Qantas 2015 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

QANTAS ANNUAL REPORT 2015

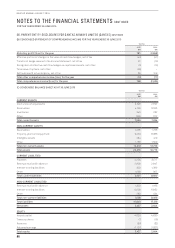

33. RELATED PARTIES

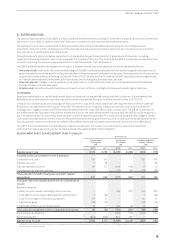

(A) REMUNERATION OF KEY MANAGEMENT PERSONNEL

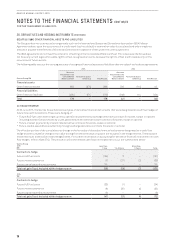

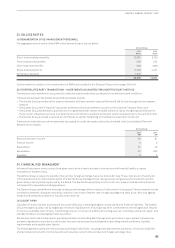

The aggregate remuneration of the KMP of the Qantas Group is set out below:

Qantas Group

2015

$’000

2014

$’000

Short-term employee benefits 13,985 9,129

Post-employment benefits 605 522

Other long-term benefits 306 (285)

Share-based payments 6,463 4,421

Termination benefits 1,316 –

22,675 13,787

Further details in relation to the remuneration of KMPs are included in the Directors’ Report from pages 28 to 46.

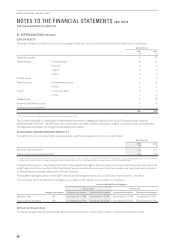

(B) OTHER RELATED PARTY TRANSACTIONS – INVESTMENTS ACCOUNTED FOR UNDER THE EQUITY METHOD

Transactions with investments accounted for under the equity method are conducted on normal terms and conditions.

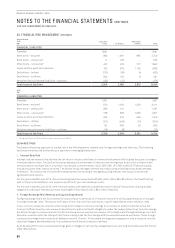

Transactions between the Qantas Group and associates include:

–The Qantas Group provides airline seats on domestic and international routes to Helloworld Ltd for sale through its travel agency

network

–The Qantas Group sells Frequent Flyer points to Helloworld Ltd and redeems vouchers on the Qantas Frequent Flyer store

–The Qantas Group established a business service agreement with Jetstar-branded airlines in Japan, Hong Kong and Vietnam for

the provision of business services to enable the low cost airline to operate a consistent customer experience for the Jetstar brand

–The Qantas Group provided a secured aircraft facility to Jetstar Hong Kong to facilitate the acquisition of aircraft.

Transactions and balances with investments accounted for under the equity method are included in the Consolidated Financial

Statements as follows:

Qantas Group

2015

$M

2014

$M

Revenue and other income 60 61

Finance income 5 6

Expenditure 61 49

Receivables 67 292

Payables 6 5

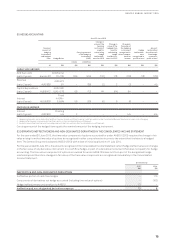

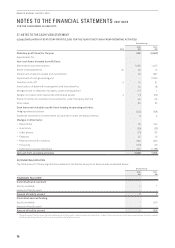

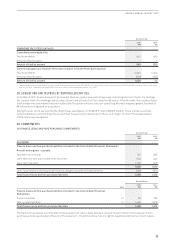

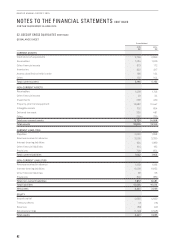

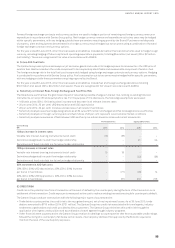

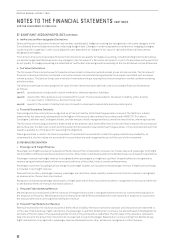

34. FINANCIAL RISK MANAGEMENT

A financial instrument is any contract that gives rise to both a financial asset of one entity and a financial liability or equity

instrument of another entity.

The Qantas Group is subject to liquidity, interest rate, foreign exchange, fuel price and credit risks. These risks are an inherent part

of the operations of an international airline. The Qantas Group manages these risk exposures using various financial instruments,

governed by a set of policies approved by the Board. The Qantas Group’s policy is not to enter into, issue or hold derivative financial

instruments for speculative trading purposes.

The Qantas Group uses different methods to assess and manage different types of risk to which it is exposed. These methods include

correlations between risk types, sensitivity analysis in the case of interest rate, foreign exchange and other price risks, and ageing

analysis and sensitivity analysis for liquidity and credit risk.

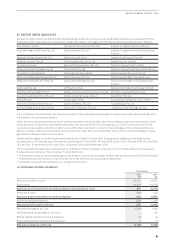

(A) LIQUIDITY RISK

Liquidity risk is the risk that an entity will encounter difficulty in meeting obligations associated with financial liabilities. The Qantas

Group manages liquidity risk by targeting a minimum liquidity level, ensuring long-term commitments are managed with respect

to forecast available cash inflows, maintaining access to a variety of additional funding sources, including commercial paper and

standby facilities and managing maturity profiles.

Qantas may from time to time seek to purchase and retire outstanding debt through cash purchases in open market transactions,

privately negotiated transactions or otherwise. Any such repurchases would depend on prevailing market conditions, liquidity

requirements and possibly other factors.

The following tables summarise the contractual timing of cash flows, including estimated interest payments, of financial liabilities

and derivative instruments. Contractual amount assumes current interest rates and foreign exchange rates.