Memorex 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.67

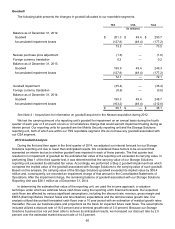

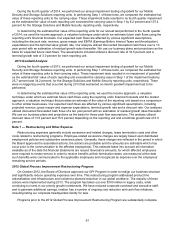

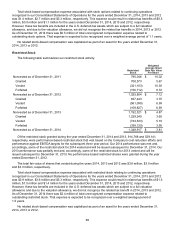

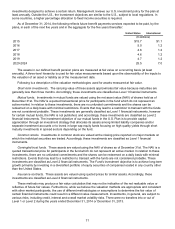

Stock Appreciation Rights (SARs)

During the years ended December 31, 2014 and 2013, we granted 0.7 million and 3.1 million SARs under the

2011 Incentive Plan to certain employees associated with our Nexsan and Mobile Security operations. These

awards were issued to incentivize employees to grow revenues. These awards expire in five years and only vest

when both of the market and performance conditions specified by the terms of the SARs are met. For the market

conditions, based on the terms of the awards, 50 percent of the SARs may vest if the 30-day average Imation stock

price reaches $10 per share or more by December 31, 2016 and the remaining 50 percent of the SARs may vest if

the 30-day average Imation stock price reaches $15 per share or more by December 31, 2016. Additionally, for the

performance condition, as a condition necessary for vesting, the net revenue of Nexsan or Mobile Security

(depending on the award) must reach certain specified stretch targets by December 31, 2016. If exercised, the

SARs require a cash payment to the holder in an amount based on the Imation stock price at the date of exercise

as compared to the stock priced at the date of grant. As of December 31, 2014 and 2013 we have not recorded any

compensation expense associated with these SARs based on the applicable accounting rules. We will continue to

assess these SARs each quarter to determine if any expense should be recorded.

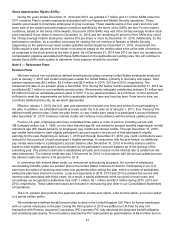

Note 9 — Retirement Plans

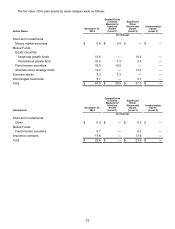

Pension Plans

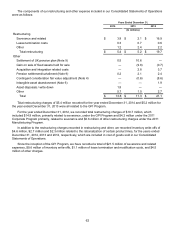

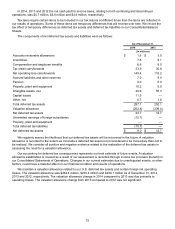

We have various non-contributory defined benefit pension plans covering United States employees employed

prior to January 1, 2010 and certain employees outside the United States, primarily in Germany and Japan. Total

pension expense was $0.2 million, $2.6 million and $2.0 million in 2014, 2013 and 2012, respectively. The

measurement date of our pension plans is December 31st. During the twelve months ended December 31, 2014 we

contributed $2.1 million to our worldwide pension plans. We presently anticipate contributing between $1 million and

$2 million to fund our worldwide pension plans in 2015. It is our general practice, at a minimum, to fund amounts

sufficient to meet the requirements set forth in applicable benefits laws and local tax laws. From time to time, we

contribute additional amounts, as we deem appropriate.

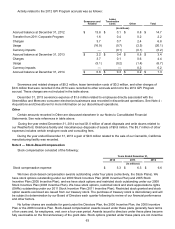

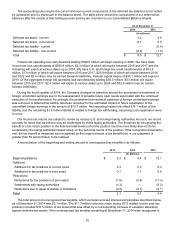

Effective January 1, 2010, the U.S. plan was amended to exclude new hires and rehires from participating in

the plan. In addition, we eliminated benefit accruals under the U.S. plan as of January 1, 2011, thus “freezing” the

defined benefit pension plan. Under the plan freeze, no pay credits were made to a participant’s account balance

after December 31, 2010. However, interest credits will continue in accordance with the annual update process.

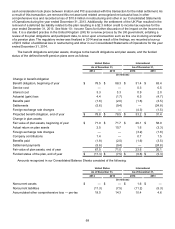

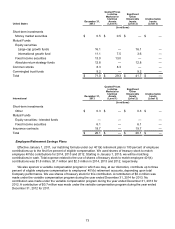

For the U.S. plan, employees who have completed three years or more of service, including service with

3M Company before July 1, 1996, or who have reached age 65, are entitled to pension benefits beginning at normal

retirement age (65) based primarily on employees’ pay credits and interest credits. Through December 31, 2009,

pay credits were made to each eligible participant's account equal to six percent of that participant's eligible

earnings for the year. Beginning on January 1, 2010 and through December 31, 2010, pay credit contributions were

reduced to three percent of each participant’s eligible earnings. In conjunction with the plan freeze, no additional

pay credits were made to a participant’s account balance after December 31, 2010. A monthly interest credit is

made to each eligible participant’s account based on the participant’s account balance as of the last day of the

preceding year. The interest credit rate is established annually and is based on the interest rate of certain low-risk

debt instruments. The interest credit rate was 3.80 percent for 2014. In accordance with the annual update process,

the interest credit rate will be 3.04 percent for 2015.

In connection with actions taken under our announced restructuring programs, the number of employees

accumulating benefits under our pension plan in the United States continues to decline. Participants in our U.S.

plan have the option of receiving cash lump sum payments when exiting the plan, which a number of participants

exiting the plan have elected to receive. Lump sum payments in 2014, 2013 and 2012 exceeded the service and

interest costs associated with those years. As a result, a partial settlement event occurred in those years and,

accordingly, we recognized a settlement loss of $1.1 million, $2.1 million and $2.4 million during 2014, 2013 and

2012, respectively. These settlement losses are included in restructuring and other in our Consolidated Statements

of Operations.

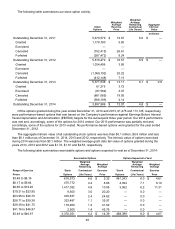

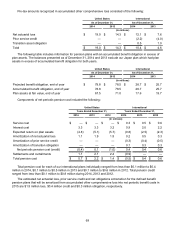

The U.S. pension plan permits four payment options: a lump-sum option, a life income option, a survivor option

or a period certain option.

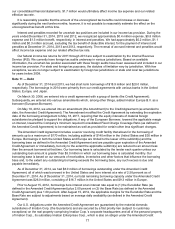

We maintained a defined benefit pension plan located in the United Kingdom (UK Plan) for former employees

with no current employees in the plan. During the third quarter of 2013 we settled our UK Plan by way of a

transaction with Pension Insurance Corporation (PIC) whereby PIC fully assumed the projected benefit obligation

and underlying plan assets. The net balance assumed by PIC represented an asset balance of $6.4 million and no