Porsche 2008 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2008 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To our shareholders The Company

200

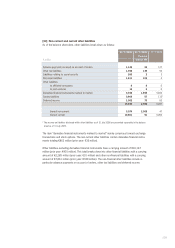

Capital management

Capital management in the Porsche group is a two-step process. In a first step, both the Porsche

subgroup and the Volkswagen subgroup manage their capital in accordance with individual require-

ments. In a second step at overall group level, a monitoring of the subgroups, the consolidation

effects and the effects from the purchase price allocation is performed.

Capital management in the Porsche subgroup

The main target of capital management in the Porsche subgroup is the continuous and long-term

increase in the value of the company and securing its liquidity and complying with the capital re-

quirements imposed by third parties. This is done in order to protect the long-term interests of the

shareholders and employees and other stakeholders.

There are minimum capital requirements imposed by third parties relating to certain profit and debt

levels. These were complied with in full in the fiscal year 2008/09.

The Porsche group supports active debt capital management with a view to reducing the cost of

capital and optimizing the capital structure.

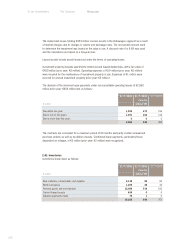

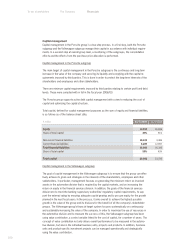

Total capital, defined for capital management purposes as the sum of equity and financial liabilities,

is as follows as of the balance sheet date:

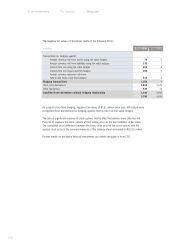

Capital management in the Volkswagen subgroup

The goal of capital management in the Volkswagen subgroup is to ensure that the group can effec-

tively achieve its goals and strategies in the interests of the shareholders, employees and other

stakeholders. In particular, management focuses on generating the minimum return on invested

assets in the automotive division that is required by the capital markets, and on increasing the

return on equity in the financial services division. In addition, the goals of the financial services

division are to meet the banking supervisory authorities’ regulatory capital requirements, to sup-

port the external rating by ensuring adequate capital gearing and to procure equity for the growth

planned in the next fiscal years. In the process, it aims overall to achieve the highest possible

growth in the value of the group and its divisions for the benefit of all the company’s stakeholder

groups. The Volkswagen group’s financial target system focuses systematically on continuously

and sustainably increasing the value of the company. In order to maximize the use of resources in

the automotive division and to measure the success of this, the Volkswagen subgroup has been

using value contribution, a control variable linked to the cost of capital, for a number of years. The

concept of value contribution not only allows overall performance to be measured in the automo-

tive division, but also in the individual business units, projects and products. In addition, business

units and product-specific investment projects can be managed operationally and strategically

using the value contribution.

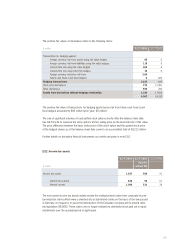

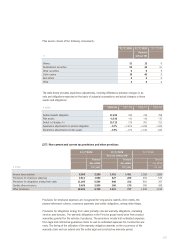

€ million 31/7/2009 31/7/2008

Equity 13,492 16,846

Share of total capital 45% 51%

Non-current financial liabilities 10,103 3,489

Current financial liabilities 6,287 12,897

Total financial liabilities 16,390 16,386

Share of total capital 55% 49%

Total capital 29,882 33,232