Memorex 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

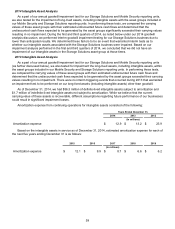

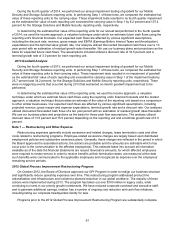

2014 Intangible Asset Analysis

As a part of our annual goodwill impairment test for our Storage Solutions and Mobile Security reporting units,

we also tested for the impairment of long-lived assets, including intangible assets with the asset groups included in

our Mobile Security and Storage Solutions reporting units. In performing these tests, we compared the carrying

values of these asset groups with their estimated undiscounted future cash flows and determined that the

undiscounted cash flows expected to be generated by the asset groups significantly exceeded their carrying values

resulting in no impairment. During the first and third quarters of 2014, as noted below under our 2014 goodwill

analysis discussion, we performed interim goodwill impairment testing for our Storage Solutions business due to

lower than anticipated results. We determined these factors to be an event that warranted interim tests as to

whether our intangible assets associated with the Storage Solutions business were impaired. Based on our

impairment analysis performed in the first and third quarters of 2014, we concluded that we did not have an

impairment of our intangible assets in the Storage Solutions asset group at those times.

2013 Intangible Asset Analysis

As a part of our annual goodwill impairment test for our Storage Solutions and Mobile Security reporting units

(as further discussed below), we also tested for impairment the long-lived assets, including intangible assets, within

the asset groups included in our Mobile Security and Storage Solutions reporting units. In performing these tests,

we compared the carrying values of these asset groups with their estimated undiscounted future cash flows and

determined that the undiscounted cash flows expected to be generated by the asset groups exceeded their carrying

values resulting in no impairment. There were no interim triggering events that occurred during 2013 that warranted

an impairment test to be performed on our long-lived assets (including intangible assets) other than goodwill.

As of December 31, 2014, we had $56.3 million of definite-lived intangible assets subject to amortization and

$1.7 million of indefinite-lived intangible assets not subject to amortization. While we believe that the current

carrying value of these assets is recoverable, different assumptions regarding future performance of our businesses

could result in significant impairment losses.

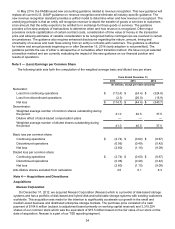

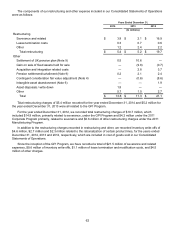

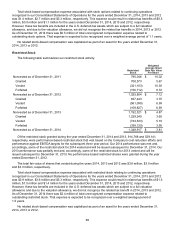

Amortization expense from continuing operations for intangible assets consisted of the following:

Years Ended December 31,

2014 2013 2012

(In millions)

Amortization expense $ 12.9 $ 13.2 $ 23.9

Based on the intangible assets in service as of December 31, 2014, estimated amortization expense for each of

the next five years ending December 31 is as follows:

2015 2016 2017 2018 2019

(In millions)

Amortization expense $ 12.1 $ 9.9 $ 8.7 $ 6.6 $ 6.2