Memorex 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.86

upon the sale of the products. Payers of levies remit levy payments to collecting societies which, in turn, are

expected to distribute funds to copyright holders. Levy systems of EU member countries must comply with the

Directive, but individual member countries are responsible for administering their own systems. Since

implementation, the levy systems have been the subject of numerous litigation and law making activities. On

October 21, 2010, the European Court of Justice (ECJ) ruled that fair compensation is an autonomous European

law concept that was introduced by the Directive and must be uniformly applied in all EU member states. The ECJ

stated that fair compensation must be calculated based on the harm caused to the authors of protected works by

private copying. The ECJ also stated that the indiscriminate application of the private copying levy to devices not

made available to private users and clearly reserved for uses other than private copying is incompatible with the

Directive. The ECJ ruling made clear that copyright holders are only entitled to fair compensation payments (funded

by levy payments made by importers of applicable products, including the Company) when sales of optical media

are made to natural persons presumed to be making private copies. Within this disclosure, we use the term

"commercial channel sales" when referring to products intended for uses other than private copying and "consumer

channel sales" when referring to products intended for uses including private copying.

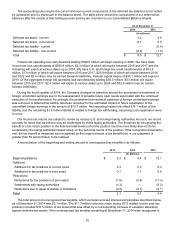

Since the Directive was implemented in 2002, we estimate that we have paid in excess of $100 million in levies

to various ongoing collecting societies related to commercial channel sales. Based on the ECJ's October 2010

ruling and subsequent litigation and law making activities, we believe that these payments were not consistent with

the Directive and should not have been paid to the various collecting societies. Accordingly, subsequent to the

October 21, 2010 ECJ ruling, we began withholding levy payments to the various collecting societies and, in 2011,

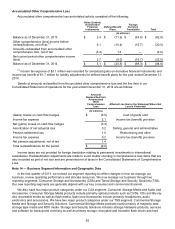

we reversed our existing accruals (totaling $7.8 million) for unpaid levies related to commercial channel sales.

However, we continued to accrue, but not pay, a liability for levies arising from consumer channel sales, in all

applicable jurisdictions except Italy and France due to court rulings that are discussed below. As of December 31,

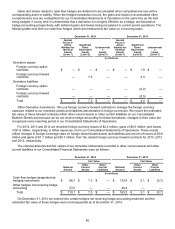

2014 and 2013, we had accrued liabilities of $9.3 million and $10.0 million, respectively, associated with levies

related to consumer channel sales for which we are withholding payment.

Since the October 2010 ECJ ruling, we evaluate quarterly on a country-by-country basis whether (i) levies

should be accrued on current period commercial and/or consumer channel sales; and, (ii) whether accrued, but

unpaid, copyright levies on prior period consumer channel sales should be reversed. Our evaluation is made on a

jurisdiction-by-jurisdiction basis and considers ongoing and cumulative developments related to levy litigation and

law making activities within each jurisdiction as well as throughout the EU. See following for discussion of reversals

of copyright levies in 2013.

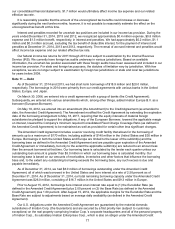

Italy. During the second quarter of 2013, an Italian court rendered a decision associated with a copyright levy

matter to which Imation was not a party. This decision (i) confirmed and provided further specificity to the October

21, 2010 ruling of the ECJ that levies should not be paid on commercial channel sales and (ii) evaluated, via audit,

the plaintiff's documentation and evidence for distinguishing between levies paid on commercial and consumer

channel sales. Based on the ruling of this Italian court, in combination with other applicable levy and law-making

activities within the EU, including Italy, we believed there was sufficient evidence that we may offset with the Italian

collecting society the estimated $39.0 million we have overpaid for copyright levies in Italy (due to us paying levies

on commercial channel sales prior to the October 21, 2010 ECJ ruling) against the amounts owed to the Italian

collecting society for unpaid levies on consumer channel sales. As such, our liability for Italian copyright levies in the

amount of $13.6 million (existing at the time of the of the second quarter 2013 Italian court decision) that arose from

consumer channel sales that had been accrued but not paid was reversed and recorded as a reduction of cost of

sales during the second quarter of 2013. We did not record a receivable for the remaining estimated $25.4 million

that we believed was owed to us by the Italian collection society for our historical over payment on levies associated

with commercial channel sales as we are not assured of its collectability. Rather, going forward, such amount began

to be realized as a reduction to cost of goods sold upon the incurrence of (and for the same amount of) valid levies

for consumer channel sales. During the last half of 2013 we offset an additional $2.6 million (within cost of sales)

and in 2014 we offset $3.4 million (within cost of sales) against a similar amount of consumer channel levies

incurred and, accordingly, we have an estimated $19.4 million of historical over payments of levies on commercial

channel sales remaining to set-off in future periods.

The Italian court required sufficient documentation and evidence to support the determination of levies between

those paid on commercial versus consumer channel sales. We believe that we have utilized a methodology, and

have sufficient documentation and evidence, to fully support our estimates that we have overpaid $39.0 million to

the Italian collection society of levies on commercial channel sales and that we had incurred (but not paid) $19.6

million of levies on consumer channel sales in Italy. However, such amounts could be subject to challenge in court

and there is no certainty that our estimates would be upheld and supported. Additionally, due to the expected

continued decline in our sales associated with optical media products, we cannot be assured that we will ever be