Memorex 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

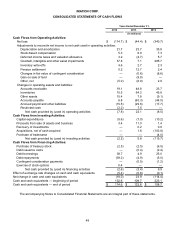

54

In May 2014, the FASB issued new accounting guidance related to revenue recognition. This new guidance will

replace all current U.S. GAAP guidance on revenue recognition and eliminate all industry-specific guidance. The

new revenue recognition standard provides a unified model to determine when and how revenue is recognized. The

underlying principle is that an entity will recognize revenue to depict the transfer of goods or services to customers

at an amount that the entity expects to be entitled to in exchange for those goods or services. The guidance

provides a five-step analysis of transactions to determine when and how revenue is recognized. Other major

provisions include capitalization of certain contract costs, consideration of time value of money in the transaction

price and allowing estimates of variable consideration to be recognized before contingencies are resolved in certain

circumstances. The guidance also requires enhanced disclosures regarding the nature, amount, timing and

uncertainty of revenue and cash flows arising from an entity’s contracts with customers. The guidance is effective

for interim and annual periods beginning on or after December 15, 2016 (early adoption is not permitted). The

guidance permits the use of either a retrospective or cumulative effect transition method. We have not yet selected

a transition method and are currently evaluating the impact of this new guidance on our financial position and

results of operations.

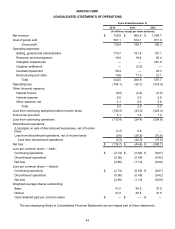

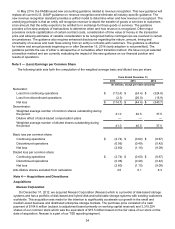

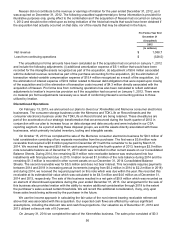

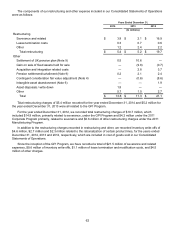

Note 3 — (Loss) Earnings per Common Share

The following table sets forth the computation of the weighted average basic and diluted loss per share:

Years Ended December 31,

2014 2013 2012

(In millions, except per share amounts)

Numerator:

Loss from continuing operations $ (112.4) $ (24.4) $ (324.8)

Loss from discontinued operations (2.3) (20.0) (15.9)

Net loss $ (114.7) $ (44.4) $ (340.7)

Denominator:

Weighted average number of common shares outstanding during

the period 41.0 40.5 37.5

Dilutive effect of stock-based compensation plans — — —

Weighted average number of diluted shares outstanding during

the period 41.0 40.5 37.5

Basic loss per common share:

Continuing operations $ (2.74) $ (0.60) $ (8.67)

Discontinued operations (0.06) (0.49) (0.42)

Net loss (2.80) (1.10) (9.09)

Diluted loss per common share:

Continuing operations $ (2.74) $ (0.60) $ (8.67)

Discontinued operations (0.06) (0.49) (0.42)

Net loss (2.80) (1.10) (9.09)

Anti-dilutive shares excluded from calculation 4.5 6.1 6.3

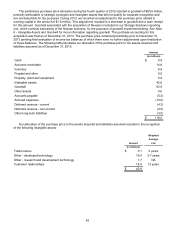

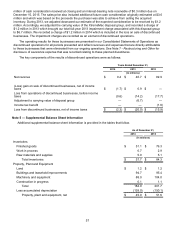

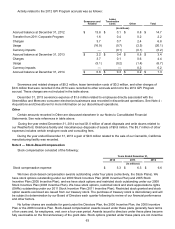

Note 4 — Acquisitions and Divestitures

Acquisitions

Nexsan Corporation

On December 31, 2012, we acquired Nexsan Corporation (Nexsan) which is a provider of disk-based storage

systems and has a portfolio of disk-based and hybrid disk-and-solid-state storage systems with existing customers

worldwide. This acquisition was made for the intention to significantly accelerate our growth in the small and

medium-sized business and distributed enterprise storage markets. The purchase price consisted of a cash

payment of $104.6 million (subject to adjustment based primarily on working capital received) and 3,319,324

shares of our common stock which was the equivalent of $15.5 million based on the fair value of our stock on the

date of acquisition. Nexsan is a part of our TSS reporting segment.