Porsche 2008 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2008 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254

|

|

157

Intangible assets acquired separately with a finite useful life are amortized on a straight-line basis

over their useful life, taking any impairments into account. Useful lives range from three to five

years. Useful lives, residual values and methods of amortization are reviewed, and adjusted if

appropriate, at least at each balance sheet date. If adjustments are made, these are accounted

for as changes in estimates.

Goodwill and intangible assets with indefinite useful lives are not amortized. Each asset or cash-

generating unit is tested at least once a year for impairment. Intangible assets with indefinite

useful lives are reviewed once a year to determine whether the indefinite life assessment continues

to be supportable. If this is no longer the case, the change in the useful life assessment from

indefinite to finite is made prospectively.

Development costs are recognized for products provided that expenditures can be attributed

reliably and all other recognition criteria of IAS 38 are met. The capitalized development costs

include all costs and overhead expenditure directly attributable to the development process that is

incurred after the point in time at which all recognition criteria are met. Capitalized development

costs are amortized beginning at start of production using the straight-line method over the ex-

pected useful life of the product, usually five to ten years. Research and non-capitalizable devel-

opment costs are expensed as incurred.

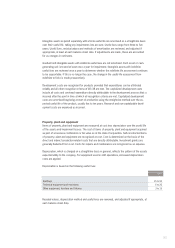

Property, plant and equipment

Items of property, plant and equipment are measured at cost less depreciation over the useful life

of the assets and impairment losses. The cost of items of property, plant and equipment acquired

as part of a business combination is fair value as at the date of acquisition. Self-constructed items

of property, plant and equipment are recognized at cost. Cost is determined on the basis of the

direct and indirect production-related costs that are directly attributable. Investment grants are

generally deducted from cost. Costs for repairs and maintenance are recognized as an expense.

Depreciation, which is charged on a straight-line basis in general, reflects the pattern of the assets

expected utility to the company. For equipment used in shift operations, increased depreciation

rates are applied.

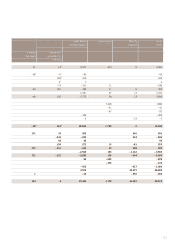

Depreciation is based on the following useful lives:

Residual values, depreciation method and useful lives are reviewed, and adjusted if appropriate, at

each balance sheet date.

Years

Buildings 25 to 50

Technical equipment and machinery 6 to 20

Other equipment, furniture and fixtures 3 to 15