Porsche 2008 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2008 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.169

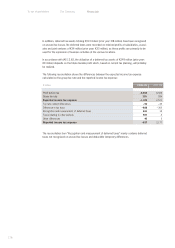

The judgements and estimates are based on assumptions that are derived from the current infor-

mation available. In particular, the circumstances given when preparing the consolidated financial

statements and assumptions as to the expected future development of the global and industry

environment were used to estimate the company’s future business performance. Where these

assumptions turn out differently than expected, and are beyond the control of management, the

figures realized may differ from those anticipated. In such cases, the assumptions, and if neces-

sary the carrying amounts of the assets and liabilities concerned, are adjusted accordingly.

The judgements and estimates made when preparing the consolidated financial statements were

subject to a high degree of uncertainty due to the uncertain economic climate. Factors which may

cause variances from judgements and estimates include new information about the buying behavior

on the sales markets and in response to this changes in planning, dependency on suppliers, in

particular exclusive suppliers, developments in share prices and exchange rates, interest rates

and the price of raw materials as well as environmental or other legal provisions. Prior to the date

of authorization of the financial statements by the executive board for issue to the supervisory

board, there were no indications that the carrying values of the assets and liabilities presented in

the consolidated balance sheet would require any significant adjustment in the following reporting

period. Judgements and estimates by management included assumptions contained in the fore-

cast report.

New accounting standards

a) The group has adopted the following new and revised IFRSs and interpretations during

the fiscal year for the first time:

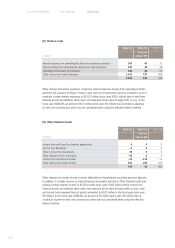

IFRS 8 “Operating Segments”

IFRS 8 regulates the financial information which an entity has to report about its operating seg-

ments. IFRS 8 replaces IAS 14 “Segment Reporting” and is subject to mandatory adoption for the

first time in fiscal years beginning on or after 1 January 2009. The Porsche group has early

adopted IFRS 8 for the 2008/09 consolidated financial statements. As a result, the segment

reporting has been reclassified. Based on the management approach, the Porsche group has two

reportable segments. Assets, revenue and expenses that cannot be allocated to the operating

segments and the consolidation are presented in reconciliation statements.

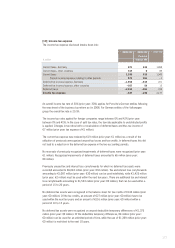

Amendment to IAS 23 “Borrowing Costs”

The amendment requires the recognition of borrowing costs which can be allocated directly to the

acquisition, construction or production of a qualifying asset. The option for the immediate recogni-

tion of borrowing costs in profit or loss is no longer applicable. The amendment is applicable for

reporting periods beginning on or after 1 January 2009. The Porsche group early adopted this

amendment as of 1 February 2009. In the fiscal year 2008/09, borrowing costs of €0.6 million

were recognized as an asset. A borrowing cost rate of 4.4% was applied in the calculation.