Qantas 2015 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

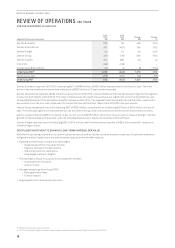

A Strong Result

Qantas reported an underlying

profit before tax of $975 million

and a statutory profit after tax of

$560 million for 2014/2015.

The underlying result was a

turnaround of $1.6 billion compared

with 2013/2014, including Qantas’

best ever second half performance,

with all segments of the Qantas

Group profitable and returning their

cost of capital for the year.

The largest driver of the improved

result was progress with the

Qantas Transformation program,

which unlocked $894 million in

transformation benefits during the

year and saw Qantas meet its target

of paying down more than $1billion

of net debt3. As a result, Qantas

has reached its optimal capital

structure – enabling it to resume

shareholder returns.

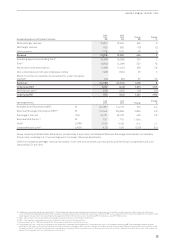

Group Performance

All segments of the Qantas Group

reported strong profits with

record results for Jetstar, Qantas

Loyalty and Qantas Freight4 on an

underlying earnings before interest

and tax (EBIT) basis. Combined

Group domestic underlying EBIT

– Qantas and Jetstar – was more

than $600million and Qantas

International was profitable on a

full-year basis for the first time since

before the Global Financial Crisis.

Financial Position

The Group’s leverage metrics are now

within an investment-grade target

range, with debt-to-EBITDA of 2.9x,

compared with 5.1x in 2013/2014.

The Group retains access to diverse

sources of funding and strong

liquidity, including $2.9 billion in

cash, $1 billion in available undrawn

facilities and a pool of unencumbered

aircraft totalling more than

US$3 billion (at market values).

Proposed Capital Return

A proposed capital return of

$505million, equivalent to 23 cents

per share, is proposed to be paid

to shareholders in early November

2015. The cash payment is subject

to shareholder approval at the

Qantas Annual General Meeting

on 23October 2015 of both the

capital return and a related share

consolidation, which is designed

to provide shareholders with an

earnings per share outcome similar to

an equivalent-sized share buy-back.

FINANCIAL OVERVIEW1

QANTAS

DOMESTIC

$480m

Underlying EBIT.

Up from $30 million

in 2013/2014

QANTAS

INTERNATIONAL

$267m

Underlying EBIT. Up from

a loss of $497 million

in 2013/2014

QANTAS

LOYALTY

$315m

record Underlying EBIT.

Up from $286 million

in 2013/2014

JETSTAR

GROUP

$230m

record Underlying EBIT.

Up from a loss of

$116 million in

2013/2014

QANTAS

FREIGHT

$114m

record Underlying EBIT4

.

Up from $24 million

in 2013/2014

1 Refer to the Review of Operations section in the Qantas Annual Report 2015 for definition and explanation of non-statutory measures.

Unless otherwise stated, amounts are reported on an underlying basis.

2 Underlying Profit Before Tax (PBT) is a non-statutory measure and is the primary reporting measure used by the Qantas Group’s chief operating decision-making bodies

(being the Chief Executive Officer, Group Management Committee and the Board of Directors) for the purpose of assessing the performance of the Group.

3 $1.1 billion since 2012/2013. Net debt including present value of operating lease obligations.

4 Since separate segmentation of Freight result in 2007/2008.

Underlying profit

before tax2

$975

MILLION

Statutory profit

after tax

$560

MILLION

Return on

invested capital

16

PER CENT

Operating

cash flow

$2

BILLION

Net free

cash flow

$1.1

BILLION

Transformation

benefits realised $894

MILLION

Net debt

reduction

$1

BILLION

Statutory

earnings per

share (EPS)

25.4

CENTS

HIGHLIGHTS

06

QANTAS ANNUAL REPORT 2015