Qantas 2015 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

QANTAS ANNUAL REPORT 2015

INTRODUCTION

OVERVIEW OF THE EXECUTIVE REMUNERATION FRAMEWORK

The objectives of the Executive Remuneration Framework are to attract, motivate, retain and appropriately reward a capable

Executive team. This is achieved by setting pay opportunity at an appropriate level and by linking remuneration outcomes to

QantasGroup performance.

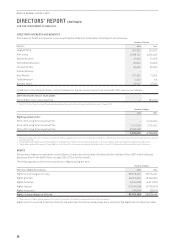

Executive Remuneration for 2014/2015

Qantas is committed to setting remuneration policy to align with the creation of shareholder value. In the four previous years:

–Annual incentive awards were not paid to the CEO in two years (2011/2012 and 2013/2014) and only partial awards were made

intheother two years (2010/2011 and 2012/2013)

–LTIP awards have not vested (and in fact had not vested for five straight years)

Remuneration outcomes for 2014/2015 have reflected the very strong financial performance of the Group, which has seen:

–A return to profitability (with management’s delivery of the Qantas Transformation program the biggest contributing factor to

theturnaround)

–Qantas being the best performing stock of ASX100 companies during 2014/2015

Awards were made under the annual incentive (the 2014/15 STIP), based on achievement against the scorecard of financial and

non-financial measures. Management delivered the Qantas Transformation program while also continuing to invest in the customer

through this period (both via product enhancements and customer service training). As a result, an excellent profit outcome was

delivered while record customer satisfaction scores were achieved in both Qantas International and Qantas Domestic.

Rights vested under the Long Term Incentive Plan (under the 2013–2015 LTIP). A fixed number of Rights were awarded to executives in 2012,

and based on Qantas’ financial performance over the three year performance period, 85 per cent of these Rights vested following testing at

30 June 2015 and converted to Qantas shares. The value of this fixed number of shares awarded to each executive increases or decreases

depending on the share price. Over the three year performance period of the 2013–2015 LTIP, the value of these shares has increased by

194 per cent. In the remuneration outcomes tables, we have disclosed the value of these shares at the start of the performance period and

have also disclosed the increase in the value of these shares that has been driven by the share price growth over the performance period.

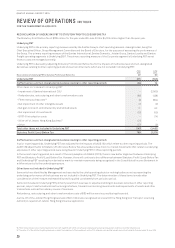

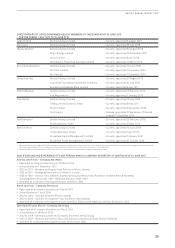

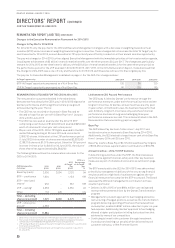

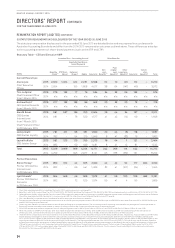

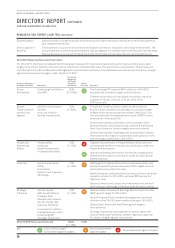

The Qantas Executive Remuneration Framework and the remuneration outcomes for 2014/2015 are summarised as follows:

Executive Remuneration Component Delivery Performance Measures

2014/2015 Remuneration and

Performance Outcomes

Base Pay

A guaranteed salary level

inclusive of superannuation.

A more detailed description

is provided on page 35.

Cash, superannuation and

other salary sacrifice benefits

(if elected).

An individual’s Base Pay is a

fixed/guaranteed element of

remuneration.

No increases to the Base Pay of

the CEO and KMP.

Additionally, the CEO opted to

forgo five per cent of his Base

Pay (from 1 January 2014 until

30June 2015).

Annual Incentive

Referred to as the Short Term

Incentive Plan (STIP).

A more detailed description is

provided on pages 35 to 36.

Two-thirds cash, one-third

shares (with a two year

restriction period).

Each year an Executive

may receive an award that

is a combination of a cash

bonus and an award of

restricted shares if the Plan’s

performance conditions

areachieved.

A scorecard of performance

measures.

Underlying PBT is the primary

performance measure (with a

50 per cent weighting).

Other performance measures

are explicitly aligned to the

execution of the Qantas Group

strategy, including delivering

on the transformation agenda.

2014/15 STIP awards paid with

a STIP scorecard outcome of

140per cent.

Underlying PBT measure

exceeded.

Transformation targets

exceeded.

Good performance against

other financial and non-

financial measures.

Long Term Incentive

Referred to as the Long Term

Incentive Plan (LTIP).

The LTIP is described in more

detail on pages 36 to 37.

Rights over Qantas shares.

If performance conditions

over a three year period are

achieved, the Rights vest and

convert to Qantas shares on a

one-for-one basis.

The performance measures

for each of the 2013–2015

LTIP, 2014–2016 LTIP and

2015–2017 LTIP are the relative

Total Shareholder Return

(TSR) performance of Qantas

compared to:

–companies with ordinary

shares included in the

ASX100

–an airline peer group (Global

Listed Airlines)

Partial vesting – 85 per cent.

LTIP awards under the

2013–2015 LTIP were tested

as at 30June 2015 and the

performance measures were

achieved:

–in full against ASX100 peer

group

–in part against the Global

Listed Airlines peer group

Therefore,

–85 per cent of Rights

converted to shares

–15 per cent of Rights lapsed