Qantas 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

QANTAS ANNUAL REPORT 2015

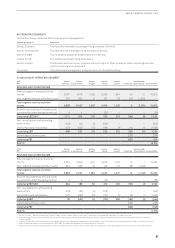

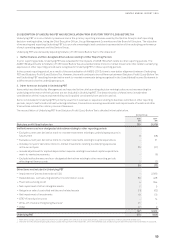

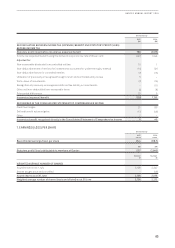

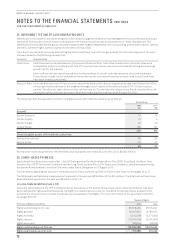

11. RECEIVABLES

Qantas Group

2015

$M

2014

$M

CURRENT

Trade debtors

Trade debtors 712 724

Provision for impairment losses (2) (3)

Total trade debtors 710 721

Sundry debtors 249 475

Total current receivables 959 1,196

NON-CURRENT

Sundry debtors 134 158

Total non-current receivables 134 158

The ageing of trade debtors, net of provision for impairment losses, at 30 June was:

Not past due 628 600

Past due 1–30 days 52 48

Past due 31–120 days 15 67

Past due 121 days or more 15 6

Total trade debtors 710 721

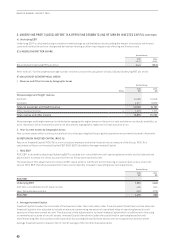

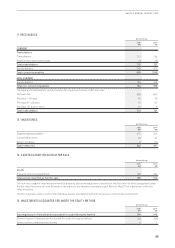

12. INVENTORIES

Qantas Group

2015

$M

2014

$M

Engineering expendables 270 245

Consumable stores 49 52

Work in progress 320

Total inventories 322 317

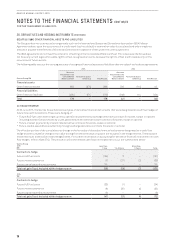

13. ASSETS CLASSIFIED AS HELD FOR SALE

Qantas Group

2015

$M

2014

$M

Assets

Property, plant and equipment 136 134

Total assets classified as held for sale 136 134

The non-recurring fair value measurement for property, plant and equipment classified as held for sale has been categorised under

the fair value hierarchy as Level 3 based on the inputs to the valuation technique used. Refer to Note 37 for a definition of the fair

value hierarchy.

The fair value less costs to sell for the individual assets was determined with reference to recent sale transactions.

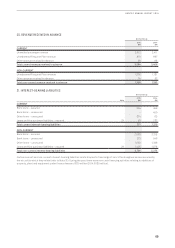

14. INVESTMENTS ACCOUNTED FOR UNDER THE EQUITY METHOD

Qantas Group

2015

$M

2014

$M

Carrying amount of investments accounted for under the equity method 134 143

Share of losses of investments accounted for under the equity method (40) (66)

Share of other comprehensive income 5 1