Memorex 2014 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2014 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

by the French collection society through offsetting such amounts against levies incurred on future consumer

channel sales or other measures.

Other Jurisdictions. At December 31, 2014, the recovery of some or all of the copyright levies previously paid

on commercial sales in EU jurisdictions other than Italy and France represents a gain contingency that has not yet

met the required criteria for recognition in our financial statements. There is no assurance that we will realize any of

this gain contingency. We also have an estimated $8.3 million of accrued but unpaid levies associated with

consumer sales in EU jurisdictions other than Italy and France that we continue to carry on our books.

We are subject to several pending or threatened legal actions by the individual European national levy

collecting societies in relation to private copyright levies under the Directive. Those actions generally seek payment

of the commercial and consumer optical levies withheld by Imation. Imation has corresponding claims in those

actions seeking reimbursement of levies improperly collected by those collecting societies. We are subject to

threatened actions by certain customers of Imation seeking reimbursement of funds they allege relate to

commercial levies that they claim they should not have paid. Although these actions are subject to the uncertainties

inherent in the litigation process, based on the information presently available to us, management does not expect

that the ultimate resolution of these actions will have a material adverse effect on our financial condition, results of

operations or cash flows. We anticipate that additional court decisions may be rendered in 2015 that may directly or

indirectly impact our levy exposure in specific European countries which could trigger a review of our levy exposure

in those countries.

Item 4. Mine Safety Disclosures.

Not Applicable.

PART II

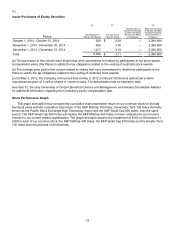

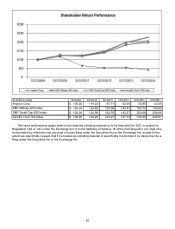

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities.

(a) — (b)

As of February 27, 2015, there were 42,857,395 shares of our common stock, $0.01 par value (common stock),

outstanding and held by 18,466 shareholders of record. Our common stock is listed on the New York Stock

Exchange and the Chicago Stock Exchange under the symbol “IMN.” No dividends were declared or paid during

2014 or 2013. Future dividend payments will depend on our earnings, capital requirements, financial condition,

limitations as set forth in our credit agreements and other factors considered relevant by our Board of Directors.

Unregistered Sales of Equity Securities

There were no unregistered sales of equity securities in 2014 and 2013. Additionally, no unregistered securities

were sold in 2014 or 2013.

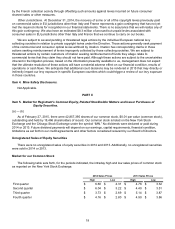

Market for our Common Stock

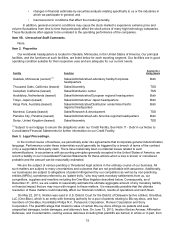

The following table sets forth, for the periods indicated, the intraday high and low sales prices of common stock

as reported on the New York Stock Exchange.

2014 Sales Prices 2013 Sales Prices

High Low High Low

First quarter $ 6.60 $ 4.31 $ 4.78 $ 3.32

Second quarter $ 6.04 $ 3.22 $ 4.40 $ 3.51

Third quarter $ 3.73 $ 2.69 $ 5.14 $ 3.87

Fourth quarter $ 4.16 $ 2.80 $ 4.90 $ 3.86