Qantas 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

QANTAS ANNUAL REPORT 2015

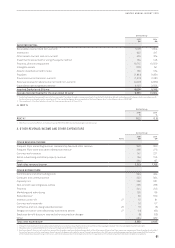

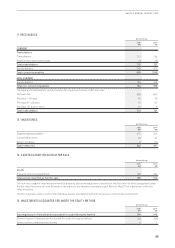

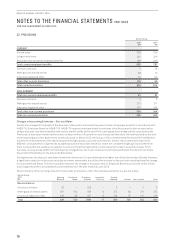

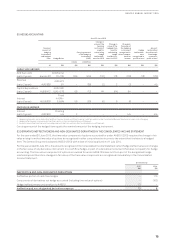

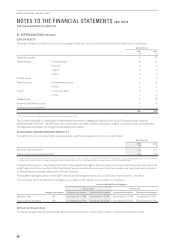

Nature and Purpose of Provisions

i. Onerous Contracts

An onerous contract is a contract in which the unavoidable cost of meeting the obligations under the contract exceeds the economic

benefit expected to be received. The Qantas Group has raised this provision in respect of operating leases on premises and onerous

customer contracts.

ii. Make Good on Leased Assets

The Qantas Group has leases that require the asset to be returned to the lessor in a certain condition. A provision has been raised for

the present value of the future expected cost at lease expiry.

iii. Insurance, Legal and Other

The Qantas Group self-insures for risks associated with workers compensation in certain jurisdictions. A provision is recognised

when an incident occurs that may give rise to a claim and is measured at the present value of the cost that the entity expects to incur

in settling the claim. Legal provisions include estimates of the likely penalties to be incurred in relation to claims and litigation in the

normal course of business.

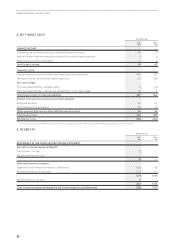

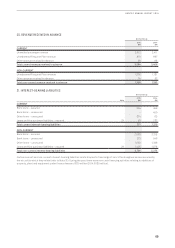

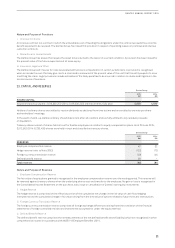

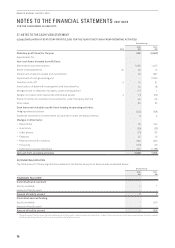

23. CAPITAL AND RESERVES

Qantas Group

2015

$M

2014

$M

ISSUED CAPITAL

Issued and paid-up capital: 2,196,330,250 (2014: 2,196,330,250) ordinary shares, fully paid 4,630 4,630

Holders of ordinary shares are entitled to receive dividends as declared from time to time and are entitled to one vote per share

atshareholders’ meetings.

In the event of wind-up, Qantas ordinary shareholders rank after all creditors and are fully entitled to any residual proceeds

onliquidation.

Treasury shares consist of shares held in trust for Qantas employees in relation to equity compensation plans. As at 30 June 2015,

3,512,952 (2014: 8,230,499) shares were held in trust and classified as treasury shares.

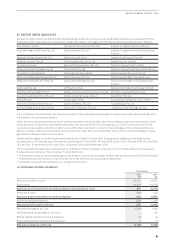

Qantas Group

2015

$M

2014

$M

RESERVES

Employee compensation reserve 47 32

Hedge reserve (refer to Note 26(C)) (122) (72)

Foreign currency translation reserve (29) (41)

Defined benefit reserve 38 –

Total reserves (66) (81)

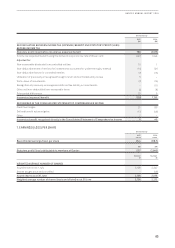

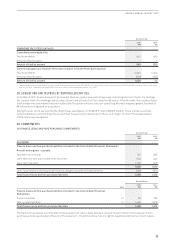

Nature and Purpose of Reserves

i. Employee Compensation Reserve

The fair value of equity plans granted is recognised in the employee compensation reserve over the vesting period. This reserve will

be reversed against treasury shares when the underlying shares vest and transfer to the employee. No gain or loss is recognised in

the Consolidated Income Statement on the purchase, sale, issue or cancellation of Qantas’ own equity instruments.

ii. Hedge Reserve

The hedge reserve is comprised of the effective portion of the cumulative net change in the fair value of cash flow hedging

instruments and the cumulative change in fair value arising from the time value of options related to future forecast transactions.

iii. Foreign Currency Translation Reserve

The foreign currency translation reserve comprises all foreign exchange differences arising from the translation of the financial

statements of foreign controlled entities and investments accounted for under the equity method.

iv. Defined Benefit Reserve

The defined benefit reserve comprises the remeasurements of the net defined benefit asset/(liability) which are recognised in other

comprehensive income in accordance with AASB 119 Employee Benefits (2011).