Memorex 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

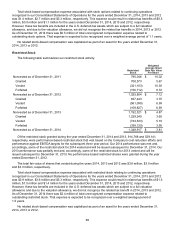

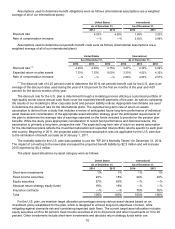

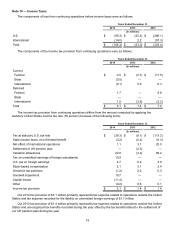

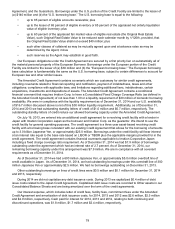

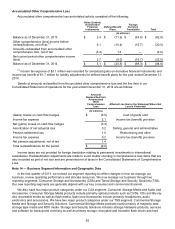

The accounting rules require the current and non-current components of the deferred tax balances to be netted

by jurisdiction prior to disclosure in the balance sheet. The table below shows the components of our deferred tax

balances after the results of that netting process as they are recorded on our Consolidated Balance Sheets:

As of December 31

2014 2013

(In millions)

Deferred tax asset - current 3.2 4.6

Deferred tax asset - non-current 8.1 9.5

Deferred tax liability - current — (0.4)

Deferred tax liability - non-current (2.3) (1.0)

Total $ 9.0 $ 12.7

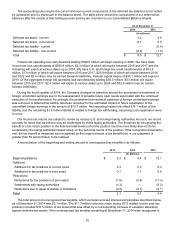

Federal net operating loss carryforwards totaling $348.5 million will begin expiring in 2026. We have state

income tax loss carryforwards of $383.9 million, $2.3 million of which will expire between 2015 and 2017 and the

remaining will expire at various dates up to 2034. We have U.S. and foreign tax credit carryforwards of $33.9

million, $7.6 million of which will expire between 2015 and 2017, $23.9 million of which will expire between 2018

and 2032 and $2.4 million may be carried forward indefinitely. Federal capital losses of $30.1 million will expire in

2019. Of the aggregate foreign net operating loss carryforwards totaling $35.3 million, $0.3 million will expire

between 2015 and 2017, $2.4 million will expire at various dates up to 2024 and $32.6 million may be carried

forward indefinitely.

During the fourth quarter of 2014, the Company changed its assertion around the permanent reinvestment of

foreign unremitted earnings due to its reassessment of possible future cash needs associated with the continued

execution of its transformation. Accordingly, the permanent reinvestment assertion of foreign unremitted earnings

was removed. A deferred tax liability has been recorded for the estimated impact of future repatriation of the

unremitted foreign earnings in the amount of $15.7 million. Net operating losses fully offset $14.1 million of this

liability, and the remaining $1.6 million liability is related to foreign tax withholding, assuming such repatriation were

to occur.

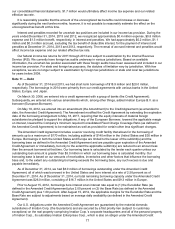

Our income tax returns are subject to review by various U.S. and foreign taxing authorities. As such, we record

accruals for items that we believe may be challenged by these taxing authorities. The threshold for recognizing the

benefit of a tax return position in the financial statements is that the position must be more-likely-than-not to be

sustained by the taxing authorities based solely on the technical merits of the position. If the recognition threshold is

met, the tax benefit is measured and recognized as the largest amount of tax benefit that, in our judgment, is

greater than 50 percent likely to be realized.

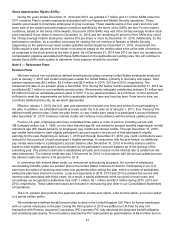

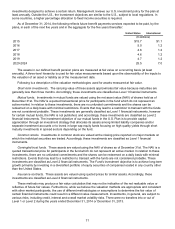

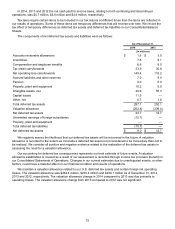

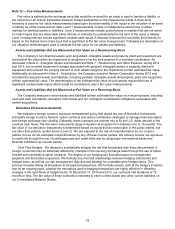

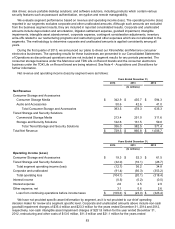

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

2014 2013 2012

(In Millions)

Beginning Balance $ 5.3 $ 4.4 $ 15.1

Additions:

Additions for tax positions of current years 0.3 0.3 0.3

Additions for tax positions of prior years 0.1 1.1 0.6

Reductions:

Reductions for tax positions of prior years (1.9) (0.4) (11.3)

Settlements with taxing authorities (1.3) — (0.2)

Reductions due to lapse of statute of limitations (0.4) (0.1) (0.1)

Total 2.1 5.3 4.4

The total amount of unrecognized tax benefits, which excludes accrued interest and penalties described below,

as of December 31, 2014 was $2.1 million. The $11.3 million reduction made during 2012 related to prior year tax

positions included $10.5 million of tax benefit that was offset by a corresponding increase in valuation allowance

against deferred tax assets. If the unrecognized tax benefits remaining at December 31, 2014 were recognized in