Qantas 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

QANTAS ANNUAL REPORT 2015

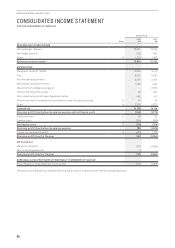

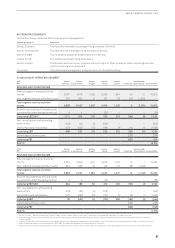

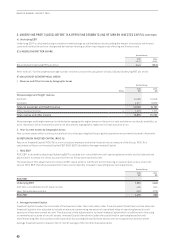

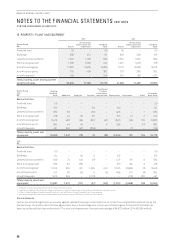

(B) OPERATING SEGMENTS

The Qantas Group comprises the following operating segments:

Operating segments Operations

Qantas Domestic The Australian domestic passenger flying business of Qantas

Qantas International The international passenger flying business of Qantas

Qantas Freight The air cargo and express freight business of Qantas

Jetstar Group The Jetstar passenger flying businesses

Qantas Loyalty The Qantas customer loyalty program (Qantas Frequent Flyer) as well as other marketing services,

loyalty and recognition programs

Corporate The centralised management and governance of the Qantas Group

(C) ANALYSIS BY OPERATING SEGMENT1

2015

$M

Qantas

Domestic

Qantas

International

Qantas

Freight

Jetstar

Group

Qantas

Loyalty Corporate

Unallocated/

Eliminations5Consolidated

REVENUE AND OTHER INCOME

External segment revenue and other

income 5,291 4,878 1,059 3,283 1,244 49 12 15,816

Inter-segment revenue and other income 537 589 8181 118 (40) (1,393) –

Total segment revenue and other

income 5,828 5,467 1,067 3,464 1,362 9(1,381) 15,816

Share of net profit/(loss) of investments

accounted for under the equity method24 4 – (37) –––(29)

Underlying EBITDAR31,171 706 156 625 323 (149) (8) 2,824

Non-cancellable aircraft operating

lease rentals (219) (42) (5) (229) – – – (495)

Depreciation and amortisation (472) (397) (37) (166) (8) (14) (2) (1,096)

Underlying EBIT 480 267 114 230 315 (163) (10) 1,233

Underlying net finance costs (258) (258)

Underlying PBT (421) 975

ROIC %416.2%

2014

$M

Qantas

Domestic

Qantas

International

Qantas

Freight

Jetstar

Group

Qantas

Loyalty Corporate

Unallocated/

Eliminations5Consolidated

REVENUE AND OTHER INCOME

External segment revenue and other

income 5,284 4,658 1,074 3,073 1,192 70 115,352

Inter-segment revenue and other income 564 639 10 149 115 (58) (1,419) –

Total segment revenue and other

income 5,848 5,297 1,084 3,222 1,307 12 (1,418) 15,352

Share of net profit/(loss) of investments

accounted for under the equity method 2 2 – (70) – – – (66)

Underlying EBITDAR3804 188 60 310 293 (150) (3) 1,502

Non-cancellable aircraft operating

lease rentals (203) (33) (5) (279) – – – (520)

Depreciation and amortisation (571) (652) (31) (147) (7) (13) (1) (1,422)

Underlying EBIT 30 (497) 24 (116) 286 (163) (4) (440)

Underlying net finance costs (206) (206)

Underlying PBT (369) (646)

ROIC %4(1.5%)

1 Qantas Domestic, Qantas International, Qantas Freight, Jetstar Group, Qantas Loyalty and Corporate are the operating segments of the Qantas Group.

2 Share of net profit/(loss) of investments accounted for under the equity method excluding share of losses in Jetstar Hong Kong which have been recognised as items outside of

Underlying PBT.

3 Underlying EBITDAR represents Underlying earnings before income tax expense, depreciation, amortisation, non-cancellable aircraft operating lease rentals and net finance costs.

4 ROIC % represents Return on Invested Capital (ROIC) EBIT divided by Average Invested Capital (Refer to Note 3(G)).

5 Unallocated/Eliminations represent other businesses of the Qantas Group which are not considered to be significant reportable segments and consolidation elimination entries.