Porsche 2008 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2008 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254

|

|

219

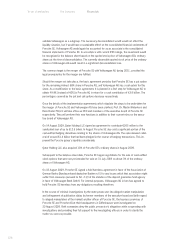

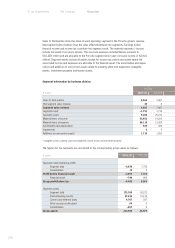

4.3.1.3 Investment risk from asset management

The Volkswagen subgroup has invested part of its liquid assets in special securities funds. These

are subject in particular to a stock and bond risk which can arise from fluctuations in market

prices, stock exchange indices and market rates of interest. The risks are counteracted in a first

step by a broad diversification of products, issuers and regional markets. In addition, exchange

rate hedges are used in the form of futures contracts when market conditions are appropriate. If

stock prices as of 31 July 2009 had been 10% higher (lower), equity would have been €54 million

higher (lower).

4.3.1.4 Commodity price risk

Commodity price risk in the automotive division results from price fluctuations and the availability

of non-ferrous metals and precious metals as well as of coal and CO2 certificates. Forward trans-

actions are entered into to limit these risks. Hedge accounting in accordance with IAS 39 is ap-

plied to the hedging of commodity risk associated with aluminum and copper.

Commodity price risk within the meaning of IFRS 7 is presented using sensitivity analyses. These

show the effect on profit and equity of changes in risk variables in the form of commodity prices.

If the commodity prices of the hedged metals had been 10% higher (lower) as of 31 July 2009,

profit would have been €49 million higher (lower). If the commodity prices of the hedging transac-

tions accounted for using hedge accounting had been 10% higher (lower) as of 31 July 2009,

equity would have been €74 million higher (lower).

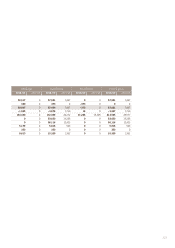

4.3.2 Market risk in the financial services divisions

Exchange rate risk in the financial services division is mainly attributable to assets that are not

denominated in the functional currency and from refinancing within operating activities. Interest

rate risk relates to refinancing without matching maturities and the varying interest rate elasticity

of individual asset and liability items. The risks are limited by the use of currency and interest rate

hedges.

Regarding the fair value portfolio hedge fixed-rate receivables and liabilities are hedged against

changes in the risk-free base rate. The assets and liabilities included in this hedging strategy are

measured at fair value for the remaining term. The resulting effects in the income statement are

offset by the corresponding gains and losses on the interest rate hedging instruments.

The value at risk is determined using a historical simulation based on the last 250 trading days

and with a retention period of 10 days as well as a confidence level of 99% and the potential

change in financial instruments if interest and exchange rates vary.