Porsche 2008 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2008 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.155

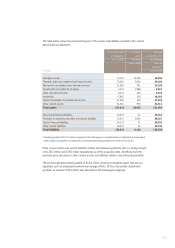

Intragroup expenses and income as well as receivables, liabilities and provisions are eliminated.

Intercompany profits from the sale of assets within the group which have not yet been resold to

third parties are eliminated. Deferred taxes are recognized for intragroup transactions that affect

income taxes. In addition, guarantees and warranties assumed by Porsche SE or one of its con-

solidated subsidiaries in favor of other consolidated subsidiaries are eliminated.

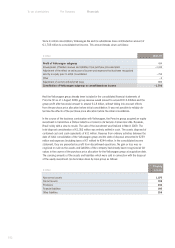

Investments accounted for at equity are carried at cost at the time of initial consolidation. The

consolidation procedures generally apply by analogy to measurement using the equity method. Any

goodwill that arises as part of the investment carrying amount is not presented separately. In

subsequent periods, the carrying amount is changed to reflect the Porsche group’s share of

changes in equity of the associate. An impairment test is made whenever there is any indication

that the entire carrying amount of the investment is impaired. At least once a year, an assessment

is made whether there is any indication that the reason for an impairment no longer exists or an

impairment amount has decreased. If this is the case, the recoverable amount is recalculated and

the impairment that no longer exists is reversed.

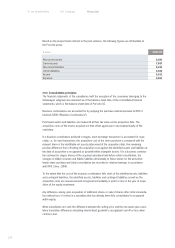

Currency translation

Foreign currency items in the financial statements of the entities included in the consolidated

financial statements are measured at the spot exchange rates at the date of the transaction.

Monetary assets and liabilities denominated in foreign currencies are translated into the functional

currency at the closing rate. Non-monetary items denominated in a foreign currency measured at

historical cost are translated using the exchange rate at the date of the initial transaction. Non-

monetary items measured at fair value in a foreign currency are translated using the exchange rate

prevailing on the date when the fair value was determined. Exchange rate gains and losses as of

the balance sheet date are recorded in profit or loss.

Goodwill and adjustments to recognize assets and liabilities arising from business combinations at

their fair value are expressed in the functional currency of the subsidiary.

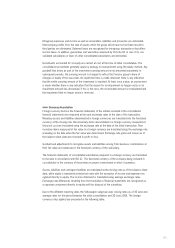

The financial statements of consolidated subsidiaries prepared in a foreign currency are translated

to the euro in accordance with IAS 21. The functional currency of the company being included in

consolidation is the currency of the primary economic environment in which it operates.

Assets, liabilities and contingent liabilities are translated at the closing rate as of the balance sheet

date, while equity is translated at historical rates with the exception of income and expenses rec-

ognized directly in equity. The income statement is translated using average exchange rates.

Exchange rate differences resulting from the translation of financial statements are recognized as

a separate component directly to equity until the disposal of the subsidiary.

Due to the different reporting date, the Volkswagen subgroup uses closing rates as of 30 June and

average rates for the period between the initial consolidation and 30 June 2009. The foreign

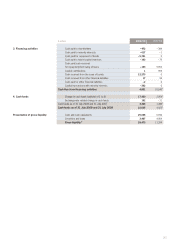

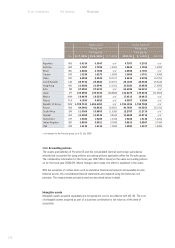

currency rates applied are presented in the following table.