Qantas 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

QANTAS ANNUAL REPORT 2015

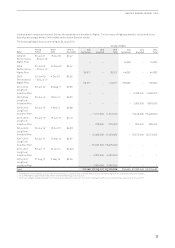

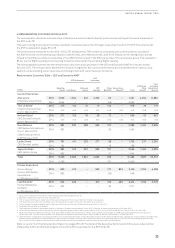

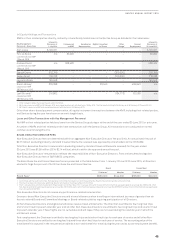

The vesting scale for each measure is:

Companies with ordinary shares included in the ASX100

Up to one-half of the total number of Rights granted may vest based on the relative TSR performance of

Qantas in comparison to the ASX100 as follows:

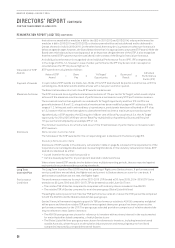

Qantas TSR Performance compared to the ASX100 Vesting Scale

Below 50th percentile Nil vesting

Between 50th and 75th percentile Linear Scale: 50% to 99% vesting

At or above 75th percentile 100% vesting

Global Listed Airlines peer group

Up to one-half of the total number of Rights granted may vest based on the relative TSR performance of

Qantas in comparison to the Global Listed Airlines peer group selected by the Board as follows:

Qantas TSR Performance compared to the Global Listed Airlines peer group Vesting Scale

Below 50th percentile Nil vesting

Between 50th and 75th percentile Linear Scale: 50% to 99% vesting

At or above 75th percentile 100% vesting

The Global Listed Airlines peer group has been selected with regard to the level of government involvement,

representation of Qantas’ key markets and continuing financial performance. For the 2014–2016 LTIP and

2015–2017 LTIP, the Global Listed Airlines peer group contains the following Airlines: Air Asia, Air France/

KLM, Air New Zealand, All Nippon Airways, International Airlines Group (British Airways/Iberia), Cathay

Pacific, Delta Airlines, Easyjet, Japan Airlines, LATAM Airlines Group, Lufthansa, Ryanair, Singapore Airlines,

Southwest Airlines, Tiger Airways and Virgin Australia. The 2013–2015 LTIP excluded Japan Airlines.

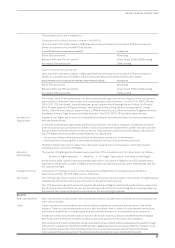

Cessation of

Employment

In general, any Rights which have not vested will be forfeited if the relevant Executive ceases employment

with the Qantas Group.

In limited circumstances approved by the Board (for example, retirement, employer-initiated terminations

(with no record of poor performance), death or total and permanent disablement), a deferred cash payment

may be made at the end of the performance period. This payment is determined with regard to the value of

the LTIP Rights which would have vested had they not lapsed, and:

–the portion of the performance period that the Executive served prior to termination

–the actual level of vesting that is ultimately achieved at the end of the performance period

The Board retains discretion to determine otherwise in appropriate circumstances, which may include

retaining some or all of the LTIP Rights.

Allocation

Methodology

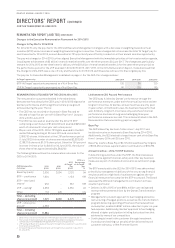

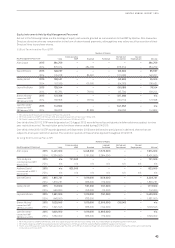

The number of Rights granted to Executives under the LTIP is calculated on a ‘fair value’ basis’, as follows:

Number of Rights awarded = Base Pay x ‘At Target’ Opportunity / Fair Value of each Right

At each year’s AGM, Qantas seeks shareholder approval for any award of Rights to the CEO. Qantas seeks

approval for the specific number of Rights to be awarded and discloses the allocation methodology and the

fair value of the Right.

Change of Control In the event of a change of control, and to the extent that Rights have not already lapsed, the Board

determines whether the LTIP Rights vest or otherwise.

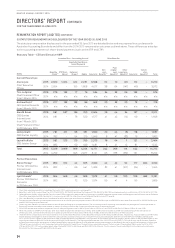

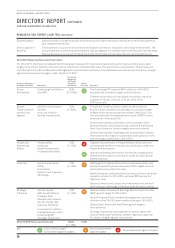

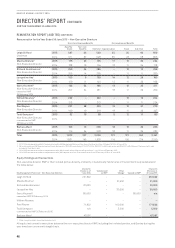

Disclosure The ‘LTIP vesting’ amount shown in the remuneration outcomes tables is equal to the number of Rights vested

multiplied by the Qantas share price at the start of the performance period.

The ‘LTIP share price growth’ amount is equal to the number of Rights vested multiplied by the increase in the

Qantas share price over the three year performance period (rather than amortising the accounting value over

the relevant performance and service period as per the accounting standards).

Benefits

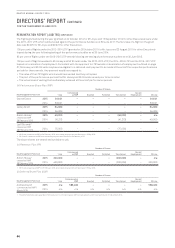

Non-cash Benefits Non-cash benefits, as disclosed in the remuneration tables, include travel entitlements while employed and

other minor benefits.

Travel Travel concessions are provided to permanent Qantas employees, consistent with practice in the airline

industry. Travel at concessionary prices is on a sub-load basis, that is, subject to considerable restrictions

and limits on availability. It includes specified direct family members or a nominated travel companion.

In addition to this and consistent with practice in the airline industry, Directors and KMP and their eligible

beneficiaries are entitled to a number of trips for personal purposes at no cost to the individual.

Post-employment travel concessions are also available to all permanent Qantas employees who qualify through

retirement or redundancy. The CEO and KMP and their eligible beneficiaries are also entitled to a number of free

trips for personal purposes after ceasing employment. An estimated present value of these entitlements

is accrued over the service period of the individual and is disclosed as a post-employment benefit.