Memorex 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

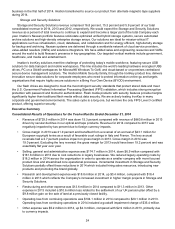

During the year ended December 31, 2014 we had $1.0 million of asset disposals and write downs related to

our Weatherford, Oklahoma facility and miscellaneous disposals of assets of $0.8 million. The $5.7 million of other

expenses includes certain employee costs and consulting fees.

During the year ended December 31, 2013 a gain of $9.8 million related to the sale of our Camarillo, California

manufacturing facility was recorded.

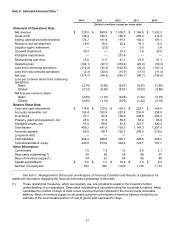

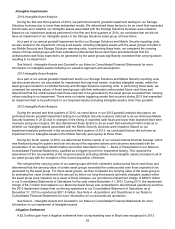

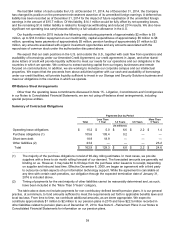

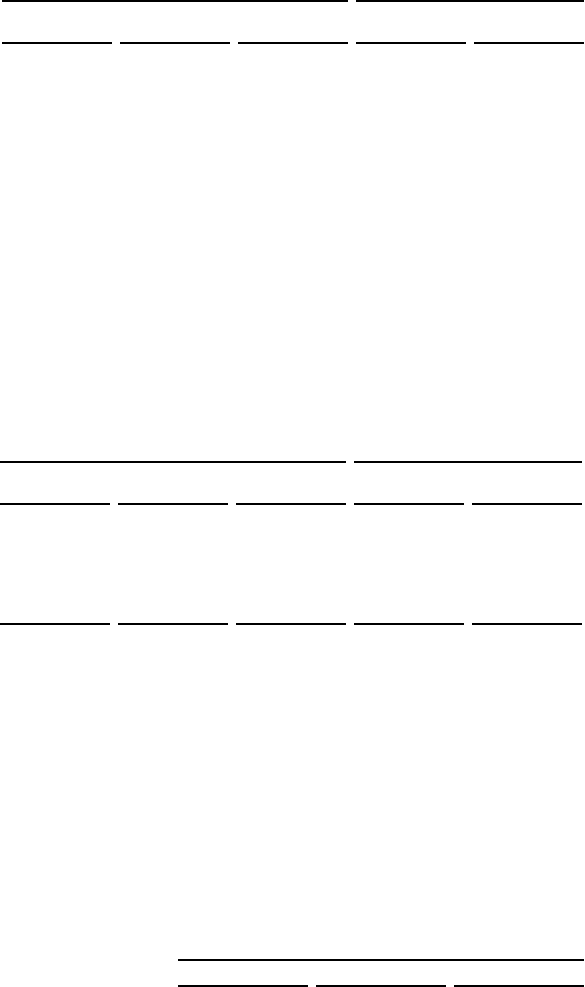

Operating Loss From Continuing Operations

Years Ended December 31, Percent Change

2014 2013 2012 2014 vs.

2013 2013 vs.

2012

(In millions)

Operating loss $ (104.1) $ (20.1) $ (318.4) NM NM

As a percent of revenue (14.3)% (2.3)% (31.6)%

_______________________________________

NM - Not meaningful

Operating loss from continuing operations increased in 2014 compared with 2013 primarily due to a goodwill

impairment of $35.4 million in 2014 and a reversal of an accrual of $23.1 million in 2013 for copyright levies, as a

result of Italian and French court rulings in 2013. Operating loss decreased in 2013 compared with 2012 due

primarily to intangible asset impairment charges of $251.8 million and a goodwill impairment charge of $23.3 million

recorded in 2012. See discussion above for further information on our 2012 impairment losses.

See Note 15 - Litigation, Commitments and Contingencies in our Notes to Consolidated Financial Statements

for more information on the levy reversal.

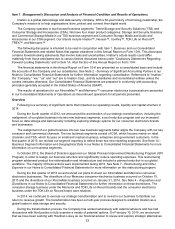

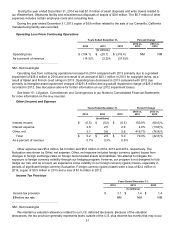

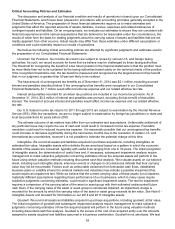

Other (Income) and Expense

Years Ended December 31, Percent Change

2014 2013 2012 2014 vs.

2013 2013 vs.

2012

(In millions)

Interest income $ (0.5) $ (0.2) $ (0.5) 150.0% (60.0)%

Interest expense 2.6 2.5 2.9 4.0% (13.8)%

Other, net 3.1 0.6 2.6 416.7% (76.9)%

Total $ 5.2 $ 2.9 $ 5.0 79.3% (42.0)%

As a percent of revenue 0.7% 0.3% 0.5%

Other expense was $5.2 million, $2.9 million and $5.0 million in 2014, 2013 and 2012, respectively. The

fluctuation was driven by Other, net expense. Other, net expense includes foreign currency (gains) losses from

changes in foreign exchange rates on foreign denominated assets and liabilities. We attempt to mitigate the

exposure to foreign currency volatility through our hedging program; however, our program is not designed to fully

hedge our risk, and as a result, we experience some volatility in our foreign currency (gains) losses, especially in

periods of significant foreign currency fluctuation. Foreign currency (gains) losses were a loss of $2.2 million in

2014, a gain of $0.5 million in 2013 and a loss of $1.6 million in 2012.

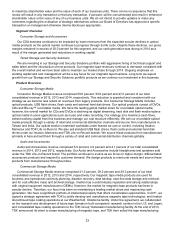

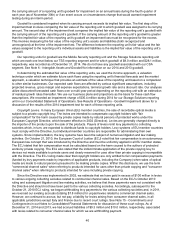

Income Tax Provision

Years Ended December 31,

2014 2013 2012

(In millions)

Income tax provision $ 3.1 $ 1.4 $ 1.4

Effective tax rate NM NM NM

_______________________________________

NM - Not meaningful

We maintain a valuation allowance related to our U.S. deferred tax assets. Because of the valuation

allowances, the tax provision generally represents taxes outside of the U.S. plus discrete tax events that may occur