Qantas 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

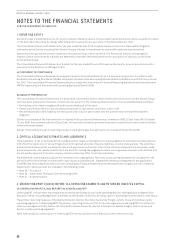

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

FOR THE YEAR ENDED 30 JUNE 2015

64

QANTAS ANNUAL REPORT 2015

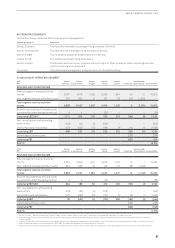

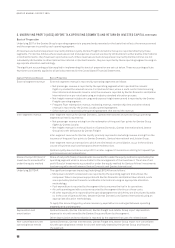

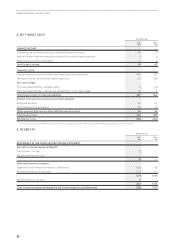

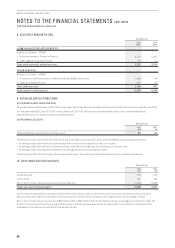

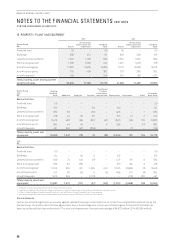

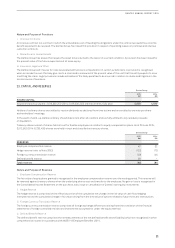

8. AUDITOR’S REMUNERATION

Qanta roup

2015

$’000

2014

$’000

DND AUDIT RELATED SERVICES

Auditors of Qantas – KPMG

–Audit and review of Financial Report 3,219 3,202

–Other regulatory audit services 23 44

Total audit and audit related services 3,242 3,246

OTHER SERVICES

Auditors of Qantas – KPMG

–In relation to other assurance, taxation and due diligence services 1,588 778

–Other non-audit services 570 34

Total other services 2,158 812

Total auditor’s remuneration 5,400 4,058

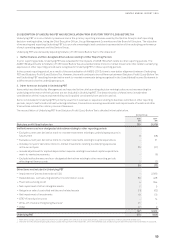

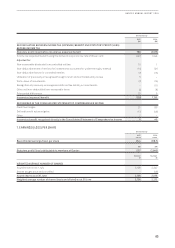

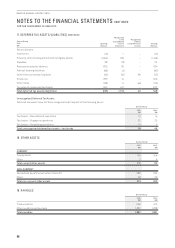

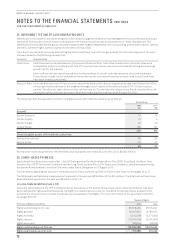

9. SHAREHOLDER DISTRIBUTIONS

(A) DIVIDENDS DECLARED AND PAID

No dividends were declared or paid in the current year by Qantas. No final dividend will be paid in relation to the year ended 30 June 2015.

For the year ended 30 June 2015, $4 million dividends (2014: $1 million) were declared and paid to non-controlling interest

shareholders by non-wholly owned controlled entities.

(B) FRANKING ACCOUNT

Qantas Group

2015

$M

2014

$M

Total franking account balance at 30 per cent 84 84

The above amount represents the balance of the franking account as at 30 June, after taking into account adjustments for:

–Franking credits that will arise from the payment of income tax payable for the current year

–Franking credits that will arise from the receipt of dividends recognised as receivables at the year end

–Franking credits that may be prevented from being distributed in subsequent years

The ability to utilise the franking credits is dependent upon there being sufficient available profits to declare dividends.

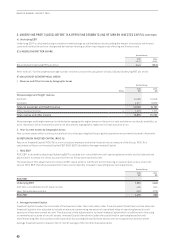

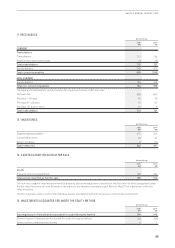

10. CASH AND CASH EQUIVALENTS

Qantas Group

2015

$M

2014

$M

Cash balances 253 206

Cash at call 197 137

Short-term money market securities and term deposits 2,458 2,658

Total cash and cash equivalents 2,908 3,001

Cash and cash equivalents comprise cash at bank and on hand, cash at call and short-term money market securities and term

deposits that are readily convertible to a known amount of cash and are subject to an insignificant risk of change in value.

Short-term money market securities of $81 million (2014: $33 million) held by the Qantas Group are pledged as collateral under the

terms of certain operational financing facilities when underlying unsecured limits are exceeded. The collateral cannot be sold or

repledged in the absence of default by the Qantas Group.