Memorex 2014 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2014 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.22

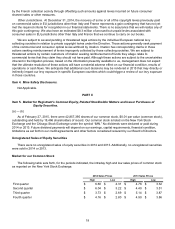

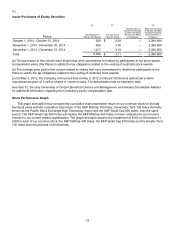

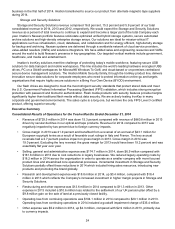

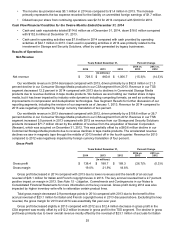

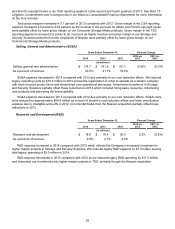

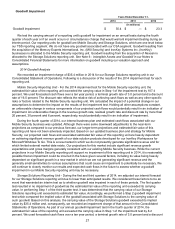

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Imation is a global data storage and data security company. With a 60-year history of technology leadership, the

Company's mission is to help organizations store, protect and connect their digital world.

The Company operates in two focused business segments: Tiered Storage and Security Solutions (TSS) and

Consumer Storage and Accessories (CSA). We have four major product categories: Storage and Security Solutions

and Commercial Storage Media in our TSS business segment and Consumer Storage Media and Audio and

Accessories in our CSA segment. Our brands include Imation™, Nexsan™, IronKey™, TDK Life on Record™,

TREK™, and Memorex™.

The following discussion is intended to be read in conjunction with Item 1. Business and our Consolidated

Financial Statements and related Notes that appear elsewhere in this Annual Report on Form 10-K. This discussion

contains forward-looking statements that involve risks and uncertainties. Imation's actual results could differ

materially from those anticipated due to various factors discussed below under “Cautionary Statements Regarding

Forward-Looking Statements” and in Item 1A. Risk Factors of this Annual Report on Form 10-K

The financial statements in this Annual Report on Form 10-K are presented on a consolidated basis and include

the accounts of the Company and our subsidiaries. See Note 2 - Summary of Significant Accounting Policies in our

Notes to Consolidated Financial Statements for further information regarding consolidation. References to “Imation,”

the “Company,” “we,” “us” and “our” are to Imation Corp., and its subsidiaries and consolidated entities unless the

context indicates otherwise. Our Consolidated Financial Statements are prepared in conformity with accounting

principles generally accepted in the United States of America (GAAP).

The results of operations for our XtremeMac™ and Memorex™ consumer electronics businesses are presented

in our Consolidated Statements of Operations as discontinued operations for all periods presented.

Overview

Following is a summary of significant items that impacted our operating results, liquidity and capital structure in

2014:

During the fourth quarter of 2012, we announced the acceleration of our strategic transformation, including the

realignment of our global business into two new business segments, a cost reduction program and our increased

focus on data storage and data security including exploring strategic options for our consumer electronics brands

and businesses.

The realignment of our global business into two new business segments better aligns the Company with our key

consumer and commercial channels. The two business segments consist of CSA, which focuses mainly on retail

channels; and TSS, which focuses on small and medium business, enterprise and government customers. In the

first quarter of 2013, we revised our segment reporting to reflect these two new reporting segments. See Note 14 -

Business Segment Information and Geographical Data in our Notes to Consolidated Financial Statements for more

information on our business segments.

In October 2012, the Board of Directors approved our Global Process Improvement Restructuring Program (GPI

Program) in order to realign our business structure and significantly reduce operating expenses. This restructuring

program addressed product line rationalization and infrastructure and included a planned reduction in our global

workforce. The majority of these actions were implemented during 2013. See Note 7 - Restructuring and Other

Expense in our Notes to Consolidated Financial Statements for more information on this restructuring program.

During the first quarter of 2013 we announced our plans to divest our XtremeMac and Memorex consumer

electronics businesses. The divestiture of our Memorex consumer electronics business occurred on October 15,

2013 and the divestiture of our XtremeMac business occurred on January 31, 2014. See Note 4 - Acquisitions and

Divestitures in our Notes to Consolidated Financial Statements for further information on these divestitures. The

consumer storage business under the Memorex and TDK Life on Record brands and the consumer electronics

business under the TDK Life on Record brand were retained.

In 2014, we continued to execute our strategic transformation and to invest in our business to facilitate our

return to revenue growth. The transformation has been a multi-year process designed to establish Imation as a

global leader in data storage and security.

During the transformation process, the Company has worked extensively with external advisors and has had

discussions with third parties to fully examine a variety of potential options. On February 10, 2015, we announced

that we have been working with Houlihan Lokey as our financial adviser to review and explore strategic alternatives