Qantas 2015 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

QANTAS ANNUAL REPORT 2015

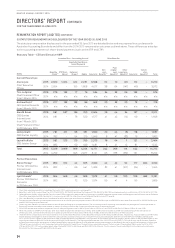

REMUNERATION REPORT (AUDITED) CONTINUED

Changes to the Executive Remuneration Framework for 2014/2015

Changes to Pay Mix for 2014/2015

For 2014/2015 only, the pay mix for the CEO and Executive Management changed, with a decrease in weighting towards annual

incentive (STIP) and an increase in weighting towards long term incentive. These changes did not increase the total ‘At Target’ pay for

each Executive for 2014/2015, as each Executive’s LTIP opportunity was offset by a reduction in their annual incentive opportunity.

The pay-mix change for 2014/2015 further aligned Executive Management with the immediate priorities of the transformation agenda,

including the achievement of $2 billion in transformation benefits over the three years to 30 June 2017. The change was particularly

relevant for 2014/2015 as the timeframe for delivery of the $2 billion of transformation benefits is for the same three year period as

theperformance period for the LTIP awarded in 2014/2015 (2015–2017 LTIP). In the 2014 Remuneration Report, it was disclosed that

the change for 2014/2015 was a one-off only and therefore for 2015/2016 each Executive will revert to their original pay mix.

The pay mix for Executive Management is detailed on page 41. For the CEO, this change involves:

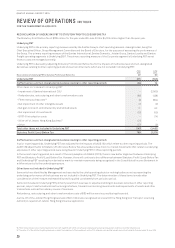

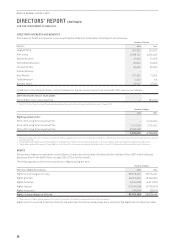

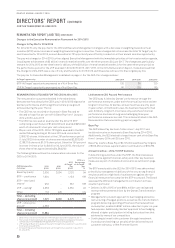

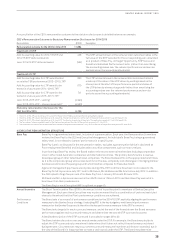

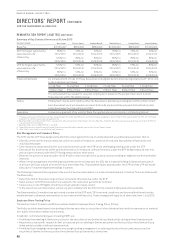

‘At Target’ opportunity 2013/2014 2014/2015 2015/2016

STIP ‘At Target’ opportunity expressed as a % of Base Pay 120 80 120

LTIP ‘At Target’ opportunity expressed as a % of Base Pay 80 120 80

REMUNERATION OUTCOMES FOR THE CEO IN 2014/2015

The remuneration outcomes detailed in the table below

demonstrate how directly the CEO’s pay in 2014/2015 aligns with

Qantas’ performance and the significant share price growth

achieved during the year. That is:

–The CEO has not received an increase in Base Pay and he

elected to forgo five per cent of his Base Pay from 1 January

2014 until 30June 2015

–The CEO has received an award under the 2014/15 STIP

comprising a cash bonus of $1,904,000 and awarded $952,000

worth of shares with a two year restriction period

–85 per cent of the 2013–2015 LTIP Rights awarded to the CEO

vested following testing at 30 June 2015 and converted to

2,188,750 shares. At the start of the LTIP performance period

(1 July 2012) this number of shares was valued at $2,353,000

(2,188,750 shares at $1.075 share price). Given the 194 per cent

increase in share price (to $3.16 on 30 June 2015), the value of

these shares has appreciated by $4,563,000

The following table outlines the remuneration outcomes for the

CEO for 2014/2015.

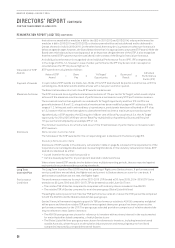

CEO Remuneration

Outcomes1

2015

$’000

2014

$’000

2015

‘At Target’

Pay

$’000

2015 as a

Percentage

of ‘At Target’

pay

%

Base Pay (cash) 2,000 2,054 2,125 94

STIP – cash bonus 1,904 –1,133 168

STIP – restricted

shares2952 –567 168

LTIP – vesting32,353 –2,550 92

Other 112 (45) –n/a

Total – excluding

share price growth 7,321 2,009 6,375 115

LTIP – share price

growth44,563

Total – including

share price growth 11,88 4

1 Detail of non-statutory remuneration methodology is explained on pages 36 and 37.

2 The number of restricted shares to be awarded will be determined based on the seven

calendar day Volume Weighted Average Share Price as at 27 August 2015.

3 LTIP vesting at 85 per cent valued at the start of the performance period (1 July 2012 when

the share price was $1.075).

4 Increase in the value of the vested shares over the performance period (1 July 2012 to

30 June 2015).

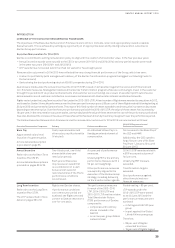

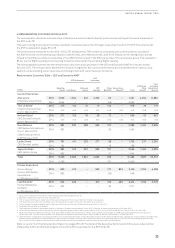

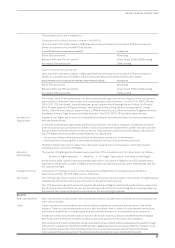

Link between CEO Pay and Performance

The CEO’s pay is linked to Qantas’ performance through the

performance measures under both the annual incentive and the

long term incentive. At Qantas, annual incentives are only paid

in years when, in the Board’s view, the business has performed

well. Similarly, long term incentives only vest where financial

performance has been strong and challenging three year

performance measures are met. This is demonstrated in the CEO

Remuneration Outcome History graph on page 31.

Base Pay

The CEO’s Base Pay has been frozen since 1 July 2011 and

he did not receive an increase to Base Pay during 2014/2015.

Additionally, the CEO elected to forgo five per cent of his Base Pay

from 1 January 2014 until 30 June 2015.

Base Pay (cash) is Base Pay of $2,125,000 less Base Pay forgone

of $106,250 and less superannuation contributions of $18,783.

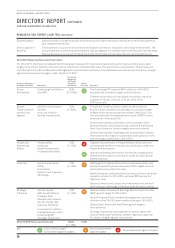

Annual Incentive – 2014/15 STIP Outcome

In determining outcomes under the STIP, the Board assesses

performance against financial, safety and other key business

measures as part of a balanced scorecard, as outlined on page

38.

The STIP award paid to the CEO for 2014/2015 was determined

primarily by management’s delivery of the very strong financial

results as well as a high level of achievement against the non-

financial measures that comprise the STIP scorecard. The Board

assessed the CEO and management’s contribution to these

results in particular:

–Delivery in 2014/2015 of over $894 million cost savings and

revenue enhancements driven by the Qantas Transformation

program

–Management’s prudent approach to fuel hedging and active

restructuring of hedged positons, as well as the transformation

program delivering operating efficiencies that reduced fuel

consumption, enabled a $597 million reduction in year-on-year

fuel expense. Additionally, Qantas’ approach to fuel hedging

allowed a higher participation in falling fuel prices than that

achieved by many of our competitors

–Continuing to invest in the customer (through investment

in product and training our people), which delivered record

customer advocacy, or Net Promoter Scores

DIRECTORS’ REPORT CONTINUED

FOR THE YEAR ENDED 30 JUNE 2015