible for

oversight of risk-related matters, being the Audit Committee

and the Safety, Health, Environment and Security Committee,

undertook their annual review of the effectiveness of Qantas’

implementation of its risk management system and internal

control framework.

The internal audit function is carried out by Group Audit and

Risk and is independent of the external auditor. Group Audit and

Risk provides independent, objective assurance and consulting

services on Qantas’ system of risk management, internal control

and governance.

The Audit Committee approves the Group Audit and Risk Internal

Audit Charter, which provides Group Audit and Risk with full

access to Qantas Group functions, records, property and

personnel, and establishes independence requirements. The

Audit Committee also approves the appointment, replacement

and remuneration of the internal auditor. The internal auditor

has a direct reporting line to the Audit Committee and also

provides reporting to the Safety, Health, Environment and

Security Committee.

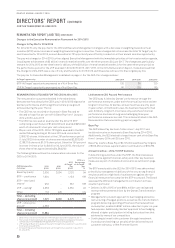

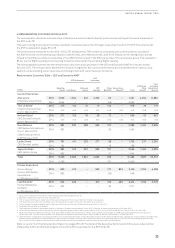

THE BOARD REMUNERATES FAIRLY AND RESPONSIBLY

The Qantas executive remuneration objectives and approach

are set out in full below.

Information about remuneration of Executive Management

is disclosed to the extent required, together with the process

for evaluating performance, in the Remuneration Report from

page28 of the 2015 Annual Report.

Qantas Non-Executive Directors are entitled to statutory

superannuation and certain travel entitlements (accrued

during service) that are reasonable and standard practice in

the aviation industry. Non-Executive Directors do not receive

any performance-based remuneration (see page 45 of the 2015

Annual Report).