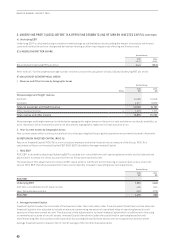

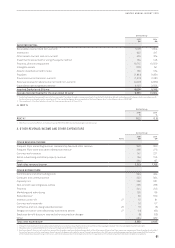

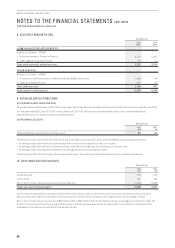

Qantas 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

FOR THE YEAR ENDED 30 JUNE 2015

68

QANTAS ANNUAL REPORT 2015

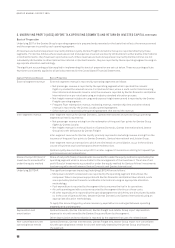

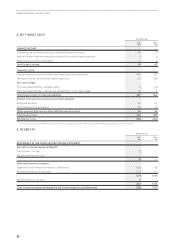

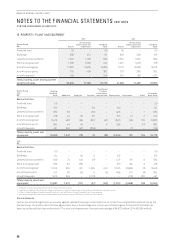

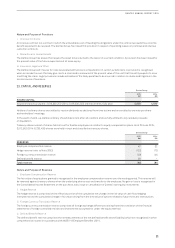

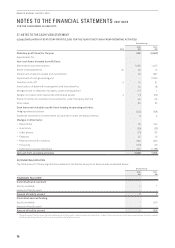

17. DEFERRED TAX ASSETS/(LIABILITIES) CONTINUED

Qantas Group

2014

$M

Opening

Balance

Recognised

in the

Consolidated

Income

Statement

Recognised

in Other

Comprehensive

Income

Closing

Balance

Reconciliations

Inventories (16) 1 – (15)

Property, plant and equipment and intangible assets (1,856) 708 –(1,14 8)

Payables 38 (13) –25

Revenue received in advance 639 35 –674

Interest-bearing liabilities (83) (2) –(85)

Other financial assets/liabilities (99) (32) 86 (45)

Provisions 335 14 –349

Other items (138) 5(46) (179)

Tax value of recognised tax losses 555 417 –972

Total deferred tax assets/(liabilities) (625) 1,133 40 548

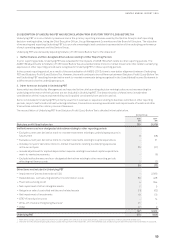

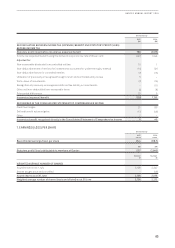

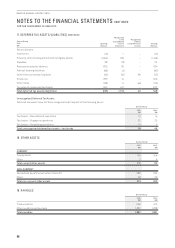

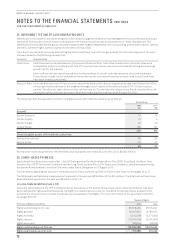

Unrecognised Deferred Tax Assets

Deferred tax assets have not been recognised with respect to the following items:

Qantas Group

2015

$M

2014

$M

Tax losses – New Zealand operations 13 14

Tax losses – Singapore operations 31 25

Tax losses – Hong Kong operations 14 9

Total unrecognised deferred tax assets – tax losses 58 48

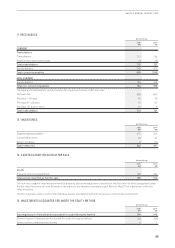

18. OTHER ASSETS

Qantas Group

2015

$M

2014

$M

CURRENT

Prepayments 109 104

Other 2 8

Total current other assets 111 112

NON-CURRENT

Net defined benefit asset (refer to Note 31) 285 233

Other 28 29

Total non-current other assets 313 262

19. PAYABLES

Qantas Group

2015

$M

2014

$M

Trade creditors 550 613

Other creditors and accruals 1,331 1,238

Total payables 1,881 1,851