Qantas 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

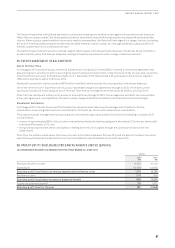

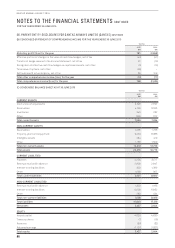

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

FOR THE YEAR ENDED 30 JUNE 2015

96

QANTAS ANNUAL REPORT 2015

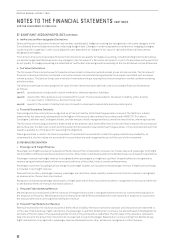

37. SIGNIFICANT ACCOUNTING POLICIES CONTINUED

J LEASES

i. Determining Whether an Arrangement Contains a Lease

At inception of an arrangement, the Group determines whether the arrangement is or contains a lease.

At inception or on reassessment of an arrangement that contains a lease, the Group separates payments and other consideration

required by the arrangement into those for the lease and those for other elements on the basis of their relative fair values for a

finance lease, if the Group concludes that it is impracticable to separate the payments reliably, then an asset and a liability are

recognised at an amount equal to the fair value of the underlying asset; subsequently, the liability is reduced as payments are made

and an imputed finance cost on the liability is recognised using the Group’s incremental borrowing rate.

ii. Finance Leased and Hire Purchase Assets

Leased assets under which the Qantas Group assumes substantially all the risks and benefits of ownership are classified as finance

leases. Other leases are classified as operating leases.

Finance leases are capitalised. A lease asset and a lease liability equal to the present value of the minimum lease payments and

guaranteed residual value are recorded at the inception of the lease. Any gains and losses arising under sale and finance leaseback

arrangements are deferred and depreciated over the lease term. Capitalised leased assets are depreciated on a straight-line basis

over the period in which benefits are expected to arise from the use of those assets. Lease payments are allocated between the

reduction in the principal component of the lease liability and the interest element.

Fully prepaid leases are classified in the Consolidated Balance Sheet as hire purchase assets to recognise that the financing

structures impose certain obligations, commitments and/or restrictions on the Qantas Group, which differentiate these aircraft from

owned assets.

iii. Operating Leases

Rental payments under operating leases are charged to the Consolidated Income Statement on a straight-line basis over the term of

the lease.

Any gains and losses arising under sale and operating leaseback arrangements where the sale price is at fair value are recognised

in the Consolidated Income Statement as incurred. Where the sale price is below fair value, any gains and losses are immediately

recognised in the Consolidated Income Statement, except where the loss is compensated for by future lease payments at below

market price, in which case the loss is deferred and amortised over the period which the asset is expected to be used. Where the sale

price is above fair value, the excess over fair value is deferred and amortised over the useful life of the asset.

With respect to any premises rented under long-term operating leases, which are subject to sub-tenancy agreements, provision is

made for any shortfall between primary payments to the head lessor less any recoveries from sub-tenants. These provisions are

determined on a discounted cash flow basis, using a rate reflecting the cost of funds.

(K) INTANGIBLE ASSETS

i. Recognition and Measurement

Goodwill is stated at cost less any accumulated impairment losses. With respect to investments accounted for under the

equity method, the carrying amount of goodwill is included in the carrying amount of the investment.

Goodwill Goodwill is stated at cost less any accumulated impairment losses. With respect to investments

accounted for under the equity method, the carrying amount of goodwill is included in the carrying

amount of the investment.

Airport Landing Slots Airport landing slots are stated at cost less any accumulated impairment losses.

Software Software is stated at cost less accumulated amortisation and impairment losses. Software

development expenditure, including the cost of materials, direct labour and other direct costs, is

only recognised as an asset when the Qantas Group controls future economic benefits as a result

of the costs incurred and it is probable that those future economic benefits will eventuate and the

costs can be measured reliably.

Brand Names and Trademarks Brand names and trademarks are carried at cost less any accumulated impairment losses.

Customer Contracts/

Relationships

Customer contracts/relationships are carried at their fair value at the date of acquisition less

accumulated amortisation and impairment losses.

Contract Intangible Assets Contract intangible assets are stated at cost less accumulated amortisation. Amortisation

commences when the asset is ready for use.