Porsche 2008 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2008 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254

|

|

211

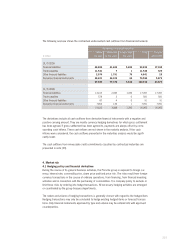

[31] Financial risk management and financial instruments

1. Hedging guidelines and financial risk management principles

The principles and responsibilities for managing and controlling the risks that could arise from

financial instruments are defined by the executive board and monitored by the supervisory board.

Internal guidelines exist within the Porsche group which clearly defines the risk management

processes. These guidelines regulate, among other things, the use of financial instruments or

derivatives and the requisite control procedures, such as a clear segregation of functions between

trade and settlement. The guidelines are based on the statutory requirements as well as the mini-

mum standards for risk management at banks. The central treasury departments of the Porsche

and Volkswagen subgroups identify, analyze and monitor the risks throughout the group using

suitable information systems. Moreover, transactions may only be concluded in permitted financial

instruments, only with approved counterparties and to the admissible extent.

The guidelines and the supporting systems are checked regularly and brought into line with current

market and product development. The group manages and monitors these risks primarily via its

business operations and financing activities and, where necessary, by using derivative financial

instruments. The Porsche group mainly uses derivative financial instruments for the management

of currency, interest, commodity and fund price risks. Without using such instruments, the group

would be exposed to higher financial risks.

2. Credit and default risk

The credit and default risk arising from financial assets involves the risk of default by counter-

parties, and therefore comprises at a maximum the amount of the positive fair values of claims

against them and the irrevocable credit commitments. The default risk of financial assets is taken

into account through adequate valuation allowances considering collateral that has already been

provided. Various measures are taken into account to reduce the default risk for primary financial

instruments, such as requesting collateral or guarantees and credit ratings based on information

from credit rating agencies and historical data. The contracting partners for monetary investments,

capital investments and financial instruments are national and international counterparties. Finan-

cial derivatives are used by the subgroups in accordance with standardized guidelines, and are

continuously monitored.

Due to the worldwide spread of business activities and the resulting diversification, there was no

major concentration of risk in the past fiscal year.

It was decided not to present the non-significant classes and a break-down of the securities class

which in the prior year contained a small amount of securities held to maturity. A credit rating is

not performed for the equity instruments.

Notes on the other disclosures